Predicting market trends is often more of an art than a science. Yet, despite its complexity, the data available can help decipher the nuances of inventory movements.

TipRanks Smart Score is a perfect example. By searching the entire database and gathering information for each stock according to 8 categories known to predict future stock performance, the Smart Score combines these categories into a single score that allows investors to see at a glance look at how the action is likely to evolve. in the coming year.

This score is assigned on a scale of 1 to 10, with lower scores indicating likely underperformance of the market as a whole, and higher scores indicating outperformance. A perfect score, a 10, is a rare gift for an action. This doesn’t necessarily mean that all the factors align perfectly, but it does indicate a potentially bright future for the stock in question.

Today we’ve selected two “Perfect 10” stocks that are also great defensive stocks, with dividends yielding 7% or more. As volatility returns to markets, the combination of likely outperformance and strong dividend yield makes these stocks ones investors should consider..

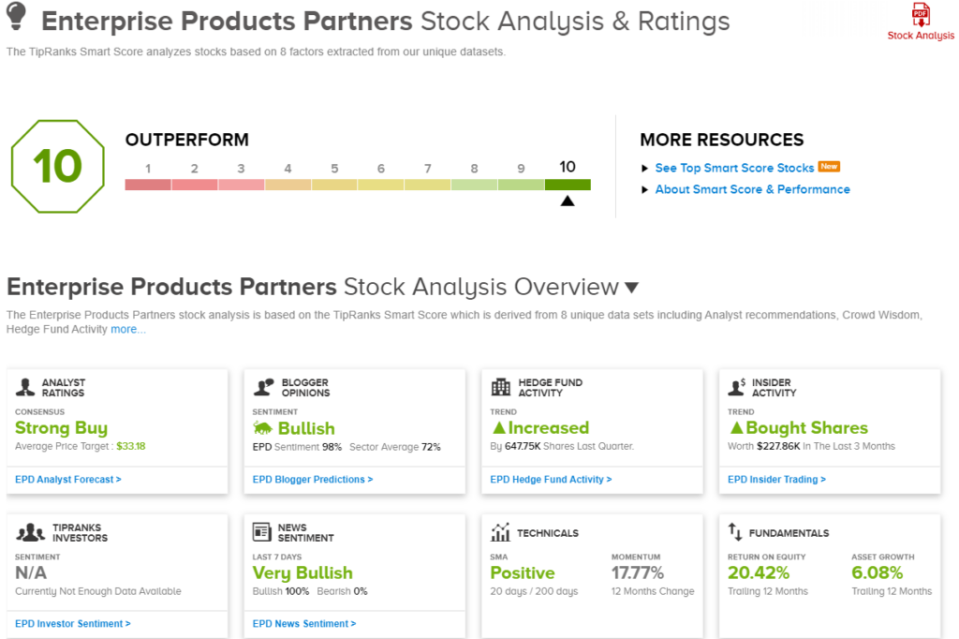

MPLX LP (MPLX)

The first company on our Perfect 10 list is a midstream company in the oil and gas industry, MPLX. Originally a division of Marathon Petroleum, the company separated from its parent company in 2012 to operate as an independent partnership company controlling the parent company’s midstream transportation assets. That’s a bit of a mouthful, but it boils down to the fact that MPLX operates an extensive network of pipelines, endpoints, river tugs and barges, and other transportation and storage assets that connect production regions of hydrocarbons across North America to storage facilities, reservoirs. farms, refineries and export terminals that bring crude oil, natural gas and their refined products to market. MPLX today has a market capitalization of $41.5 billion and generated $11.34 billion in revenue last year.

Among MPLX’s main assets are its rail and road supports, maritime operations and export terminals. These facilities enable the mass movement of hydrocarbon products, refined and unrefined, independent of pipelines, and can deliver products to global distribution networks. The company also has facilities for processing natural gas and using natural gas liquids. MPLX is known for selling natural gas commodity liquid products such as ethane, propane, butane, isobutane and natural gasoline.

In the last reported quarter, for 1Q24, MPLX reported total revenue of $2.85 billion. Although this amount increased by 5.2% year-over-year, it was just under forecast, missing by $50 million. Ultimately, the company reported EPS of 98 cents; This represents an increase of 7 cents per share year-over-year and a return of 2 cents per share better than expected.

The strong earnings fully covered the dividend payment on MPLX common stock, which was declared in April for 85 cents per share and paid on May 13. The annualized rate of $3.40 per common share gives a forward yield of 8.32%. MPLX has paid its regular stock dividend every quarter since 2013 and has a history of regularly increasing this payment.

This company’s strong business and high-yielding dividends are at the heart of Truist Securities’ optimistic outlook. Analyst Neal Dingmann, who ranks among the top 1% of Street equity professionals, writes of the stock: “MPLX has not only been active in organically growing its collection and processing segments as well as logistics and transportation business, but the company recently completed an accretive acquisition and continues to pay notable returns to shareholders. To our surprise, MPLX repurchased a number of units last quarter in addition to its large dividend which currently exceeds an 8% yield. We expect moderate growth ahead, driven by the liquids-rich Appalachian regions, with potential for significant upside if/when natural gas prices return to more normal levels.

