Over the past century, no asset class has generated a higher average annual return than stocks. With thousands of publicly traded companies and exchange-traded funds for investors to choose from, investors of all backgrounds and risk tolerances are likely to find a stock that meets their goals and grows their wealth.

But among the countless strategies available to investors, few have been as successful as buying and holding stocks. dividend stocks.

Last year, investment advisors Hartford Funds released a detailed report (“The Power of Dividends: Past, Present and Future”) that examined the outperformance of dividend stocks over the past half-century (1973-2023). ). Working with Ned Davis Research, Hartford Funds found that dividend stocks more than doubled non-payers’ average annual returns over 50 years: 9.17% versus 4.27%.

Additionally, dividend-paying stocks have proven to be less volatile. While non-payers were 18% more volatile than non-payers S&P500 and produced modest returns over 50 years, dividend stocks were 6% less volatile than the benchmark index. Companies that regularly share a percentage of their profits with investors tend to be consistently profitable and proven, hence lower volatility.

While the Dow Jones Industrial Average and S&P 500 are known for their dividend paying companiesYou might be surprised to learn that growth-oriented programs Nasdaq-100 is also home to a number of fantastic income stocks.

Right now, two high-yielding and struggling Nasdaq-100 stocks are ripe for selection and begging to be purchased by opportunistic investors. Note: “High-yield” refers to any stock whose yield is at least twice the current yield of the S&P 500 (1.34%, as of June 14, 2024).

Time to pounce: Starbucks (2.9% yield)

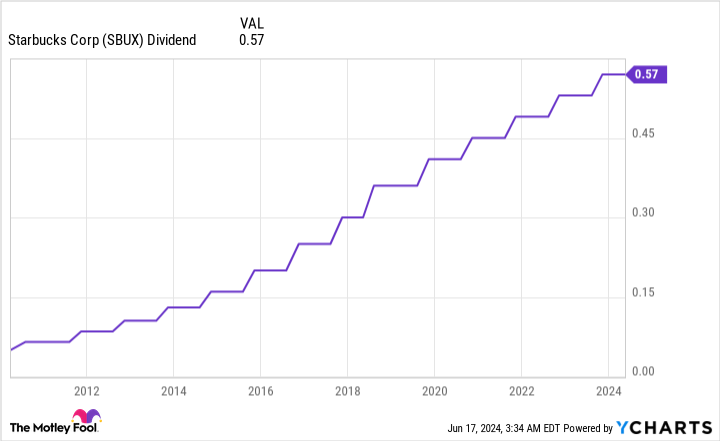

The top Nasdaq-100 high-income stock that seems obvious right now is the global coffee chain. Starbucks (NASDAQ:SBUX). The company’s shares have fallen 37% since hitting an all-time high in 2021, which has, in turn, pushed its dividend yield to nearly 3%.

There’s no doubt that Starbucks’ second-quarter operating results are bad. Starbucks has a long history of blowing away Wall Street’s generally conservative growth estimates. But the coffee giant reported a 4% drop in global same-store sales and once again lowered its sales forecast for the full 2024 financial year, which ends at the end of September.

The culprits for this weakness appear to be a combination of higher input costs (both labor and coffee), the company’s new beverages not resonating with consumers, and the rebound China’s economy after three years of strict COVID-19 lockdowns, which took longer than expected. While there is no excuse to make, none of these headwinds are long-term in nature.

For example, Starbucks has an exceptionally loyal customer base. The company closed March with 32.8 million active Rewards members in the United States, up 6% from the year-ago period. Rewards members generally spend more per ticket than non-members, and they are more likely to rely on mobile ordering and store their credit card information on their smartphone. Simple things like mobile ordering and storing payment information on smartphones speed up in-store lines and make Starbucks stores more efficient over time.

To add to this point, Starbucks has never been afraid to increase the price of its beverages or food items to counter rising costs. Having a loyal customer base makes it easy for the business to combat inflation and the occasional slight drop in foot traffic.

