With the focus on artificial intelligence (AI) and mega-cap growth stocks, it’s easy to overlook the impressive rise of stable stalwarts like Walmart (NYSE: WMT). Up just under 30% year-to-date, Walmart is the sector’s best-performing component. Dow Jones Industrial Average — exceeding the gains of Amazon, Microsoft, Appleand other growth stocks. Additionally, Walmart has increased its dividend for more than 50 consecutive years, making it a King of dividends.

Walmart has a clear plan for growth in profits and increase in its dividend — but the stock has become more expensive and the yield is only 1.2%.

Manufacturer of outdoor tools and products Stanley Black & Decker (NYSE:SWK) is also a dividend king. But the stock has fallen more than 10% over the past three months and 57% over the past three years. Here’s why Stanley Black & Decker is no longer popular, how it’s a game-changer, and why it’s worth buying now.

An Introduction to Stanley Black & Decker

Stanley Black & Decker sells a variety of hand tools, power tools and accessories under brand names such as DeWalt, Stanley, Black+Decker, Craftsman and others.

A whopping $13.4 billion, or 85% of 2023 revenue, came from its tools and outdoor segment, while just $2.4 billion came from its business-to-business (B2B) industrial segment. Sixty-two percent of 2023 sales were in the United States. The company was therefore heavily impacted by inflation, rising interest rates, weak consumer spending, and a tough housing market. Meanwhile, other industrial companies that are primarily dedicated to B2B sales, such as General Electric And Siemens – are hovering around unprecedented highs.

Peaks and valleys

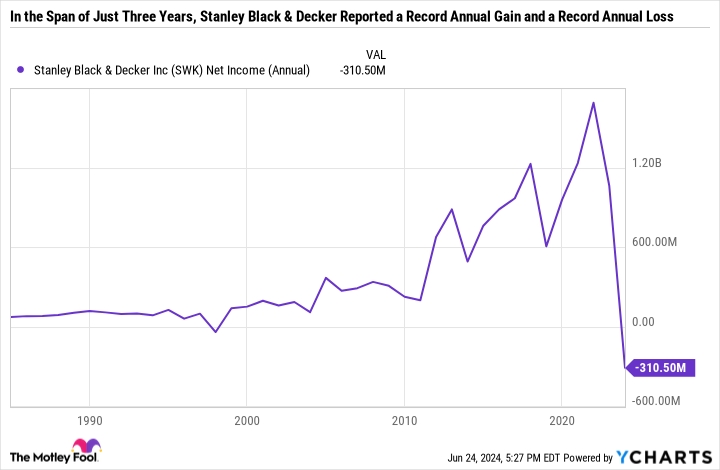

Stanley Black & Decker has had its ups and downs in recent years. The company made a record net profit of $1.69 billion in 2021, only to lose a record $311 million in 2023. The following chart illustrates this dramatic picture well.

You may be wondering how a business can go from a period of growth and expansion to a period of weakness in just a few years. The answer is simple: The COVID-19 pandemic has upended the tool maker’s business, disrupting supply chains and consumer behavior. Initially, Stanley Black & Decker benefited from a surge in spending on goods, which was reflected in its 2021 results. But by 2022, it became clear that demand had only been delayed by a few years and that the boom was not sustainable.

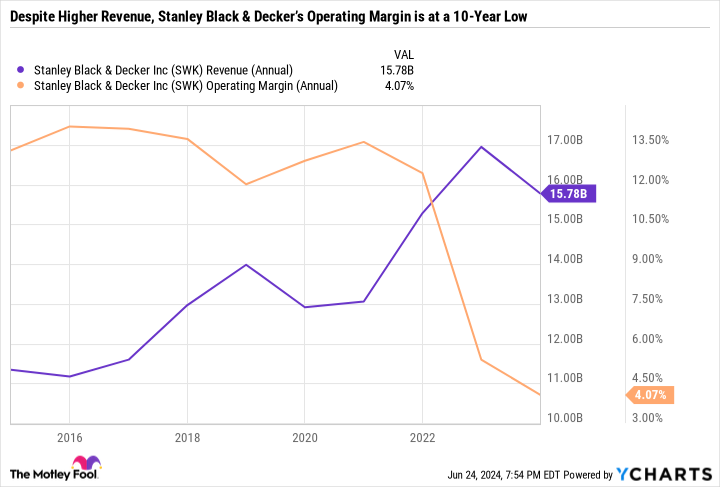

Stanley Black & Decker’s operating expenses have increased to meet demand. But when demand fell and revenues began to decline, these higher expenses ate into margins. In 2023, Stanley Black & Decker had an operating margin of just over 4%, compared to a range of around 12-14% before the pandemic, illustrating how inefficient the company has become.

Getting back on track

The company has implemented a massive cost-cutting effort to restore margins – aiming to achieve an adjusted gross margin of 35% over the long term and 30% for the full year 2024. Stanley Black & Decker achieved $145 million in pre-tax cost savings last quarter, bringing its overall cost savings to $1.2 billion since the program launched in the second quarter of 2022.

