(Bloomberg) — U.S. Treasuries rallied Wednesday as data showed hiring slowed at a faster pace than expected and shares of a New York bank fell after reporting a surprise loss , raising concerns about the health of regional lenders.

Most read on Bloomberg

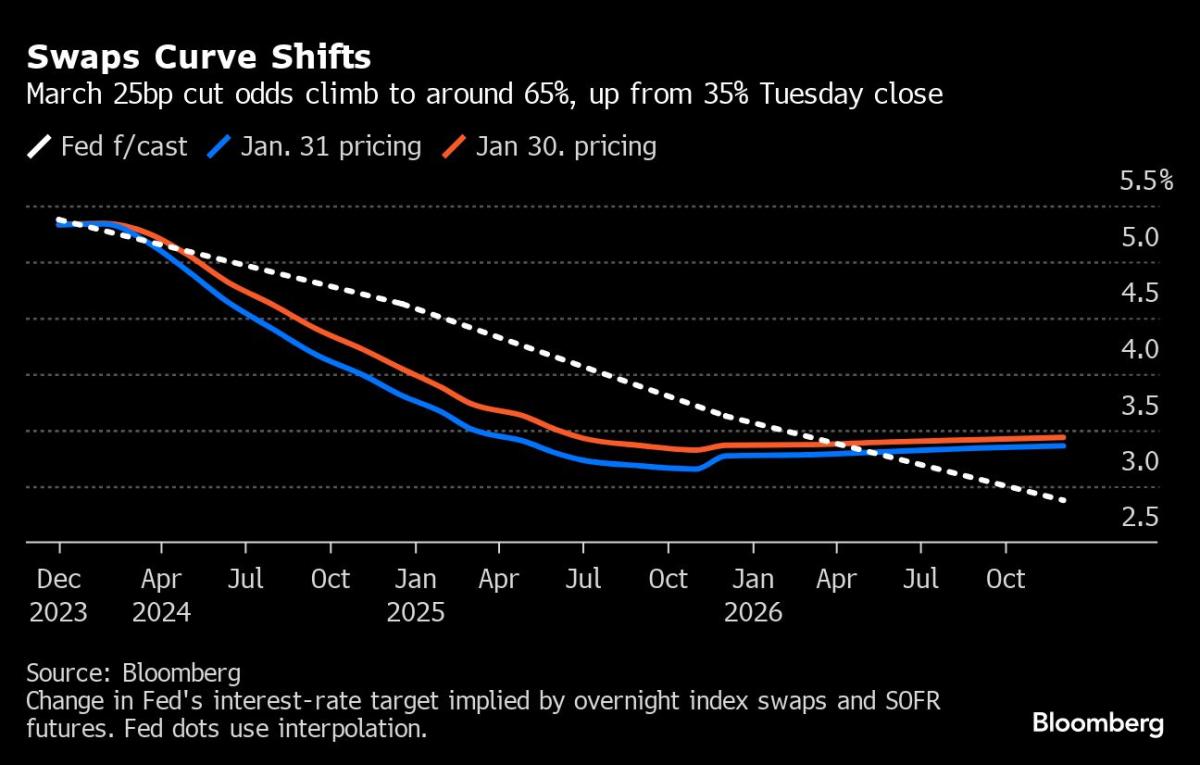

The move sent two- to five-year Treasury yields falling more than 10 basis points as traders anticipated a higher likelihood of Federal Reserve interest rate cuts as soon as March. Fed policymakers are expected to wrap up a two-day meeting Wednesday afternoon with no policy changes expected. The US 10-year yield has fallen back below 4%.

New York Community Bancorp, the regional lender that bought deposits from Signature Bank last year, fell a record 45% after reporting a fourth-quarter loss and dividend cut. The regional KBW banking index fell 4.8%, the biggest one-day drop since May. His slide evokes memories of the banking crisis that followed the collapse of Silicon Valley Bank in March.

“At the moment it appears to be an isolated event,” said Tom di Galoma, co-head of global rates trading for BTIG in New York. “The bond market is looking for an event that would prompt the Fed to ease policy.”

Government bonds rebounded globally, with larger yield cuts in several euro zone markets after slower-than-expected French inflation figures helped the outlook for lower rates. interest of the European Central Bank.

In the United States, traders increased their bets on a Fed rate cut in 2024, with the chance of a first cut in March estimated at around two-thirds likely, up from a third on Tuesday. Nearly 150 basis points of rate cuts have been planned for all of 2024, up from around 135 basis points. The dollar fell to its lowest level in a week and safe-haven buying sent the yen and Swiss franc higher.

The yield on two-year Treasury notes fell 15 basis points to 4.18%, the lowest level since January 16.

Previously, bonds had benefited from support from US economic data, including January’s ADP employment and fourth-quarter employment costs – both of which rose less than expected – as well as the Treasury’s announcement on the size of auctions for the February to April quarter. Treasury said the increases it made would likely be the last for at least several quarters.

The data “lines up well, with initial markets underestimating the likelihood of a cut in March,” said Ed Al-Hussainy, global rates strategist at Columbia Threadneedle.

Al-Hussainy downplayed the impact of New York Community Bancorp, saying it has “no systemic value.” “I guess it’s not a happy day for their shareholders, but otherwise it doesn’t matter,” he said.

–With assistance from Edward Bolingbroke and Alexandra Harris.

(Adds other global markets in fifth and sixth paragraphs.)

Most read from Bloomberg Businessweek

©2024 Bloomberg LP