Stocks of most semiconductor stocks, including industry leaders Broadcom (NASDAQ:AVGO), Arm holds (NASDAQ:ARM)And Search Lam (NASDAQ: LRCX) were coming together today, with these three increases of 5.2%, 5.3% and 4.6%, respectively, at 12:50 p.m. ET on Wednesday.

These three chip leaders are players in the race for artificial intelligence (AI), and their stocks have seen solid price appreciation in 2024. But that growth came to a halt last month, as recent reports from inflation were hotter than expected in April.

But today, more positive news about AI continued to trickle in. Meanwhile, on Wednesday, the May jobs report was weaker than expected. That fueled hopes of falling inflation and strengthened the Federal Reserve’s prospects of lower interest rates this year.

Is bad news good news?

This morning, the Automatic data processing The Employment Report (ADP) was released for May, showing that 152,000 jobs were created last month, below expectations of 175,000.

Additionally, the April figure was revised downward to 188,000 jobs added. The report also shows that wage gains for job changers moderated to 7.8%. The report agrees well with yesterday’s Survey on job vacancies and labor turnover report, which also showed a drop in job postings.

What does this have to do with semiconductor stocks, and why would it be good? Because lower-than-expected job numbers and moderate but still solid wage growth suggest services inflation may begin to ease, as wage pressures and labor shortages have been a factor key to the services inflation we have seen over the past two years. .

A moderate economy that does not fall into recession would be an ideal scenario, allowing the Federal Reserve to reduce federal funds rate this year without the need for a recession – what’s called a “soft landing”.

High interest rates have a particular impact on growth stocks, which often trade at high multiples, as well as cyclical stocks that can be sensitive to an economic downturn. And semiconductor stocks possess both of these qualities, especially as many of them have seen their valuations rise on expectations of strong AI-fueled growth.

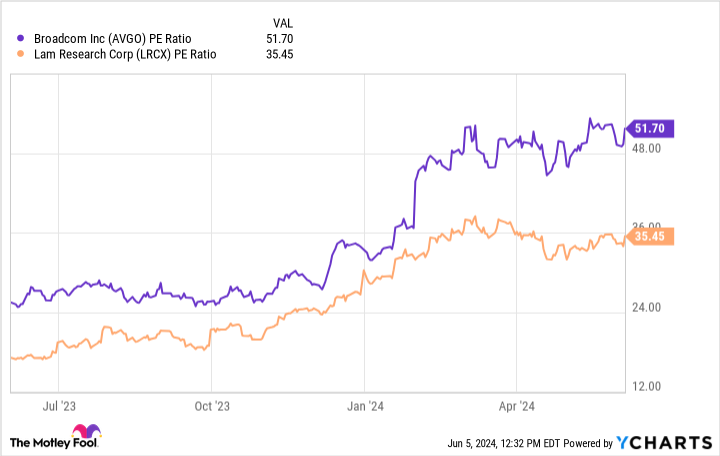

For example, Broadcom and Lam Research have each seen their price-to-earnings (P/E) ratio more than double over the past year, to 52 and 35, respectively. Meanwhile, Arm Holdings has consistently traded at a extremely high valuation since its IPO in September, with a P/E of 460.

So the prospects of lower interest rates today appear to be boosting the entire chip sector, especially as the AI growth story remains intact.

A report that Semiconductor manufacturing in Taiwan (TSMC) is reportedly investing in the most advanced type of extreme ultraviolet (EUV) lithography machine this year, called high NA, suggesting that the world’s top foundry will quickly upgrade to the latest chip manufacturing technology.

This suggests that the demand for AI and the competition associated with it continues unabated, and may even gain momentum, which would be a good thing for all three companies. TSMC makes chips for Broadcom, as well as many chips based on the Arm architecture. In fact, TSMC’s biggest customer is Applewhich designs Arm-based chips for its smartphones and PCs.

Qualcomm has also started producing Arm-based chips for AI-enabled PCs and potentially even servers in an effort to expand its market beyond handsets. These chips will also be manufactured by TSMC factories. TSMC’s investment news could therefore mean strong growth for Arm.

Greater investment in EUV would also benefit Lam Research, whose etching and deposition machines are used alongside EUV lithography machines as part of the chip manufacturing process.

Lam pioneered a new technology that will likely need to be used with high-NA EUV machines, like the one TSMC reportedly purchased, to prevent defects that occur more easily at extremely fine molecular sizes. Existing processes struggle to maintain design integrity at extremely small sizes. Therefore, an acceleration in the adoption of strong NA could also mean good things for Lam Research.

Is the chip cycle getting longer in the tooth or has it just started?

The semiconductor sector has largely recovered from the 2022 lows, with many stocks now up by several multiples of their 2022 low prices. However, their businesses are just starting to see a recovery in revenue and their profits, driven by AI and a recovery in traditional sectors like smartphones and PCs.

Yet even though the recovery has been around 18 months, AI-driven growth could make the boom last longer than previous cycles. And if the Fed can achieve a soft landing with lower interest rates and no recession, so much the better.

Should you invest $1,000 in Arm Holdings right now?

Before buying Arm Holdings stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Arm Holdings was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $713,416!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Billy Duberstein and/or his clients hold positions at Apple, Broadcom, Lam Research and Taiwan Semiconductor Manufacturing. The Motley Fool features and recommends Apple, Lam Research, Qualcomm and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Mad Motley has a disclosure policy.

Why semiconductor stocks Broadcom, Arm Holdings and Lam Research rallied today was originally published by The Motley Fool