It’s been a horrible year for Walgreens Boot Alliance (NASDAQ:WBA) stock, which is down more than 45% during this period. In fact, it’s been a rough decade, with the stock falling more than 75% in the last 10 years.

With the stock now trading at the same level as it was in 1998, let’s look at what went wrong for the company and whether investors should consider purchasing shares at these levels.

The difficulties of the company

One of the biggest problems facing Walgreens and the pharmaceutical industry in general is constant reimbursement pressure. The company has been constantly talking about this problem since at least early 2016.

Within the prescription drug industry, pharmacies are reimbursed by pharmacy benefit management (PBM) companies whose job is to negotiate prices for their health insurance provider clients. The big three PBMs now control about 80% of the market and have driven down reimbursement rates.

The pressure has hit the entire industry, from large pharmacies, like Walgreens, to small independents. In a National Community Pharmacists Association survey, nearly a third of independent pharmacies said they planned to close their doors this year due to reimbursement pressures. Meanwhile, Rite Aid filed for bankruptcy last fall.

For its part, Walgreens has tried to expand beyond the pharmaceutical sector to counter the reimbursement pressure it is seeing. However, this led to a poor acquisition on its part, as former CEO Rosalind Brewer decided to create a more integrated company that would treat patients across their continuum of care.

Walgreens’ big mistake was buying a large stake in VillageMD, which itself was acquiring various medical groups to expand. However, expanding beyond its core markets has proven difficult for ViilageMD and last year the company decided to pull out of a number of newer markets. During its most recent quarter, Walgreens took a $5.8 billion after-tax goodwill writedown on its investment in VillageMD, acknowledging that it had significantly overpaid for the company.

For a company with $8.8 billion in net debt, not including operating leases, an ill-advised investment was not a good use of cash. The company is now looking to preserve cash and had to cut its dividend by almost half in January.

Can the company be turned around?

When it comes to reimbursement, the amount of blood from a stone is limited to what PBMs can pull from pharmacies. New CEO Tim Wentworth comes from the PMB sector, where he was previously CEO of Express Scripts. He plans to move reimbursements to a cost-plus model, in which the company could benefit when it is able to help slow inflationary pressures on drug prices on its end. It is already using this type of model in the UK with Boots, where pharmacists can advise patients and prescribe treatments for seven common health conditions.

However, the company cautioned that even if PBMs are open to this type of model, it will take time for the industry to move toward it.

On the side of VillageMD and the company’s other healthcare businesses, the damage was done because the investment didn’t perform as expected. The write-down is not in cash, so it is more of an admission of error than anything else and shows the likelihood that the business will not grow as expected. Instead, the company is working to restructure VillageMD’s cost structure and reduce its footprint in order to improve profitability.

For the quarter, the company’s U.S. healthcare business was able to post positive adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $17 million and a modest adjusted operating loss of $34 million. At the same time, VillageMD sales increased 20% thanks to like-for-like growth. So there are, at the very least, signs that this segment will no longer weigh on the company’s bottom line.

Is it time to buy the stock or stay away?

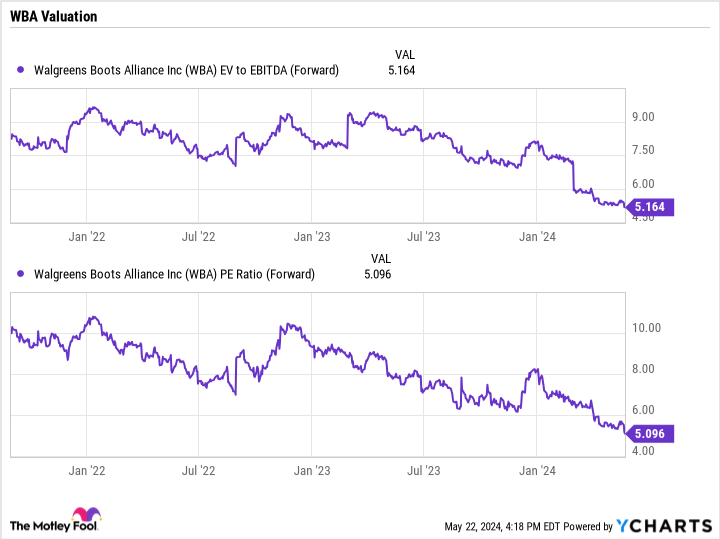

HAS forward price/earnings (P/E) of around 5 and an enterprise value (EV)/EBITDA ratio of 5, Walgreens stock is cheap. This last measure takes into account its net debt and excludes non-monetary elements.

The path to recovery for the business is possible, but it will not happen overnight and it is not guaranteed. The company has a lot of debt, but it also has assets that it can consider selling to reduce debt if necessary in the future. UK drugstore Boots is one option, as it has performed well with retail market share growth for 12 consecutive quarters.

At this point, Walgreens stock is an option worth considering for patient investors with a tolerance for risk.

Should you invest $1,000 in Walgreens Boots Alliance right now?

Before you buy Walgreens Boots Alliance stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Walgreens Boots Alliance was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $652,342!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has no position in any of the securities mentioned. The Mad Motley has a disclosure policy.

Walgreens Boots stock just hit its lowest level since 1998. Is it time to buy the dip or stay away? was originally published by The Motley Fool