A full quarter of 2024 is now behind us, and it is clear that we are in the midst of a new uptrend, similar to last year. The gains are substantial; markets reached a low point in October 2023, and the S&P500 is up about 24.5% from that point, while the NASDAQ has rebounded 29%. Since the start of the year, the indices are up 9% and 10% respectively.

And, while last year’s gains were based on a narrow base of ultra-large-cap technology companies, this year’s gains are based on a broader base, giving investors more investment options. Professional stock analysts are also taking note and are quick to rate stocks as “buys” for the remainder of this year.

In this context, we have dug up the details of two names on which analysts at financial giant Wells Fargo have been bullish. They recently improved their ratings – so it’s “time to buy,” in other words. Using the TipRanks database, we can see that these stocks already have “buy” ratings and double-digit upsides, while Wells Fargo’s view sees gains of up to around 60%. Here are the details.

GoodRx Holdings (GDRX)

The top Wells Fargo pick on our list is GoodRx, a company that takes pharmacy services and combines them with both online technology and the growing telehealth industry to create a package designed to streamline drug distribution on prescription. The company is based in Santa Monica, California, has been in business since 2011 and its operations are based on a key idea regarding healthcare consumers: giving them access to better information will result in better consumer decisions and better health care outcomes.

Expanding on this idea, GoodRx today offers its users the information they need, including price transparency and affordability solutions, based on convenient telehealth consultations. The result is a patient-focused online pharmacy designed to promote better medication adherence and faster medication regimens, all for better patient outcomes.

GoodRx’s main service is access to prescription medications at discounted prices. Patients can consult doctors and pharmacists, use electronic coupons and choose from generic drug equivalents. The system is optimized to ensure that every patient receives the right prescription, with the right instructions, executed easily. The service is available directly through the company’s website, where users can also find informative articles written by healthcare professionals, to add context to prescription services.

By the numbers, GoodRx has built a significant business. The company delivers more than 200 billion pricing points daily and estimates that 80% of transactions are repeat business – a strong indication of satisfied customers. Overall, GoodRx estimates it has saved its customers approximately $60 billion over the years.

Turning to the bottom line, we see that GoodRx posted revenue of $196.6 million in 4Q23, a figure that beat forecasts by a modest $730,000 and grew nearly 7%. from one year to the next. Ultimately, EPS of ($0.06) missed estimates by a penny.

Assessing the company’s prospects, Wells Fargo analyst Stan Berenshteyn believes GoodRx is well-positioned to outperform. He writes: “Analysis of strategic pivots over the past two years indicates possible headwinds to growth, but revenue visibility (and downside risk) appears to have improved significantly. We believe this allows GoodRx to deliver a beat & raise narrative in 2024 with an upside to consensus expectations in 2025. We expect this momentum to help GDRX close the valuation gap versus its peers , thus allowing the stock to experience significant outperformance compared to its peers. the next 12 months.

As such, the analyst recently raised his GDRX rating from equal weight (neutral) to overweight (buy), while his $10 price target (from $7.5) indicates one-year upside by 49%. (To see Berenshteyn’s track record, Click here.)

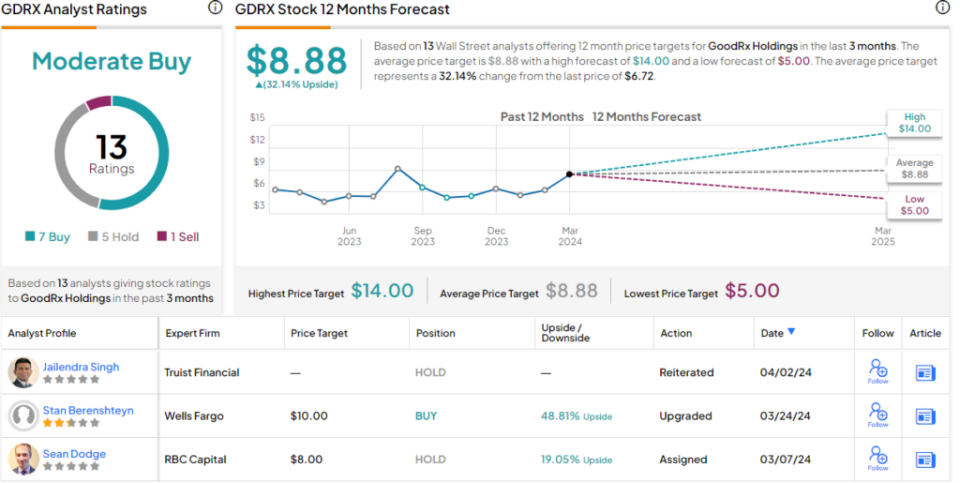

This stock has 13 recent analyst reviews, broken down into 7 Buys, 5 Holds and 1 Sell, for a consensus rating of Moderate Buy. Shares are trading at $6.72, and their average target price of $8.88 suggests 32% upside potential for the year ahead. (See GoodRx Stock Forecast.)

NeuroPace (NPCE)

Next comes NeuroPace, another Californian company active in the medical field. NeuroPace focuses on the treatment of epilepsy. The company developed the RNS system, a medical device designed to detect and prevent seizures without the use of medication. This is an important advance because some types of epilepsy are known to be resistant to medications.

The NeuroPace system works directly in the brain, where it can monitor and record electrical activity, and apply nerve stimulation when seizures are indicated. Because the device also records EEG data, patients and doctors can fine-tune stimulation and better monitor the rhythm and frequency of seizures. Patients using the device report a significant reduction in seizure activity, and 1 in 5 patients were reported as “seizure-free” at their last medical checkup.

The company’s revenues have shown a near constant upward trend since the second half of 2022. In the most recently reported quarter, for 4Q23, revenues were $18 million, up 41% from last year. $12.8 million reported in 4Q22. The company’s EPS, reported as a loss of 23 cents per share, was 8 cents higher than expected. For full-year 2024, the company expects revenue to be between $73 million and $77 million, up from $65.4 million in 2023.

However, Wells Fargo’s Vik Chopra thinks the company could play it safe here. “Our analysis demonstrates upside potential through 2024 and beyond as NPCE expands access to RNS outside of Level 4 CECs,” Chopra said. “We do not believe that management has considered significant revisions in the 2024 Project CARE Guide and, as such, we see potential for upward revisions…we like the setup as NPCE grows within the community framework and do not think that the opportunity of the CARE project is taken into account. .”

Expressing confidence, Chopra rates the shares overweight (buy – upgraded last month) and his $20 price target implies a 62% upside over a one-year horizon. (To see Chopra’s track record, Click here.)

There is general consensus on the Street that this is a stock to buy; The Strong Buy consensus rating is based on 7 recent reviews that include 6 Buys for 1 Hold. Shares have an average price target of $17.71, suggesting a 43% one-year upside from the current stock price of $12.37. (See NeuroPace Stock Forecast.)

To find great ideas for trading stocks at attractive valuations, visit TipRanks. Best Stocks to Buya tool that brings together all the information about stocks from TipRanks.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.