Hewlett-Packard Enterprise Inc (NYSE:HPE) is surging today, up 9.5% to $17.04 at last look, extending Friday’s post-earnings rally. The stock fell immediately after the company’s mixed first-quarter results and disappointing second-quarter guidance, but ended the day up 2.2%. Now, shares maintain a slight lead of 0.8% year to date.

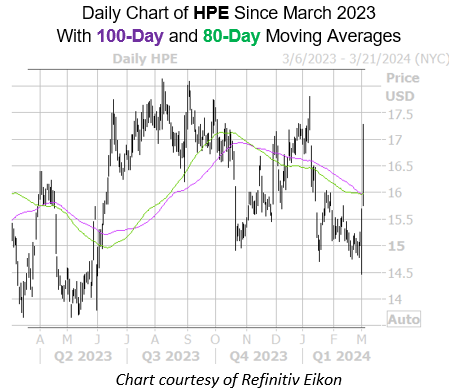

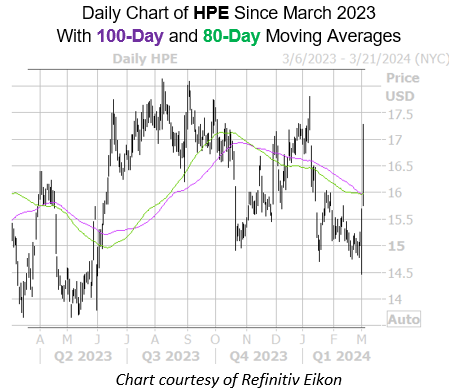

However, for those betting on a correction, HPE’s rally is putting pressure on the charts. According to Rocky White, senior quantitative analyst at Schaeffer, Hewlett-Packard stock is within one standard deviation of its 80- and 100-day moving averages. The stock received seven similar signals on its 80-day trendline, after which the stock turned negative a month later 57% of the time, an average loss of 1.3%. Its 100-day trend line flashed six times and the stock was negative a month later 50% of the time, an average decline of 1.7%.

Renewed optimism in the options stands could also bring tailwinds. On the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), HPE’s 50-day call/put volume ratio of 9.57 is higher than 98% of ‘last year.

When looking at Hewlett-Packard stock, options seem like a good way to go. The Schaeffer’s Volatility Index (SVI) of 26% ranks in the 14th percentile of its annual range, meaning options traders are currently pricing in low volatility expectations.