Stock prices of Cirrus Logic (NASDAQ:CRUS) have been in good shape so far in 2024, posting gains of 48% as Wall Street becomes optimistic about the chipmaker’s prospects. The market is excited about the recovery of the smartphone market, its strong quarterly results and a potential improvement in the situation of its largest customer. Apple (NASDAQ:AAPL).

After all, Cirrus relies heavily on Apple for a large portion of its revenue. In the recently concluded fiscal year 2024 (which ended March 30), Apple accounted for 87% of Cirrus’ revenue. Apple’s share of Cirrus’ revenue has been increasing in recent years. Apple contracts accounted for 83% and 79% of its revenue in the previous two fiscal years.

Although depending on a single client for so much business is not a good thing, a turnaround in fortune for Apple linked to his efforts in artificial intelligence (AI) This could be a blessing for Cirrus Logic. Here’s why.

Cirrus Logic’s largest customer could help accelerate its growth

Cirrus Logic is known for providing audio codecs, camera controllers, fast-charging chips, and haptic solutions to smartphone customers like Apple. It reported revenue of $372 million in the fourth quarter of fiscal 2024, which was flat year over year but crushed Wall Street’s estimate of $317 million. The company’s non-GAAP (adjusted) earnings jumped 35% year over year to $1.24 per share, and that figure was nearly double the consensus estimate of $0.64 per share.

Additionally, Cirrus’ guidance of $320 million in revenue for the current quarter, in the middle of its guidance range, added to investor optimism as it was better than the 302 million dollars estimated by analysts. Forecasts point to a slight increase in revenue from the year-ago period’s figure of $317 million.

The fortunes of Cirrus are therefore closely linked to those of Apple. This explains why Cirrus’ revenue growth wasn’t strong last quarter. Apple’s iPhone shipments, for example, fell nearly 10% year over year in the first quarter of calendar year 2024, according to market research firm IDC. Sales of iPads and wearable devices also fell. As a result, Apple’s overall revenue declined 4% year-over-year in the second quarter of fiscal 2024 (which ended March 30).

The good news for Cirrus Logic is that Apple’s iPhone sales are expected to accelerate as the year progresses, driven by the proliferation of AI. Market research firm Counterpoint Research estimates that the AI-powered smartphone market could grow at a compound annual growth rate (CAGR) of 65% through 2027.

Although Apple does not yet have an AI-enabled phone in its portfolio (unlike Samsung), the company recently announced a series of AI-related features that are expected to be included in the next iPhone, which goes on sale later this year. Whether it’s allowing users to leverage AI to summarize text, create original images or transcribe phone calls, Apple has unveiled several features that could help it jump on the technology bandwagon. ‘AI.

JP Morgan Analyst Samik Chatterjee believes that integrating AI-specific features into 2024 iPhone models should spur a strong upgrade cycle and help Apple sell more smartphones. Specifically, Chatterjee expects Apple to sell 244 million iPhone units in fiscal 2025, which would represent a 10% increase over estimated shipments for the current fiscal year. This momentum is expected to continue in fiscal 2026, with shipments estimated at 268 million units.

Additionally, with the tech giant’s Apple Intelligence platform only compatible with the iPhone 15 Pro series and iPads and MacBooks powered by M1 chips, the company could see a robust device upgrade cycle arrive. JPMorgan believes this new upgrade cycle will be on par with the one Apple saw when 5G smartphones arrived, and it’s worth noting that the tech giant’s growth took off at that time.

Additionally, Apple is expected to launch MacBooks with AI-enabled chips this year, which would allow the company to tap into another potentially lucrative market. All of this bodes well for Cirrus Logic and explains why analysts have become bullish on its prospects.

Improving growth could lead to further inventory increases

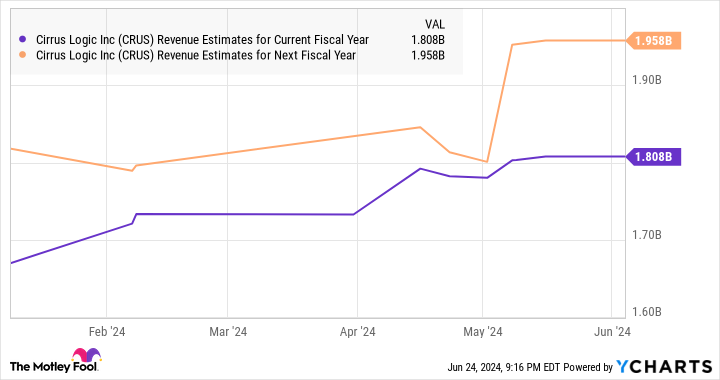

Cirrus Logic’s revenue for fiscal 2024 was down nearly 6% from the previous year to $1.79 billion. However, analysts expect a slight improvement in the current fiscal year, as shown in the following chart.

As the chart above shows, analysts have been raising their revenue forecasts for the next fiscal year and expect Cirrus to see stronger growth. The prospects for AI-enabled smartphones and PCs, and Cirrus’ relationship with a major player like Apple in these markets, should help it maintain healthy growth for a long time.

That’s why investors would do well to buy Cirrus Logic stock while it’s still cheap. This semiconductor stock currently trades at 26 times current earnings, a discount to Nasdaq-100The earnings multiple of 32 (using the index as a proxy for tech stocks). We saw that Cirrus’ earnings accelerated nicely in the previous quarter, and the company could continue this trend with help from Apple.

So there is a good chance that Cirrus will be able to add to the already impressive gains recorded in 2024.

Should you invest $1,000 in Cirrus Logic right now?

Before buying Cirrus Logic stock, consider this:

THE Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors should buy now…and Cirrus Logic wasn’t one of them. The 10 selected stocks could generate monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005…if you invested $1,000 at the time of our recommendation, you would have $774,526!*

Stock Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool recommends Cirrus Logic. The Motley Fool has a disclosure policy.

This Semiconductor Stock Surged 48% in 2024, and Artificial Intelligence (AI) Could Help It Soar Further was originally published by The Motley Fool