Time has shown that the only certainty in the stock market is uncertainty. No matter how experienced you are or how many advanced investing tools you have, no one can reliably predict stock price movements.

That’s the beauty of dividends: They offer investors a chance to generate returns regardless of how a company’s stock price performs, and they can also be a good source of income if you hold enough dividends. actions.

For investors looking to add ultra-high yielding dividend stocks to their portfolio, the following two tobacco companies might be good choices.

1. Altria Group

Altria Group (NYSE:MO) is the global leader in tobacco, with a portfolio including brands such as Marlboro, Copenhagen oral sachets and NJOY e-cigarettes.

Altria’s stock has struggled a bit in recent years, but 2024 was a nice (and much-needed) turnaround, thanks in part to the success of tobacco-free products like NJOY.

Many investors are hesitant to invest in tobacco companies due to the harmful health effects of smoking. Altria therefore traditionally offers a very high yield dividend to attract and retain investors. She also remained faithful to this strategy. His last 12 months (TTM) the yield of around 8.3% is more than 6 times higher than S&P500the yield.

The biggest concern about Altria’s business is the decline in smoking among U.S. adults. In 2005, nearly 21 in 100 American adults smoked. By 2021, that share had fallen to about 12 out of 100. That’s great news for public health, but it’s not the best news for Altria’s core business.

For better or worse, rising cigarette prices alone aren’t enough to deter most people from buying them, and Altria has relied on its pricing power to offset the decline in cigarette volume. sales. This has helped keep the company’s finances strong and ensure it remains shareholder friendly.

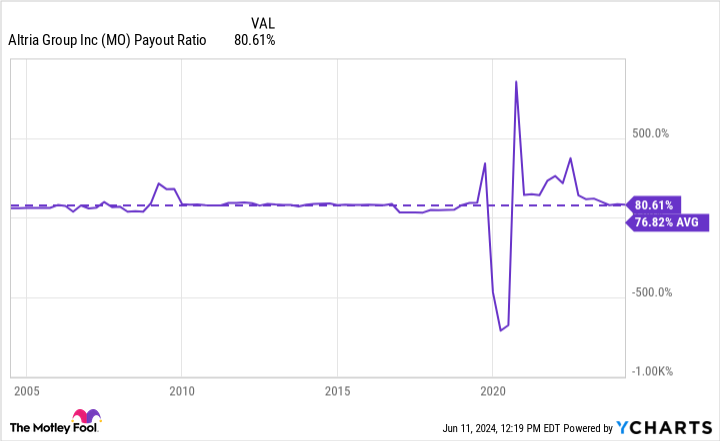

Altria’s current payout ratio of around 80% may seem high, but that’s in line with where the company has historically kept it (aside from abnormal levels early in the pandemic). The company is a dividend king, so this statistic shouldn’t cost investors peace of mind wondering if it will maintain its dividend.

2. British American Tobacco

British American Tobacco (NYSE:BTI) isn’t as big as Altria, but it has a diverse portfolio of brands that have performed well over the years, including Newport and its vaping brand, Vuse.

As with Altria, falling smoking rates have affected British American Tobacco’s business, but the company has done well with its brands in non-smoking categories like vape tobacco and heated tobacco (where it has market share). market share of 16.8% by volume) and oral nicotine sachets (27% by volume). market share). In the US market, Vuse has a 51.5% value share (how much money it makes selling its products compared to what others make), and its new single-use Vuse Go 2.0 is expected to help strengthen its position.

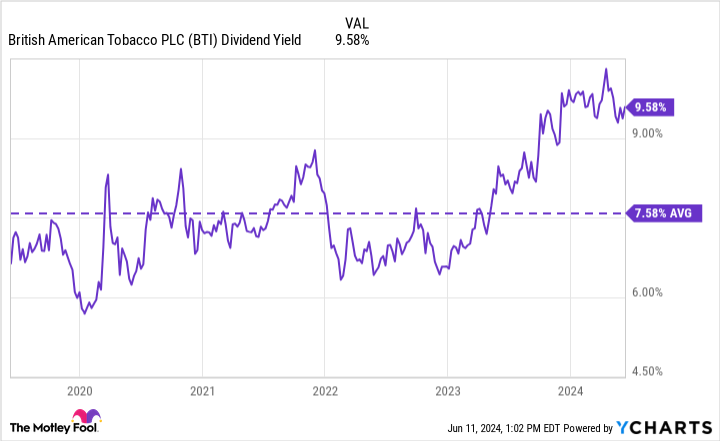

British American Tobacco continues to be a huge cash generator, converting over 90% of its operating profits into cash flow. This has allowed it to remain very shareholder friendly and generous with its dividends. Its TTM yield is over 9.5%, one of the highest returns for a non-REIT stock, and well above its five-year average.

British American Tobacco also plans to increase shareholder value through share buybacks. It plans to spend 700 million pounds ($890 million) on share buybacks this year and another $1.15 billion in 2025.

With a lucrative dividend and a low valuation (its price-to-earnings ratio is near its lowest level in about five years), British American Tobacco offers long-term investors more upside potential than downside.

Should you invest $1,000 in Altria Group right now?

Before buying Altria Group stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and the Altria group was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $767,173!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Steve Walters has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco Plc. The Motley Fool has a disclosure policy.

Want secure dividend income in 2024 and beyond? Invest in these 2 very high yielding stocks. was originally published by The Motley Fool