Demand for artificial intelligence (AI) services has skyrocketed over the past year, prompting countless technology companies to pivot their businesses toward this nascent sector. The launch of OpenAI’s ChatGPT has reignited interest in AI and highlighted how far the technology has come.

According to Grand View Research, the AI market is expected to grow at a compound annual rate of 37% until at least 2030, pushing it to a value close to $2 trillion. AI will likely boost countless industries as the technology is applied to sectors such as consumer technology, cloud computing, autonomous vehicles, machine learning, and more.

So there are dozens of ways to invest in AI and benefit from the long-term expansion of the market. Here are two AI stocks that could go parabolic.

1.Intel

It wasn’t easy being a Intel (NASDAQ:INTC) investor in recent years, with the company facing some obstacles.

Intel was responsible for more than 80% of the central processing unit (CPU) market for at least a decade and was the leading chip supplier for Applethe MacBook range for years. But the tech giant’s dominance has made it complacent, leaving it vulnerable to more innovative competitors.

Flea Rival Advanced microsystems began to gradually eat away at Intel’s processor market share in 2017, and that share has now fallen to 63%. Then, in 2020, Apple severed ties with Intel in favor of more powerful in-house hardware designs. As a result, Intel shares have fallen about 35% over the past three years.

However, the fall from grace seemed to reignite a fire under Intel, and the company took steps to come back strong in the years to come. Last June, Intel announced a “fundamental change” in its business, adopting an in-house foundry model that it says will save it $10 billion by 2025.

Additionally, Intel is investing heavily in AI. In December 2023, the company launched a range of AI chips, including Gaudi3, a graphics processing unit (GPU) designed to compete with similar offerings from the market leader Nvidia. Intel also introduced new Core Ultra processors and Xeon server chips, which include neural processing units to run AI programs more efficiently.

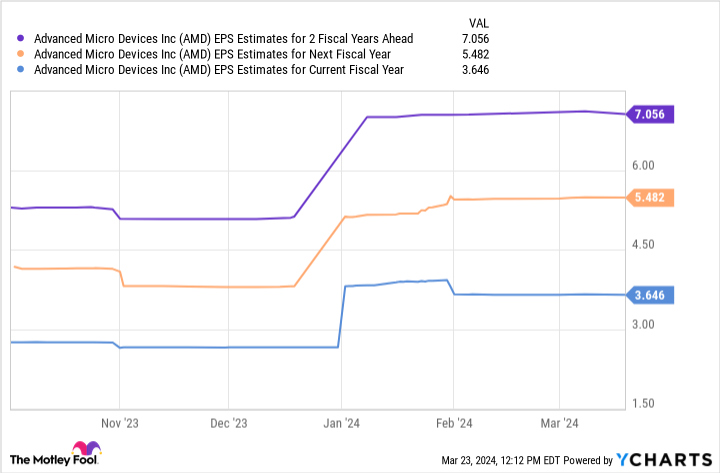

Intel has a mountain to climb to catch up with its AI rivals. However, it’s a promising direction that could pay off big in the long run, and earnings per share (EPS) estimates support its significant potential.

This chart indicates that Intel’s earnings could reach nearly $3 per share over the next two fiscal years. By multiplying this figure by the company’s forward price/earnings (P/E) ratio ratio of 31, you get a stock price of $91. Given its current position, these projections could see Intel shares soar 112% by fiscal 2026. With its growing position in AI, Intel is currently a screaming buy.

2. Advanced micro-devices

If you want to invest in AI, you can’t have too many chip stocks in your portfolio. These companies develop the hardware needed to train and run AI models. AMD is an attractive investment option: it currently has the second largest market share in GPUs and is gradually expanding into AI.

Last December, AMD unveiled its new MI300X AI GPU. The chip was designed to directly compete with Nvidia’s offerings and has already attracted the attention of some of the tech industry’s biggest players, signing Microsoft And Metaplatforms as customers.

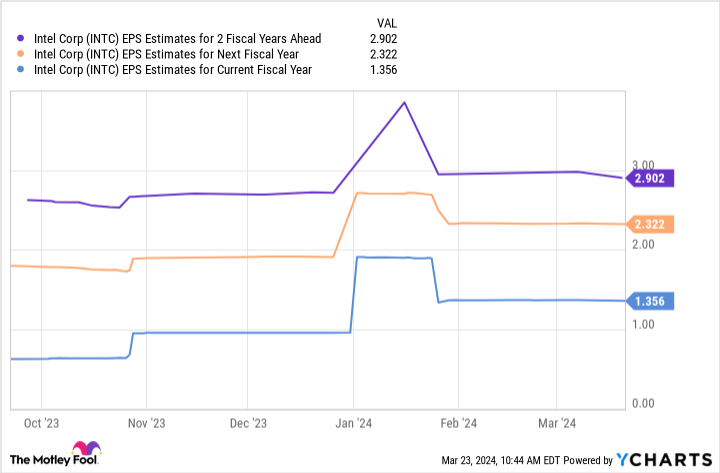

AMD’s profits do not yet reflect its investment in AI. However, its recent quarterly results suggest it is moving in the right direction. In the fourth quarter of 2023, AMD’s revenue increased 10% year-over-year to $6 billion, beating analysts’ expectations by around $60 million. The company’s AI-driven data center segment saw revenue growth of 38%.

In addition to AI chips, AMD is diversifying its market position by expanding into AI-powered PCs. According to research firm IDC, PC shipments are expected to see a big increase this year, with AI integration serving as a key enabler. And a Canalys report predicts that 60% of all PCs shipped in 2027 will be AI-enabled.

AMD’s earnings are expected to reach $7 per share over the next two fiscal years. In a calculation similar to Intel’s, multiplying this number by AMD’s forward P/E of 49 yields a stock price of $345. Compared to its current position, AMD stock would climb 92% by fiscal 2026. Like Intel, AMD stock could go parabolic if all goes well.

Should you invest $1,000 in Intel right now?

Before buying Intel stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Intel was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns March 25, 2024

Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Daniel Cook has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Advanced Micro Devices, Apple, Meta Platforms, Microsoft and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short 405 calls $ in January 2026 on Microsoft and short $47 calls in May 2024. Intel. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool