War in Ukraine, war in the Middle East, threats of war in China: there is no doubt that the global security situation is becoming chaotic. Closer to home, the halls of Congress are witnessing an unusual degree of bipartisan agreement on defense spending. And on the stock markets, investors are taking a closer interest in aeronautics and defense stocks.

Military actions have been known to deplete supplies faster than expected, and defense contractors are eyeing increased orders for the foreseeable future. Additionally, technological changes are reshaping the way militaries are structured—unmanned aircraft and ships, in particular, are coming into their own as autonomous technology improves and are likely to permanently alter the makeup of air forces and naval fleets.

These are just some of the factors impacting defense sector stocks. Covering the aerospace-defense sector for investment firm BTIG, analyst Andre Madrid is particularly attentive to growing demand from governments and the military.

“We are currently witnessing some of the strongest bipartisan support for defense spending since the Reagan administration and the end of the Cold War…The Russian-Ukrainian conflict, which is rapidly escalating into one of Europe’s land wars the deadliest since World War II, has raised concerns among American leaders. allies in Europe, who have now agreed to rapidly accelerate defense spending. This increase in defense spending will result in increased demand from US suppliers, as the European defense supply chain is ill-equipped to cope with the increase in orders,” Madrid said.

With this position in mind, Madrid has selected two aerospace and defense stocks as strong near-term buys. We used the TipRanks Database to find out what the rest of the street has to say about his choices. Let’s take a closer look.

Northrop Grumman (NOC)

The first stock on our list, Northrop Grumman, is the modern incarnation of two famous aircraft design firms. Both Northrop and Grumman were active in the aircraft industry before World War II, and both companies were well known for their wartime warplane designs; Northrop’s P-61 was one of the first purpose-built night fighters, and Grumman’s F6F was the most produced and successful naval fighter of the war. The two companies merged in 1994 and Northrop Grumman is known today for its involvement in such important aviation programs as the B-2 bomber and its successor, the B-21; the Navy’s E-2 aerial radar plane and C-2 transport plane; and the Air Force’s T-38 supersonic trainer.

Additionally, the company is heavily involved in electronic warfare, digital integration systems, directed energy weapon development, ballistic missiles, Manta Ray unmanned long-range submersible, mine hunting systems , NASA’s Artemis launch system and even old-fashioned munitions. production. Northrop Grumman is today one of the go-to companies relied on by the Pentagon and other U.S. and foreign government and military agencies to build and maintain weapons systems and to produce the technology that will support future weapons.

Defense is and always has been a big business, and Northrop Grumman raked in $39 billion in revenue last year. In the first quarter of this year, the company reported revenue of $10.1 billion, up 8.6% from a year earlier and some $340 million more than expected. The company’s earnings, according to GAAP measures, came in at $6.32 per share, 55 cents per share higher than expected.

In two important metrics that bode well for the future, Northrop Grumman saw 1Q24 net contract awards rise to $6.5 billion. The company reported a $78.9 billion backlog of work.

In short, Northrop Grumman is a defense contractor with a strong position, and BTIG’s Madrid sees this as the basis for its continued success. He writes of NOC: “We expect the company to be one of the fastest growing defense prime contractors over the remainder of the decade for two reasons: 1) exposure to competitive markets high growth endpoints, such as space and 2) the existence of multiple markets. Critical Records Programs (PoR) deemed essential to national security. Combined with strong free cash flow that is largely returned to shareholders in the form of buybacks and dividends, we view NOC as the most attractive long-term defense name.

To quantify this position, Madrid gives these stocks a Buy rating, along with a $565 price target that suggests one-year upside potential of nearly 32%.

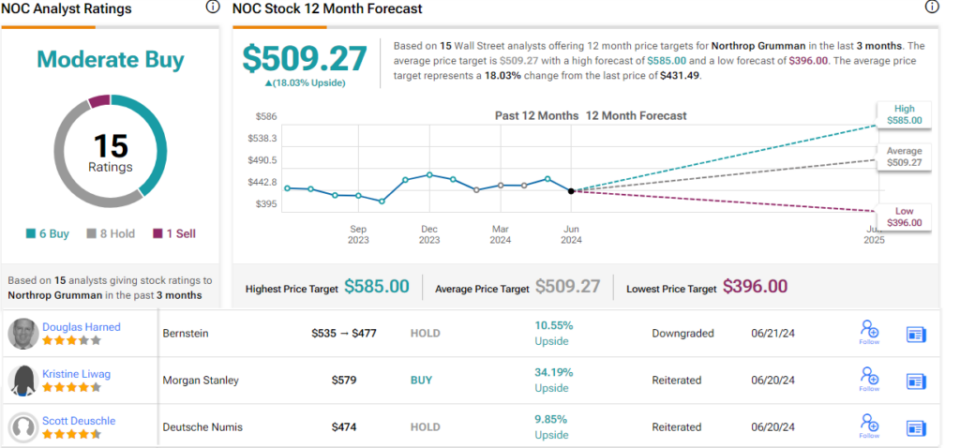

Overall, Wall Street is willing to buy into this sector, but is less bullish than BTIG. The stock has a Moderate Buy consensus rating, based on 15 recent reviews, including 6 to Buy, 8 to Hold, and 1 to Sell. Shares are priced at $431.49, and their average price target of $509.27 implies an 18% gain for the year ahead. (See CNO Stock Market Forecast)

