An earlier version of this article incorrectly stated how the unpaid mortgage balance was counted toward the taxable gain from the sale..

Dear tax professional,

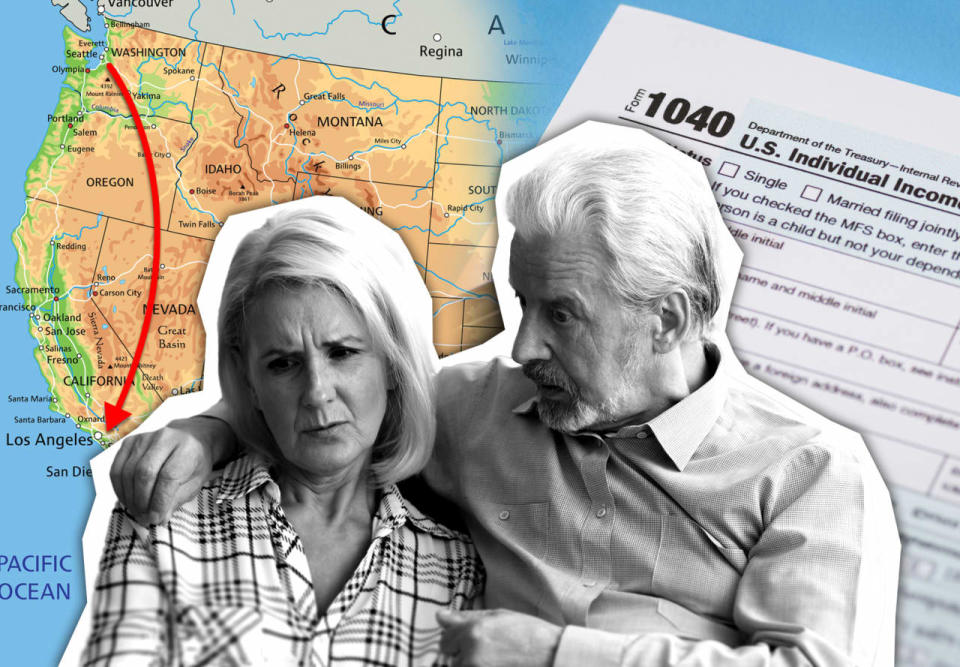

We are planning to sell our home in Sammamish, Washington, worth about $1.4 million. We still owe a $310,000 mortgage. We will use the proceeds to purchase a home in Orange County, California to be closer to family and loved ones.

Most read on MarketWatch

We purchased it in 1996 for $230,000 and completed a series of improvements to the home at a cost of $120,000. Between moving and buying a new home in California as seniors, help us manage the taxes we face.

What tax incentives should we expect now that we are both over 65?

Californian dream

Dear dream,

This is a major change in your life and I hope you find an ideal place, close to your loved ones. This is also an important tax measure for you and many seniors like you. There’s going to be a “silver tsunami» as baby boomers, generally aged 59 to 77, downsize.

Let’s review your tax situation as you start packing your belongings:

Box 1: Federal capital gains taxes

Let’s say you receive $1.4 million for your house. Median sales prices in the Sammamish real estate market were $1.8 million in May, up more than 13% from last year, according to red fin.

Capital gain is your profit after accounting for your cost basis. If it is your main residence, part of the profits escape capital gains tax. For single filers, the first $250,000 of profits are free of capital gains and rise to $500,000 for married couples.

Some home improvements will increase your cost basis, according to the IRS. This includes upgrades to bedrooms, bathrooms, decks, garages, central air conditioning, furnaces, flooring, fences, swimming pools and more. Keep receipts, in case the IRS wants proof.

What can’t be included are repairs and maintenance that keep your home running but don’t make it more valuable to potential buyers. Painting does not increase the cost basis or repair leaks, according to the IRS. (But you can include the costs of selling your home.)

Assuming the IRS considers all of your $120,000 in improvements as increases over your original purchase price of $230,000, that’s a cost basis of $350,000. So let’s get to the numbers. If you can make $1.4 million (you’re lucky) at a cost of $350,000, that’s a little over $1 million in profit.

But there’s still the $310,000 left to pay off the remaining mortgage balance.

The unpaid mortgage has no impact on the tax scenario, said Rob Seltzer, president of Seltzer Business Management in Los Angeles. There’s still a taxable gain of just over $1 million to deal with, he said.

Since you’re a “we” and (presumably) married, you’re about to avoid capital gains on the first $500,000 of profits. The remaining $550,000 would be subject to capital gains tax, which could be 0%, 15% or 20% depending on the rest of your income.

It is rather the average price. The 15% rate is a wide range that encompasses a large number of people. For a married couple filing jointly, the 15% rate applies this year to households whose annual taxable income is between $94,051 and $583,750.

Meanwhile, the remaining $310,000 mortgage reduces net after-tax cash flow, Seltzer said.

With a 15% rate, you’re looking at about $82,500 in federal capital gains taxes after give-and-take on margins on the final price and costs, Seltzer said. The IRS still gets its share, but a sum like that is a small price for a good return on investment.

After some quick math, assuming a $1.4 million sale on this home purchased in 1996, that gives you about a 5% return on your home’s value each year, noted Jennifer Baick, vice president of the financial planning group at Mercer Advisors.

Box 2: Washington State Taxes

Your state has a relatively new capital gains tax. But profits from home sales are exempt from this capital gains tax, according to the Washington government. Ministry of Revenue. There is also no income tax in Washington. But state and local real estate excise taxes apply to.

Box 3: Income taxes in California

You’re about to make a nice profit on the sale of your home. But be prepared to pay a lot to find an address in Orange County. The median sales price for homes in the county was $1.2 million in May, an 18% year-over-year increase, according to red fin.

Unlike Washington, the Golden State levies income taxes. But the proceeds from the sale of your Washington state home should not be subject to California income tax, Seltzer said.

As long as you don’t become a California resident Before you sell your house in Washington, he said. “It appears their residency would begin after the property is sold,” he told MarketWatch in an email.

Box 4: Tax breaks in California

California is one of several states that does this not tax Social Security income. At the federal level, monthly payments become taxable once a married couple’s “combined income” exceeds $32,000 per year.

You asked about potential tax breaks and incentives for California residents over 65. California offers certain tax credits, such as Senior Household Credit Managerintended for older residents with special circumstances and income eligibility limits.

At local level, Orange County and other California counties have property tax programs for certain blind, disabled and elderly taxpayers. These programs defer payment of property taxes, but generate a lien on the property that must ultimately be repaid.

Requirements include at least 40% equity in the home and an annual income of less than $51,762, according to the California State Comptroller. It’s worth asking a California tax professional to see if there are other arrangements for you.

But even if these possibilities seem limited in terms of tax reduction, it is still worth it. The greatest opportunity is your chance to be near your family.