The stock market is approaching its best time of the year, according to Goldman Sachs.

The bank noted that the Nasdaq 100 has been positive in July for 16 consecutive years.

“These statistics are staggering for NDX,” Goldman Sachs said.

The best days and weeks of the year for the stock market are fast approaching.

If history is any guide, this suggests that S&P500 could rise 4% next month to record highs, according to Goldman Sachs.

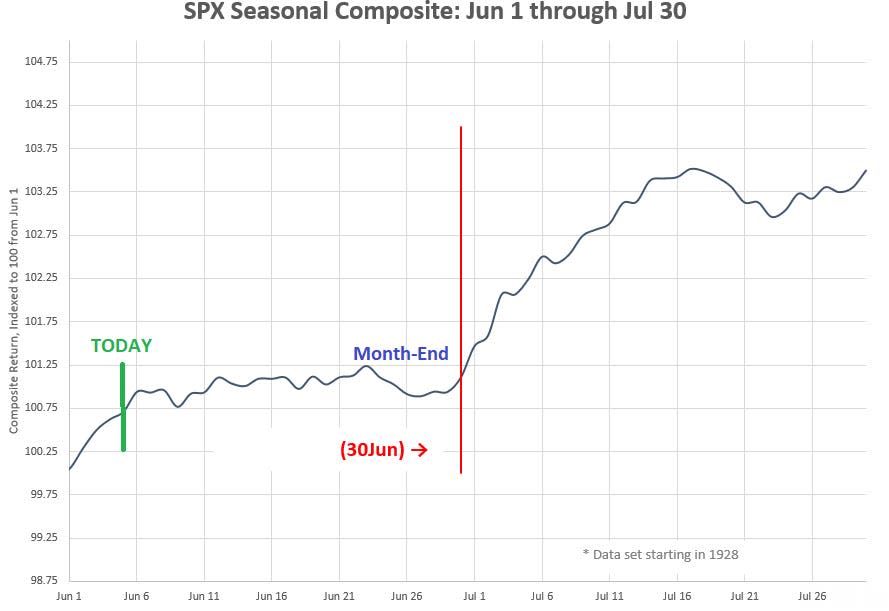

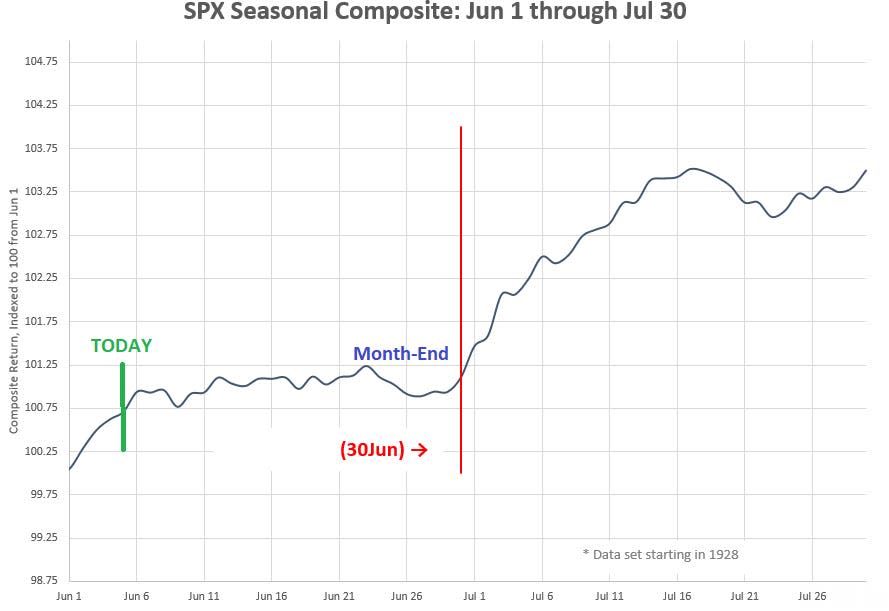

The bank said in a note this month that since 1928, the best days of the year typically occur during the first two weeks of July.

“Since 1928, July 3 has the highest rate of positive results for the S&P (72.41%), followed by July 1 (72.06%) and other statistically significant trading days in the first two weeks of July,” said the managing director of Goldman Sachs. » said Scott Rubner.

The S&P 500’s average daily gain for July 3 is 0.49% and for July 1 it is 0.36%. And from July 1 to July 17, only two days showed an average loss, July 7 at -0.07% and July 16 at -0.01%.

“The first 15 days of July were the best two-week trading period of the year since 1928,” Rubner said.

Additionally, recent market trends show that July as a whole was incredibly bullish for the stock market.

“These statistics are staggering for NDX over the last 16 years,” Rubner said of the Nasdaq 100. “NDX has been positive for 16 consecutive Julys with an average return of 4.64%.”

Meanwhile, the S&P 500 index has been positive for nine consecutive Julys, offering an average return of 3.66%.

If similar seasonal trends play out this year, a gain of nearly 4% would propel the S&P 500 to a new record high of 5,665 based on current levels.

As for what could generate more bullish returns in the coming weeks, Rubner pointed out that a record liquidity reserve of more than $7 trillion in money market funds could soon flood the market.

Additionally, passive equity allocations could generate flows into equities as the quarter-end and second-half rebalancing schedules begin in early July.

“New quarter (Q3), new half year (2H), that’s when a wall of money quickly hits the stock market,” Rubner said.

Read the original article on Business Insider