Aerovironment (OPENING)

Next on our list is AeroVironment, a global market leader in the development and deployment of multi-mission autonomous “smart” robots. These can include unmanned aircraft systems (UAS), unmanned ground vehicles (UGV), high-altitude pseudo-satellites (HAPS), and even offensive errant munitions systems (LMS). AeroVironment is a technology provider that delivers solutions to bring together the latest advances in robotics, sensors, AI, connectivity and data analytics. The company has found that unmanned vehicles have the potential to save lives on the battlefield and transform the way armies fight.

This defense technology company’s main product set is its line of unmanned, runway-independent reconnaissance drones. These small planes can be launched by a crew of soldiers, in almost any conditions. They can be deployed from tanks, combat vehicles, communications trucks and even small boats – and once in place, they can orbit the battlefield while providing timely surveillance and communications capabilities. real to the troops.

AeroVironment’s unmanned ground vehicles are small, tracked robots designed to put “eyes on the ground.” Able to navigate varied terrain, supported by small vehicles and even portable command units, these robots can spot the enemy and provide 360-degree video surveillance.

The company’s third main class of drones is the wandering munitions system. These remote-controlled aircraft can orbit above combat zones, monitoring the situation on the ground – all while carrying a load of munitions. The operator can deliver them when needed, precisely.

When it comes to financial data, AVAV beat expectations in its just-released FQ4 (April Quarter) report. Revenue rose 5.9% on an annual basis to a record $196.98 million, beating analysts’ forecasts of $7.99 million. Ultimately, non-GAAP EPS of $0.43 beat expectations by $0.22, although this figure represents a sharp decline from the $0.99 generated during the same period of the year. last year.

For fiscal year 2025, the company expects revenue between $790 million and $820 million, halfway below the consensus of $809.7 million. This, combined with the sharp decline in profits, could be a possible explanation for investors’ pessimistic reaction to the posting.

However, in assessing AVAV’s prospects, for Madrid it is this company’s combination of premium products, strong demand and proven ability to deliver that add up to an optimistic valuation. “We view the company as the leading player in unmanned systems with a strong operational heritage spanning several decades,” the analyst said. “We see AeroVironment as a beneficiary of unmanned systems spending, both domestically and abroad. We favor the strong margin profile of the Small UAS product line and the proven capability of the Switchblade errant munitions platform in Ukraine and beyond. We expect expansion into international markets to continue, which will boost both sales and margins.

Analyst BTIG rates AVAV shares a Buy, and his price target, set at $255, suggests an upside of 32% over the coming months.

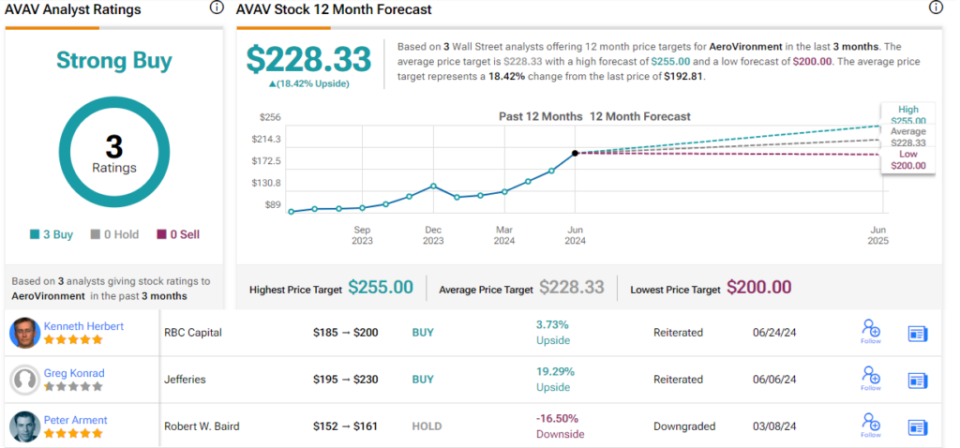

While there are only 3 recent analyst reviews here, they are all positive, making the Strong Buy consensus rating on the stock unanimous. Shares are priced at $192.81 and have an average price target of $228.33, suggesting an 18.5% upside by this time next year. (See AVAV stock market forecasts)

To find great ideas for trading stocks at attractive valuations, visit TipRanks. Best Stocks to Buya tool that brings together all the information about stocks from TipRanks.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.