The 5-star analyst follows these comments by reiterating his Buy rating on the stock, and he sets a price target of $48, implying a one-year upside potential of nearly 17.5%. With the dividend yield added to that, the one-year total return could reach almost 26%. (To see Dingmann’s track record, Click here)

Truist’s bullish outlook on this stock is in line with the Street consensus. MPLX stock has a Strong Buy consensus rating based on 9 recent reviews that break down to an unbalanced 8 Buy to 1 Hold split. Shares are priced at $40.86 and the average target price of $46.13 represents a potential gain of 13% for the coming year. (See MPLX Stock Forecast)

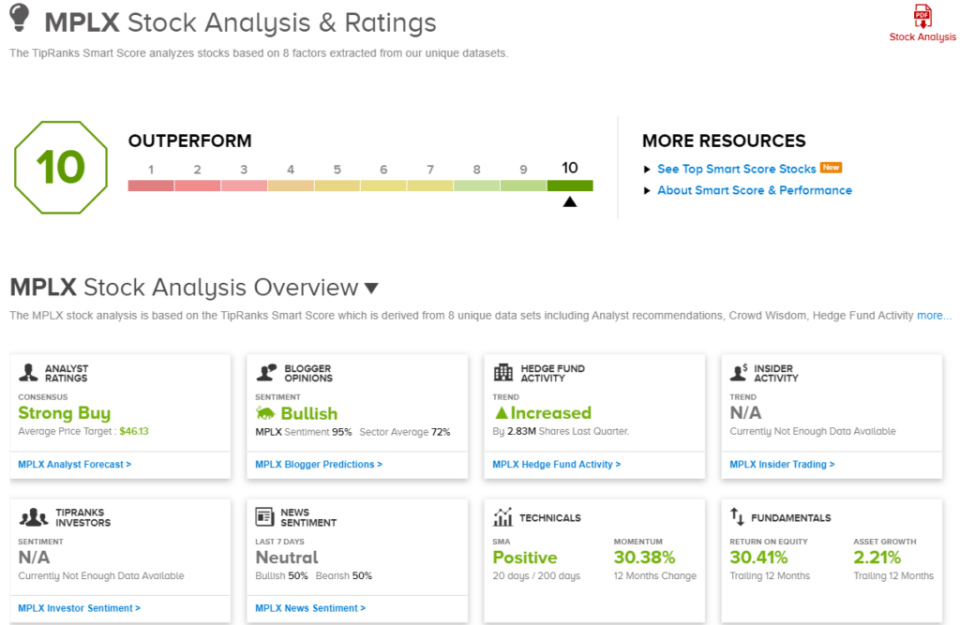

Enterprise Product Partners (EPD)

The second stock we’ll look at here, Enterprise Products Partners, is another North American midstream energy company. Enterprise is one of the largest companies in the industry, with a market capitalization exceeding $62 billion and annual revenue of nearly $50 billion. Like MPLX above, Enterprise operates as a partnership company and its activities involve the transportation and distribution of hydrocarbon-based energy sources.

Specifically, Enterprise has a network of transportation, distribution and storage assets, including fractionation facilities, deep water docks and storage tanks with a liquid storage capacity of more than 300 million barrels and 14 billion cubic feet of natural gas capacity. The company’s pipeline assets total more than 50,000 miles. In addition to its transportation services, the company can provide natural gas collection and processing. Enterprise’s network of assets is centered on the Gulf Coast, primarily in Texas and Louisiana, with a secondary center on the Texas-New Mexico border. The assets extend to the Southeast, the Appalachian Mountains, the Great Lakes, the Mississippi Valley and the Rocky Mountains.

Enterprise is expanding its commercial network, particularly in the rich Permian Basin of Texas. The company is currently working to develop three new natural gas processing facilities in the Delaware Basin region in the larger Permian formation. The plants under development will significantly increase Enterprise’s capacity to process natural gas and natural gas liquids in this important production region, and are expected to begin commissioning during 2Q26.

In its 1Q24 report, Enterprise posted revenue of $14.76 billion, beating forecasts by $940 million and growing more than 18% year-over-year. The company’s profit, reported as GAAP EPS of 66 cents, increased 3 cents from the same period a year ago, but missed forecasts by a penny per share.

Despite the slight shortfall, EPS still more than covered the company’s dividend, which was declared on April 5 at the rate of 51.5 cents per common share. This payment, sent on May 14, amounts to $2.06 per share annualized and offers investors a forward yield of nearly 7.2%.

This is another stock that has caught Truist’s attention, and when we check again with analyst Dingmann, we find that he is bullish on the company’s expansion plans and its potential of performance, writing: “The company continues to benefit from strong Permian and incremental growth. another key regional demand for its processing, collection, maritime and other segments. We believe the company is responding quite strategically by building facilities where needed, including the soon-to-be-completed three Permian processing plants, which will then total 19 for the region, producing a total of 675,000 B /d of NGL. We expect notable growth relatively soon, leading to additional shareholder returns beyond the current strong level.

Dingmann rates EPD a Buy, while setting a price target of $35 to suggest 22% one-year upside potential. With the dividend, the yield here could reach 30%.

Overall, there is strong support for this stock’s Strong Buy consensus rating: 12 recent analyst reviews include 11 Buys and just 1 Hold. Shares are trading at $28.65 and have an average price target of $33.18, implying a 16% upside over a one-year horizon. (See EPD Stock Forecast)

To find great ideas for trading stocks at attractive valuations, visit TipRanks. Best Stocks to Buya tool that brings together all the information about stocks from TipRanks.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.