High-quality companies with sustainable earnings growth can be engines of wealth creation that will enhance a portfolio over time. Most people who retire with a high net worth have likely enjoyed exceptional returns on their stock investments.

It’s important to note that investors shouldn’t bet too much on any one horse — one diversified portfolio is essential to managing your risks. That said, there are some stocks you can buy and hold over the next decade that could make a noticeable difference in the growth of your nest egg.

Here are two of those names. Consider investing $10,000 in each of these stocks, and they could help you retire as a millionaire.

Amazon will continue to benefit from e-commerce and cloud tailwinds

What a story Amazon (NASDAQ:AMZN) East. The company began selling books online in the mid-1990s and is now the dominant e-commerce retailer, with a market share of approximately 38% in the United States. Perhaps even more impressive is that Amazon followed up on that first step with Amazon Web Services, which has become the world’s largest cloud infrastructure platform with a global market share of 31%.

The business has been a very successful long-term investment. A $10,000 investment in Amazon stock in its early days would now be worth more than $18 million. Of course, Amazon is now worth almost $2 trillion, so there is simply no room in the global economy for it to increase in size and value to such a magnitude again. However, the company still has enough upside to justify a $10,000 investment today. Amazon’s core segments, e-commerce and cloud computing, still have plenty of room to grow. E-commerce still only represents 16% of retail in America. Meanwhile, increasing investments in artificial intelligence around the world should mean big things for Amazon and other cloud platforms.

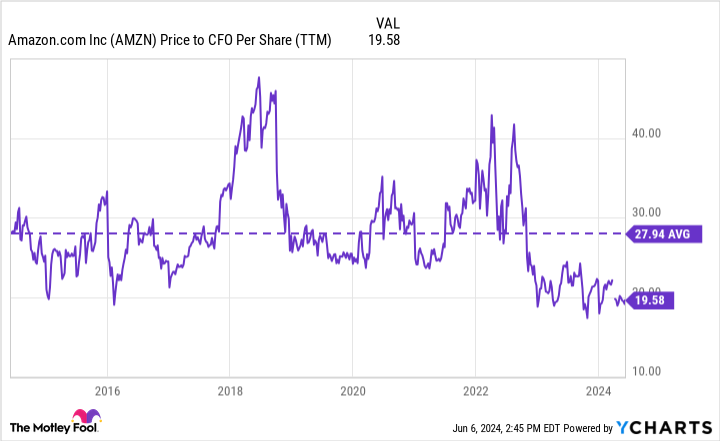

A large company like Amazon must also trade at the right valuation in order to have the potential to generate significant incremental returns. Let’s check this box. If you value Amazon based on its operating cash flow – in other words, the cash it generates from its normal business activities before investing in itself for further future growth – the Stocks are about as cheap as they’ve been in the last decade. (as shown in the table above). This winner is poised to keep winning, so don’t hesitate to include it in your long-term investment plans.

Netflix has a proven track record in the growing streaming industry

It is not easy to innovate or create new industries. Companies that attempt to do this are often faced with many skeptics, and Netflix (NASDAQ:NFLX) has certainly had its share of them over the years. However, the streaming pioneer is now the global streaming king, with more than 270 million paid subscriptions at the end of the first quarter. Memberships grew 16% year-over-year in the first quarter, showing there’s still plenty of room for growth as people around the world gradually move from cable TV to streaming.

And when a company becomes as big as Netflix, it can use many tricks to eliminate the company’s profit growth. In addition to simply growing its subscriber base, Netflix can raise its prices, crack down on password sharing (which has been hugely successful), and are diversifying towards new content and multimedia formats. The company has been gradually moving into live sports content and is testing video games now that the technology is advanced enough to be able to stream games via the cloud.

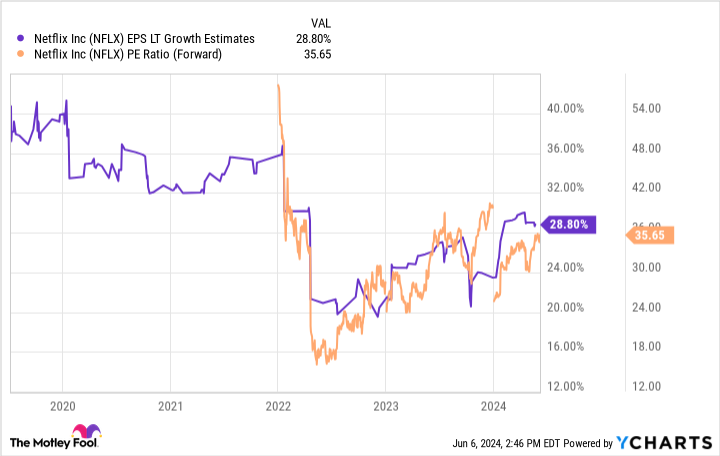

Netflix shares have significantly outperformed the broader market over the past decade. But the company appears poised for more years of strong profit growth. Shares trade today at 35 times earnings, but analysts estimate earnings will grow at an annualized rate of more than 28% over the next three to five years. This should make the stock attractive to investors.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Amazon was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $740,688!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Amazon and Netflix. The Mad Motley has a disclosure policy.

Want $1 million in retirement? Investing $10,000 in each of these 2 stocks for the long term could help you on your way was originally published by The Motley Fool