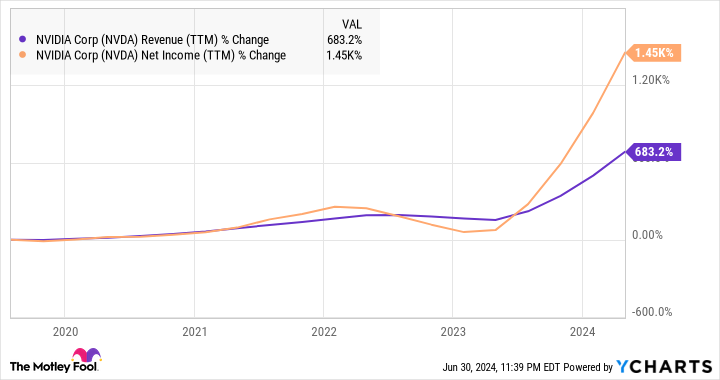

The last five years have been breathtaking for Nvidia (NASDAQ: NVDA) shareholders, as the company’s market capitalization has soared 2,900%, turning an investment of just $100 in the stock five years ago into just over $3,000 at the time of this writing.

The 30-fold increase in Nvidia’s stock value over the past five years can be justified by the multiple catalysts that have supported the company’s growth. Unusually strong demand for its graphics processing units (GPUs) deployed in personal computers (PCs), data centers, and automotive applications has led to a dramatic increase in the company’s revenue and profits during this period.

It would now seem far-fetched to expect Nvidia stock to rise another 30x over the next five years, given that it has a market capitalization Nvidia’s stock is currently valued at just over $3 trillion and is one of the three largest companies in the world. For comparison, the entire global economy was worth about $105 trillion in 2023. However, given the catalysts ahead, there’s a good chance that Nvidia’s stock will continue to climb over the next five years, although those gains may not be as astronomical as those of the past five years.

AI Accelerates Nvidia’s Growth

For fiscal 2024, which ended January 28, Nvidia reported revenue of $60.9 billion, up from $11.7 billion in fiscal 2019. That’s a five-fold increase in Nvidia’s revenue over the past five years. Analysts predict the same could happen in the future, thanks to the massive growth engine represented by the artificial intelligence (AI) market.

Mizuho Securities predicts that Nvidia’s data center revenue alone will reach $280 billion in 2027, which will coincide with most of Nvidia’s 2028 fiscal year. That would be a significant increase from the $47.5 billion in data center revenue the company reported in fiscal 2024 (which ended in January of this year and coincided with 11 months of 2023) and the $89 billion in revenue it is expected to generate from that market in the current 2025 fiscal year.

One reason this forecast might be accurate is that the AI chip market is expected to reach $400 billion in annual revenue by 2027 (which would be fiscal 2028 for Nvidia), according to Nvidia’s peers. AMD. Mizuho’s revenue estimates for Nvidia for calendar year 2027 (fiscal year 2028 for Nvidia) suggest that the company would control 70% of the AI chip market by that date. While that’s down from the company’s current 90%+ share of that market, it would still be able to generate a massive revenue increase given the potential size of the AI chip market four fiscal years into the future.

What’s worth noting here is that even if the AI chip market takes longer than expected to reach $400 billion in revenue, and even if Nvidia’s share shrinks to 50%, its data center revenue alone could still quadruple in the coming years.

These catalysts could give Nvidia an additional boost

Nvidia has other potential growth drivers that could help expand its revenue.

For example, the PC graphics card market is expected to benefit from increased spending on gaming hardware. Statista predicts that the gaming hardware market will generate $161 billion in revenue in 2024 and predicts that it could reach $241 billion by 2029. Nvidia is expected to be a big beneficiary of this growth, as it controlled 88% of the PC graphics card market in the first quarter of 2024.

Meanwhile, in the first quarter of fiscal 2025, growing demand for digital twin systems pushed revenue from Nvidia’s professional visualization business up 45% year over year to $427 million.

Nvidia is just scratching the surface of a potentially massive opportunity in the digital twin market. According to a forecast from Mordor Intelligence, the sector could generate $126 billion in revenue by 2029. Of the $26 billion it expects this year, that would represent a compound annual growth rate of 37%. More importantly, Nvidia is building a solid customer base for its digital twin offerings, according to remarks made by CFO Colette Kress at the latest earnings conference call:

Companies are using Omniverse to digitalize their workflows. Omniverse-powered digital twins help Wistron, one of our manufacturing partners, reduce end-to-end production cycle times by 50% and defect rates by 40%. And BYD, the world’s largest electric vehicle manufacturer, is adopting Omniverse for virtual factory planning and retail layouts.

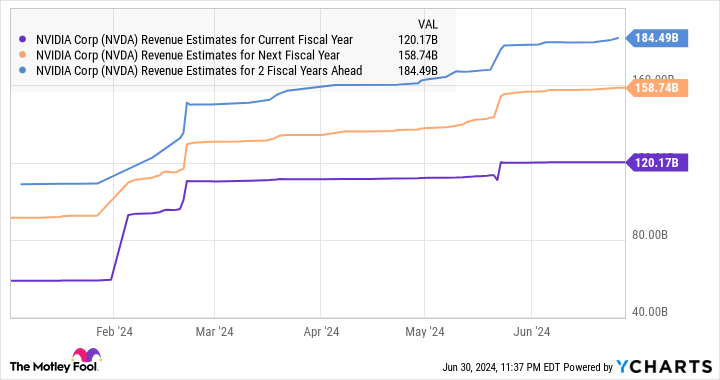

Kress added that industrial software developers such as Cadence, AnsysDassault, and Siemens are some of the big names adopting its digital twin software. So there’s a good chance that Nvidia’s revenue growth over the next five years will match what it’s seen over the past five years. In fact, analysts predict its revenue will triple in just three fiscal years (from fiscal 2024 levels of $60.9 billion).

Assuming Nvidia reaches $184.5 billion in revenue in fiscal 2027, its revenue would have grown at a compound annual rate of 45%. If the semiconductor giant’s growth slows over the next two years to, say, 25% per year, its revenue could reach $288 billion after five years. That would represent a fivefold increase in revenue from fiscal 2024, and would be nearly equal to the company’s growth over the past five years.

Of course, there’s a good chance that the company could grow at a faster pace thanks to the catalysts discussed above. That’s why investors who haven’t yet bought this growth stock can still consider adding Nvidia to their portfolio. The tech giant looks set for a much bigger upside over the next five years.

Should You Invest $1,000 in Nvidia Right Now?

Before you buy Nvidia stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors need to buy now…and Nvidia isn’t one of them. These 10 stocks could deliver monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $786,046!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Cadence Design Systems, and Nvidia. The Motley Fool recommends Ansys. The Motley Fool has a disclosure policy.

Where will Nvidia stock be in 5 years? was originally published by The Motley Fool