(Bloomberg) — As the carbon offset market gets a new lease of life thanks to the COP28 climate summit in Dubai, bankers on Wall Street and the City of London are positioning themselves to get a piece of the deals they say come.

Most read on Bloomberg

Banks that have established carbon trading and finance desks include Goldman Sachs Group Inc., Citigroup Inc., JPMorgan Chase & Co. and Barclays Plc. They seek to finance the development of carbon sequestration projects, trade credits and advise corporate clients on the purchase of offsets. They also want to support local projects in emerging markets that currently lack the financial muscle to scale up their work.

“Many project developers don’t have huge balance sheets and have difficulty raising funds,” said Sonia Battikh, global head of carbon offset trading at Citi. “Figuring out how to fill that funding gap and channel money into projects is where a bank like Citi can play a role.”

Wall Street is fighting for a foothold in a market that has the potential to reach as much as $1 trillion, as offsets offer companies a way to reach net zero emissions without eliminating all their emissions. Rich Gilmore, chief executive of investment manager Carbon Growth Partners, said it was already clear there would soon be a serious shortage of high-quality credit, given the demand.

In this context, “Wall Street giants will have to find a balance between speed to market and a deep understanding of the rules, standards and expectations” regarding the evolution of the voluntary carbon market, he said. declared.

For now, this is a market still trying to emerge from a long list of controversies.

Many of the credits generated have drawn criticism from climate scientists for their apparent failure to meet the environmental claims of those selling them. Last month, the chief executive of South Pole – the world’s largest seller of carbon offsets – resigned as the company pledged to look into allegations of greenwashing and “learn from experience”.

Bankers who study the market say such episodes cannot erode confidence in the future of carbon offsetting. “It would be a shame if criticism, while well-intentioned, undermined financial flows to these projects,” said Kiru Rajasingam, head of European electricity, gas and emissions trading at Citi.

And speaking at the COP28 summit in Dubai, John Kerry, the US climate negotiator, described himself as “a strong believer in the power of carbon markets to drive ambition and action”.

Ingmar Grebien, who heads the Commodities Sustainable Solutions unit at Goldman Sachs, said the markets he studies “remain fragmented and in their infancy in terms of efficiency and transparency.”

At Goldman, which last year hired former Gazprom executive Leigh Smith with a mandate that included trading carbon credits, “the focus is on expanding trading and financing solutions for sustainable products like as carbon, renewable energy and other emerging environmental products,” Grebien said.

JPMorgan hired its first voluntary credit trader in Houston earlier this year, according to a person familiar with the matter who asked to remain anonymous discussing information they are not authorized to disclose. A JPMorgan spokesperson, who declined to name the new employee, said the company was “adding carbon trading capabilities.”

The largest U.S. bank offers carbon credit trading as well as capital, advisory and market-making services. This is an “increasingly important” area of focus for JPMorgan, the spokesperson said.

For some, the arrival of global banks in a market that is not yet properly regulated is a worrying development.

“After a year of revelations about the horror of voluntary forest carbon projects,” it’s “astonishing that people are again saying we need this without a complete overhaul,” said Michael Sheren, a former senior adviser to the Bank of England. member of the Cambridge Institute for Sustainability Leadership.

“The VCM is like a many-headed snake that has risen again at COP28,” he said.

Although climate scientists have long warned against relying on offsets to achieve net zero emissions, they also recognize that these products are essential when it comes to tackling residual emissions in hard-to-reduce sectors.

And in the name of exorcising the ghosts of the past, a new era of collaboration has taken hold during the first week of COP28. The largest voluntary carbon standards bodies have agreed to align best practices and improve transparency, while leading organizations plan to establish a comprehensive integrity framework for carbon credit schemes.

The US Commodities Futures Trading Commission, which regulates derivatives markets, used the COP28 summit to unveil standards for high-integrity carbon offset futures trading. United Nations officials at the talks in Dubai are expected to announce new safeguards around the voluntary carbon market, which will be based on guidelines drafted by experts last month.

Voluntary carbon credits “are not going to solve the climate crisis,” Rajasingam said. “But at the same time, we don’t want valuable projects to go unfunded because of a reputational stigma.” »

For now, carbon prices are at historic lows. Last year, demand fell 12%, with a further 5% decline in 2023, according to BloombergNEF.

“But the fundamental drivers behind demand have not changed,” wrote BNEF’s Layla Khanfar in a recent research note.

