“I suggest the Vanguard one.”

Warren Buffett wrote these words in his 2013 letter to Berkshire Hathaway shareholders. The legendary investor had just explained why his will calls for most of the money his family inherits to be invested in a low-cost investment. S&P500 index fund. Buffett did not hesitate to give his preference in his commentary on Vanguard.

I think Buffett’s choice regarding Vanguard is the right one. However, with the S&P 500 trading at a high valuation, others exchange-traded funds (ETFs) within the Vanguard family could be smarter choices for investors. A Vanguard ETF especially looks like an obvious buy at the moment.

All the energy

THE Vanguard Energy Index Fund ETF (NYSEMKT:VDE) attempts to monitor the performance of MSCI US IMI Energy Index 25/50. The “IMI” in the fund name stands for “investable market index.” The “25/50” refers to the index requirements that no more than 25% of assets be invested in a single issuer and that the sum of the weightings of all issuers representing more than 5% of the ETF must not be may exceed 50% of the ETF. total assets.

The most important thing to know about VDE is that it focuses on all things energy. This ETF holds 113 stocks of companies involved in all aspects of the energy sector.

Top VDE holdings include oil and gas giants ExxonMobil, Chevron, ConocoPhillips, EOG ResourcesAnd Marathon Oil. However, the ETF also holds significant stakes in other energy stocks, such as the oil services leader. Schlumberger and natural gas infrastructure company Williams Enterprises.

Vanguard is known for offering low-cost funds. VDE is a good example. The ETF annual report spending rate is only 0.10%, much lower than the 0.99% average of similar funds.

Why VDE seems like the obvious choice

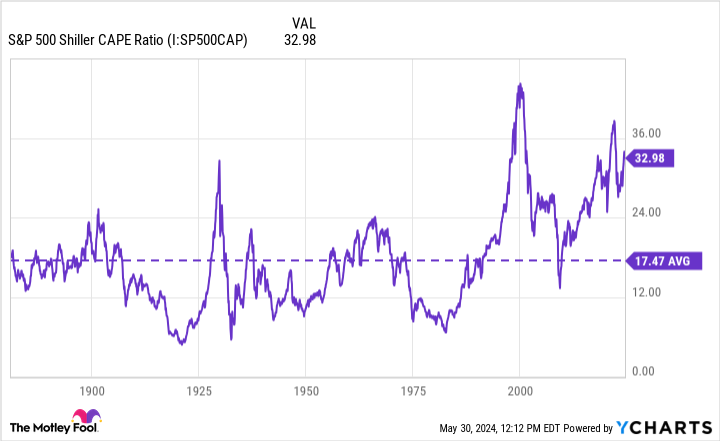

As I mentioned earlier, the valuation of the S&P 500 is high. The S&P 500’s adjusted price-to-earnings ratio (CAPE) (sometimes called the Shiller CAPE ratio) is just a hair below 33, nearly double its long-term average.

However, VDE is cheap in comparison. Its price/earnings ratio is only 12.4. This attractive valuation is also not due to sluggish profit growth. Stocks owned by the ETF have generated average earnings growth of 31.3% over the past five years.

VDE also offers a 30-day SEC yield of 2.71%. This yield is almost double that of Vanguard S&P 500 ETF. Such a high yield means that VDE does not need to generate as much share price appreciation for investors to enjoy strong total returns.

But I suspect that the VDE share price will increase considerably over the next few years. For what? An oil shortage could be imminent. Western oil CEO Vicki Hollub predicts an oil shortage by the end of 2025. She doesn’t think crude oil reserves will be replaced quickly enough.

Other oil industry executives agree with Hollub on market dynamics. If they are right, oil prices will likely rise in the second half of this decade. This is optimistic for energy stocks – and for VDE.

Use a little brain power

Is the Vanguard Energy ETF really an obvious buy right now? Investors should always use their intelligence before purchasing stocks or ETFs. There are always risks to consider. In the case of VDE, it is possible that the Chinese economy will struggle and reduce demand for oil and gas. OPEC could also significantly increase production.

However, I think the outlook for VDE looks pretty good. This Vanguard ETF offers a simple way to invest in a broad basket of energy stocks that are attractively valued as a group and expected to have strong growth prospects.

Should you invest $1,000 in Vanguard World Fund – Vanguard Energy ETF right now?

Before purchasing shares of Vanguard World Fund – Vanguard Energy ETF, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Energy ETF was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $671,728!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 28, 2024

Keith Speights holds positions in Berkshire Hathaway, Chevron, ExxonMobil, Vanguard S&P 500 ETF and Williams Companies. The Motley Fool holds positions in and recommends Berkshire Hathaway, Chevron, EOG Resources, and Vanguard S&P 500 ETF. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

This Vanguard ETF Looks Like an Obvious Buy Right Now was originally published by The Motley Fool