The older I get, the more I focus on my retirement. I focus my retirement account on investments that generate passive income and can deliver compelling price appreciation with less volatility. While this strategy may cause me to miss out on upside potential, it helps me not lose sleep at night knowing that my retirement stays on track.

I recently added a new investment to my retirement account that I believe can improve my ability to achieve my retirement goals: JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ). THE exchange traded fund (ETF) offers a high dividend yield and upside potential with a decline volatility. I’m starting small in what could become a foundational investment in my retirement account.

What is the JPMorgan Nasdaq Equity Premium Income ETF?

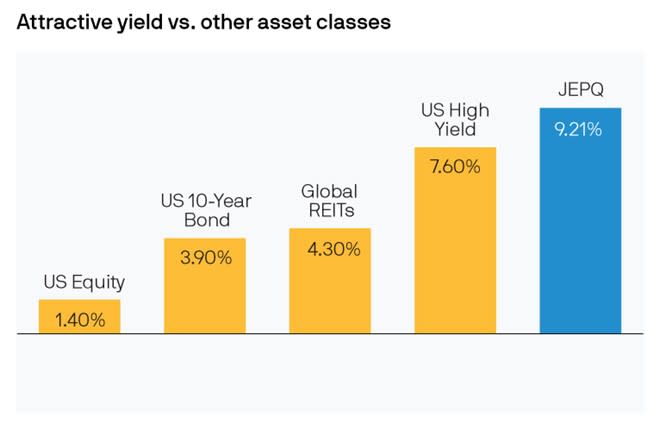

The JPMorgan Nasdaq Equity Premium Income ETF has a simple mission: it aims to provide investors with consistent premium income with lower volatility. It certainly offers a higher income yield these days:

As this chart shows, the ETF has generated a monster income yield of 9.2% over the past 30 days, providing investors with more income than they could have received by investing in high-yield bonds (that’s to say, junk bonds). Meanwhile, the dividend yield has been even higher (10.8%) over the past 12 months.

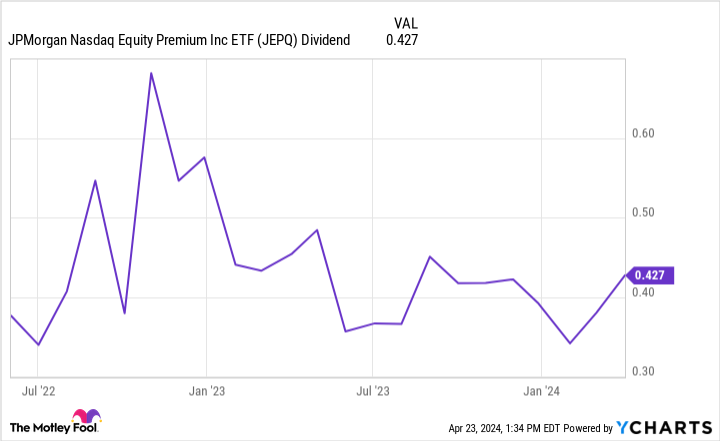

The ETF pays monthly distributions to its investors. They vary from month to month depending on the income generated by the ETF:

The actively managed fund charges investors a fairly reasonable sum ETF expense ratio of 0.35%. These competitively priced management fees allow investors to keep more of the assets income generated by the fund.

How the JPMorgan Nasdaq Equity Premium Income ETF Generates Returns

The JPMorgan Nasdaq Equity Premium Income ETF has a two-pronged investment strategy:

Underlying Equity Portfolio: The fund’s managers use an applied approach from data science to fundamental research and portfolio construction to construct a high-quality portfolio of stocks.

Disciplined Option Overlay Strategy: The fund writes out of the money purchase options on the Nasdaq-100 hint. This strategy aims to generate monthly distributable income for the fund’s investors.

Funds main The income-generating strategy involves selling call options on the Nasdaq-100, an index filled with growth stocks. It tends to be more volatile than S&P500. However, volatility benefits the fund’s investors because it allows the fund to generate higher options premium income by writing calls on the index. This dynamic is why the ETF offers a higher yield than its sister fund, JPMorgan Equity Premium Income ETFwho writes call options on the S&P 500.

The other aspect of this fund’s strategy is holding a portfolio of stocks. It currently has 97 positions (which include options), led by:

Although these leading technology stocks are also among the largest holdings in the Nasdaq-100, the fund does not aim to track this index. He holds stocks based on his fundamental, data-driven approach.

The fund’s portfolio offers investors upside potential in stocks. However, even though he tends to hold more volatile stocks, he offsets this volatility by writing call options on the Nasdaq-100 Index, which generates income while reducing volatility. This strategy allows it to produce more regular returns.

A great addition to my retirement portfolio

I’m excited to add the JPMorgan Nasdaq Equity Premium Income ETF to my retirement account. The fund should provide me with a premium monthly income stream that I can reinvest until I’m ready to retire. In addition to this, it would be necessary provide price appreciation with low volatility to help increase the value of my account. These features will likely make this an ETF I purchase regularly as I work toward retirement.

Should you invest $1,000 in Jp Morgan Exchange-Traded Fund Trust – JPMorgan Nasdaq Equity Premium Income ETF right now?

Before purchasing shares of the Jp Morgan Exchange-Traded Fund Trust – JPMorgan Nasdaq Equity Premium Income ETF, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Jp Morgan Exchange-Traded Fund Trust – JPMorgan Nasdaq Equity Premium Income ETF was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $506,291!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Matt DiLallo holds positions in Alphabet, Amazon, Apple, Jp Morgan Exchange-Traded Fund Trust – JPMorgan Nasdaq Equity Premium Income ETF, JPMorgan Chase and JPMorgan Equity Premium Income ETF. The Motley Fool holds positions and recommends Alphabet, Amazon, Apple, JPMorgan Chase, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Why I Just Added This Ultra-High-Yielding Dividend ETF to My Retirement Account was originally published by The Motley Fool