Investors love tobacco stocks because of their high dividend yields and growing dividend payouts. Long-term shareholders of these companies have made fortunes simply by owning and monitoring the stocks. dividend payments accumulate in their accounts.

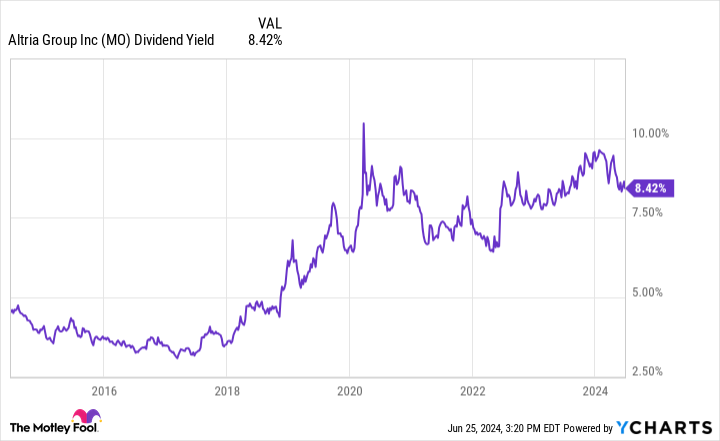

Today, Altria Group (NYSE:MO) has a dividend yield of 8.43%. The U.S.-focused tobacco giant can generate $1,000 in annual dividends for investors who currently buy $11,862 worth of stock. But is this dividend sustainable? Is Altria Group a safe dividend stock today?

I think it is. Here’s why Altria Group is a smart option for investors looking to build a diversified dividend income portfolio.

Volume is decreasing, but new categories are emerging

Altria Group owns the American brand Marlboro, which is the country’s leading premium cigarette with around 40% market share. This domination has lasted for decades. However, investors are concerned that the overall decline in volumes in the cigarette category is accelerating, which has led stocks like Altria to underperform the market.

For example, Altria estimated last quarter that cigarette volumes were down 9% from a year earlier for the entire U.S. market. Despite this, the company’s net sales for smokable products decreased by only 2.3%, with the segment’s operating profit also declining by a similar amount. Although the situation is not ideal, Altria has been able to raise prices to counter decades of declining volumes in order to maintain profits.

Smokable products now account for the majority of Altria’s $11.4 billion in operating profits, but they are increasingly being replaced by new nicotine products in vapes and nicotine pouches. The company’s recent acquisition of the Njoy brand represents a 4.3% market share, which increased by 0.6 percentage points over the last quarter. Now, the U.S. government and law enforcement are stepping up their crackdown on illegal vaping devices, which should help Njoy significantly increase its market share.

Additionally, nicotine pouch brand On! saw shipment volumes increase 32% year-over-year in the most recent quarter. It’s still a small part of the brand portfolio, but it’s expected to continue growing rapidly. It could also help that its largest nicotine pouch competitor, Zyn, is currently experiencing supply shortages in the U.S.

The dividend is not only safe, but can also grow

Recent declines of 9% in volumes and 2% in profits in the smoking products category are concerning for investors. However, calculations on Altria’s dividend payout show that the 8%-plus dividend yield is here to stay.

Over the past 12 months, Altria has paid a dividend of $3.88 per share. Free cash flow per share – the fuel for dividend payments – was $5 and has been consistently higher than the dividend per share over the past five years. Altria is also reducing its number of shares outstanding through a share repurchase program, which has reduced the number of shares outstanding by a total of 8% over the past five years.

Having 8% fewer shares means an 8% lower cumulative dividend payout while maintaining the same dividend per share level. This also contributes to free cash flow per share growth, even if nominal free cash flow is flat. So, even if Altria’s earnings stagnate due to a sharp decline in volumes, the company has enough room to increase its dividend per share due to the wide gap between its dividend payout and its free cash flow as well as the consistent buyback program.

Is the stock a buy?

With such a high dividend yield, I think contrarian investors looking to build retirement income would be wise to buy Altria Group shares today. Its dividend yield has risen from less than 4% to more than 8% over the past 10 years as the stock has struggled. But the company is still healthy and has the earnings power to sustain a growing dividend over the next five years and beyond.

Buying just over $11,000 worth of Altria stock can add $1,000 in dividend income to your portfolio each year. Investors should remember to diversify their holdings, though. If $11,000 is a large investment for you, start with a smaller amount and build up your dividend income by buying more shares over time. It’s never a good idea to go all-in on a single stock, because no company is a risk-free investment. The same goes for Altria and any other tobacco stock.

As investors flock to tech and AI stocks with huge earnings multiples, it may make sense to zig while others zag and buy high dividend stocks like Altria Group in 2024.

Should You Invest $1,000 in Altria Group Right Now?

Before you buy Altria Group stock, consider the following:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks Investors need to buy now…and Altria Group isn’t one of them. These 10 stocks could deliver monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $759,759!*

Securities Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the securities mentioned. The Mad Motley has a disclosure policy.

Want $1,000 in ultra-secure dividend income? Buy $11,862 of this super high dividend yielding stock was originally published by The Motley Fool