It must be recognized that Stanley Black & Decker has remained on track to achieve its objectives. When he first announced the program, he projected $1 billion in pre-tax savings by the end of 2023 and $2 billion in savings within three years. During its first quarter 2024 earnings conference call, Stanley Black & Decker said it still targets $1.5 billion in pre-tax savings by the end of 2024 and $2 billion by the end of 2025 .

Inventory reduction has been another focus for the company. Stanley Black & Decker is forecasting inventory reductions of $400 million to $500 million for the full year and capital expenditures of just $400 million to $500 million. The inventory reduction and tight spending controls should help the company hit its full-year free cash flow (FCF) target of $600 million to $800 million. That’s still a far cry from the $1.08 billion in FCF the company earned for all of 2019, which is a good benchmark given that this was before the pandemic disrupted its operations.

High yield with (potentially) cheap valuation

The FCF forecast for 2024 would allow Stanley Black & Decker to cover its dividend with FCF. During the last quarter, Stanley Black & Decker paid $121.8 billion in dividends. Over the past two years, the company has increased its dividend by at least $0.01 per share per quarter to maintain its dividend king status, which is understandable given that the company is undergoing a turnaround. Therefore, investors should also expect minimal increases over the next few years, meaning annual dividend spending is expected to be less than $500 billion for 2024 and 2025.

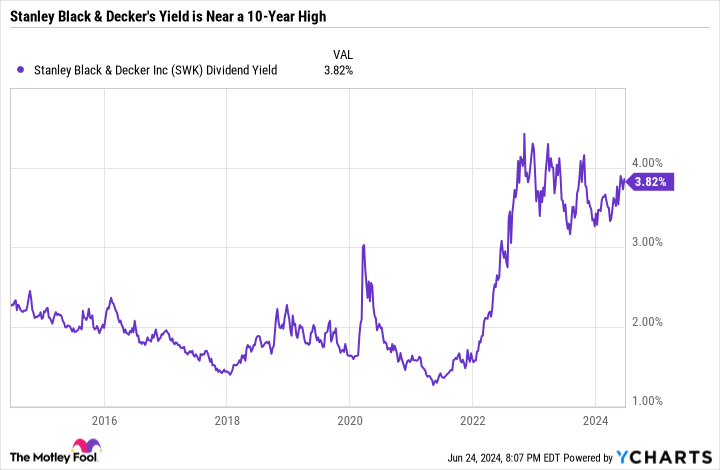

A lower stock price coupled with a moderately higher dividend has propelled Stanley Black & Decker’s yield to 3.8% – significantly higher than the roughly 2% yield investors were getting before the pandemic.

Given its net loss in 2023, Stanley Black & Decker currently has a negative price-to-earnings ratio (PER). However, analyst estimates reflect the impact of its cost-cutting efforts and a return to profitability. Average analyst estimates are for earnings per share (EPS) of $4 in 2024 and $5.48 in 2025. Based on 2025 EPS forecasts, Stanley Black & Decker would have a price-to-earnings ratio of just 15.5, which is very cheap for a dividend king. However, a lot could go wrong between now and this full-year 2025 figure is released. Investors should therefore not rely on analyst estimates.

Stanley Black & Decker is worth the wait

Stanley Black & Decker has mismanaged the COVID-19 pandemic, supply chain disruptions and interest rates. And the stock price reflects those mistakes, being only about 15% off its 10-year low. However, the company has done a good job over the past seven quarters of sticking to its cost-cutting plan.

In the near term, Stanley Black & Decker’s free cash flow projections suggest the company is able to fund its dividends with cash. In the medium term, a return to profitability and earnings growth make the stock seem like an attractive value.

Even if the business recovers, investors shouldn’t expect the company to significantly increase its dividends or repurchase shares. The balance sheet has weakened in recent years due to higher debt. S&P GlobalThe company’s June 20 annual review gave it an A- credit rating, which is good but could be improved.

At times like this, it’s important to step back and think about where a business will be in three to five years. If Stanley Black & Decker can return to pre-pandemic form and chart a path to growth, the valuation and yield will make the stock look too cheap to ignore. Patient investors may want to acquire shares of the Dividend King now, while others may prefer to take a wait-and-see approach to ensure Stanley Black & Decker can operate effectively under a simpler business model.

Should You Invest $1,000 in Stanley Black & Decker Right Now?

Before buying Stanley Black & Decker stock, consider this:

THE Motley Fool Stock Advisor The team of analysts has just identified what it believes to be the 10 best stocks Investors should buy now…and Stanley Black & Decker wasn’t one of them. The 10 selected stocks could generate monstrous returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $759,759!*

Securities Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Stock Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Amazon, Apple, Microsoft, S&P Global and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Mad Motley has a disclosure policy.

Walmart is a bulletproof dividend king, just like this high-yielding dividend stock that’s down 11% in the past 3 months was originally published by The Motley Fool