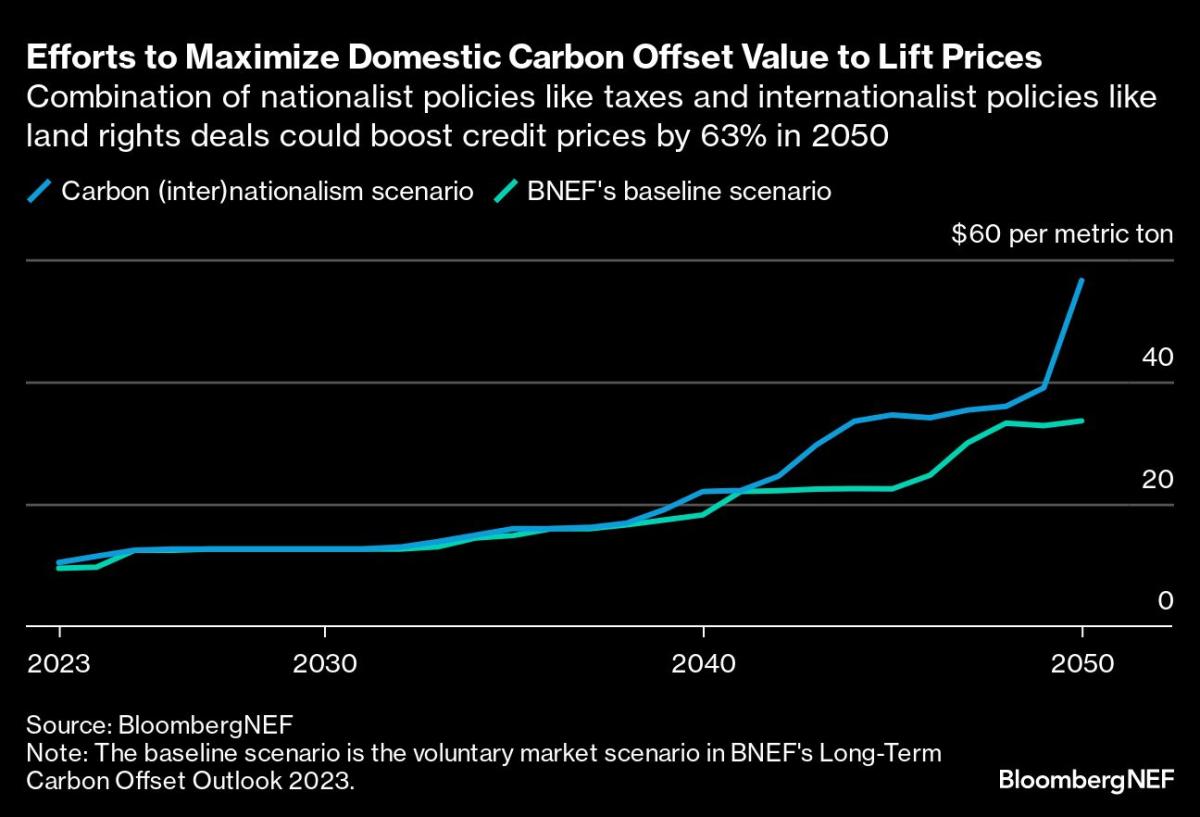

Driving factors include the simple fact that many companies will not be able to meet net zero targets without resorting to offsets, as well as the prospect of national restrictions. Such dynamics paves the way for a considerable rise in prices by the middle of the century, estimates BNEF.

How compensation works:

The aim of the voluntary carbon offset market is to generate carbon credits, which are then typically purchased by companies to offset their emissions. A carbon credit is a paper guarantee purporting to represent a tonne of CO2 reduced or removed from the atmosphere, generated by projects such as wind farms or tree planting. Project developers team up with intermediaries such as South Pole to sell the credits. Buyers can trade in the units or use them to offset their own emissions, in which case they must withdraw the credit to prevent it from being used twice.

Citi’s carbon markets team currently consists of four London-based traders and four salespeople covering the voluntary carbon market. Barclays has hired industry veteran from Shell Plc, Oliver Morning, to run its carbon trading operations, Bloomberg reported last month.

Among the long list of unknowns surrounding the carbon offset market is the element of technological innovation, which could suddenly energize the field of carbon removal. This can make some project financing seem more like “venture capital-type risk,” Rajasingam said.

“Carbon credits are best when prices and methodologies are established, not for technologies that are still emerging,” he said. “That said, we intend to be very active in the moves as they become larger.”

Michael R. Bloomberg, founder and majority owner of Bloomberg LP, parent company of Bloomberg News, is the UN secretary-general’s special envoy for climate ambition and solutions. Bloomberg Philanthropies regularly partners with the COP Presidency to promote climate action.

Bloomberg LP, the parent company of Bloomberg News, is partnering with South Pole to purchase carbon credits to offset global travel emissions.

Most read from Bloomberg Businessweek

©2023 Bloomberg LP