Weak sales in China are also not a cause for great concern. It will take time for China’s economy to resolve supply chain problems that followed three years of strict provincial pandemic lockdowns. As China’s middle class finds its place, these consumers will likely have more incentive to return to their local Starbucks.

However, the main reason to trust Starbucks in the long term is its ability to innovate. A perfect example is Starbucks who completely overhauled their drive-thru boards during the pandemic. She installed video to personalize the drive-thru experience, and also promoted high-margin food and drink pairings on her order boards. The company has also tinkered with new food products to encourage lunch customers to visit its stores.

Although Starbucks is currently going through an undeniable period, the company has a history of using beverages, food and technological innovations to attract traffic to its stores. The company’s forward price-to-earnings (P/E) ratio of less than 20 marks the lowest level in a decade and represents a 30% reduction from its average forward P/E multiple over the past five years. last years.

Time to pounce: Walgreens Boots Alliance (6.4% yield)

The other high-yielding and struggling Nasdaq-100 stock that opportunistic investors can pounce on right now is the drugstore chain. Walgreens Boot Alliance (NASDAQ:WBA). Walgreens shares have fallen 84% since reaching an all-time high of nearly $100 per share in 2015.

Walgreens has had no shortage of challenges over the past two years. It faces growing competition from online pharmacies, has settled litigation over its role in the opioid crisis and is trying to dig itself out of a mountain of debt. The company’s dividend was also cut by almost 50% in January 2024. Long story short, there are viable reasons why Walgreens stock is struggling.

While turnarounds at brick-and-mortar retailers aren’t short-term events, the stage is being set for Walgreens Boots Alliance stock to eventually do a 180 for investors looking for value and income.

As I’ve noted before, the most significant of all the changes undertaken by Walgreens was the hiring of Tim Wentworth as CEO. Wentworth is the former CEO of pharmacy benefits management company Express Scripts, as well as Evernorth, Cignathe organization of health services. The key point is that Wentworth has extensive experience in healthcare, something former CEO Rosalind Brewer lacked. With an experienced CEO in place, Wentworth can tackle Walgreens’ problems head on.

As is to be expected with any turnaround, Walgreens is tightening its belt. After successfully reducing operating expenses by $2 billion, at the end of fiscal 2021 (the company’s fiscal year ends August 31), the new plan is to increase annual cost savings to reach a total of $4.1 billion. The cost reduction should improve margins and allow the company to reduce some of its outstanding debt.

I will add to the above that the sale of non-core assets is also being considered to reduce debt. There is speculation that Walgreens may choose to sell its Boots franchise in the UK, which would improve the financial flexibility of its balance sheet.

But this recovery is not limited to simple cost reduction. The Walgreens leadership team has shown itself ready to invest heavily in various digital initiatives. The company has notably reorganized its supply chain and developed its online website. Although its physical stores generate the bulk of its sales, direct-to-consumer sales offer a path to sustained organic growth.

The other big change is Walgreens Boots Alliance’s shift toward healthcare. While moving into new verticals requires a learning curve – the company took a significant non-cash writedown on its investment in VillageMD during its most recent quarter – it’s a smart move for a company aiming to to improve customer loyalty at the local level.

While things may look bleak on paper for Walgreens Boots Alliance, the company’s transformation efforts are well underway. At around 5 times next year’s earnings and with a yield of 6.4% (the highest yield in the Nasdaq-100), all the negative news (and some) appears to be fully priced into the company’s outlook .

Should you invest $1,000 in Starbucks right now?

Before buying Starbucks stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Starbucks wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $808,105!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Sean Williams holds positions within Walgreens Boots Alliance. The Motley Fool posts and recommends Starbucks. The Motley Fool has a disclosure policy.

It’s Time to Pounce: 2 High-Yielding, High-Yielding Nasdaq-100 Stocks That Are Just Begging to Buy Now was originally published by The Motley Fool