(Bloomberg) — U.S. stock index futures fell after a disappointing sales outlook from Micron Technology Inc. highlighted the risks of relying on artificial intelligence chipmakers to fuel the stock market rally.

Bloomberg’s most read articles

Investors will also focus on a series of U.S. economic data on Thursday that will help chart a path forward for Federal Reserve policy, after Fed Governor Michelle Bowman tempered market expectations for lower interest rates. Treasury yields maintained yesterday’s rise and the dollar gauge was hovering near its highest level in eight months.

“It’s all about the Fed: Higher for longer is about keeping interest rates very high, attracting money to the U.S. and keeping the dollar strong,” said Andrew Brenner, head of the Fed. international fixed income at NatAlliance Securities LLC.

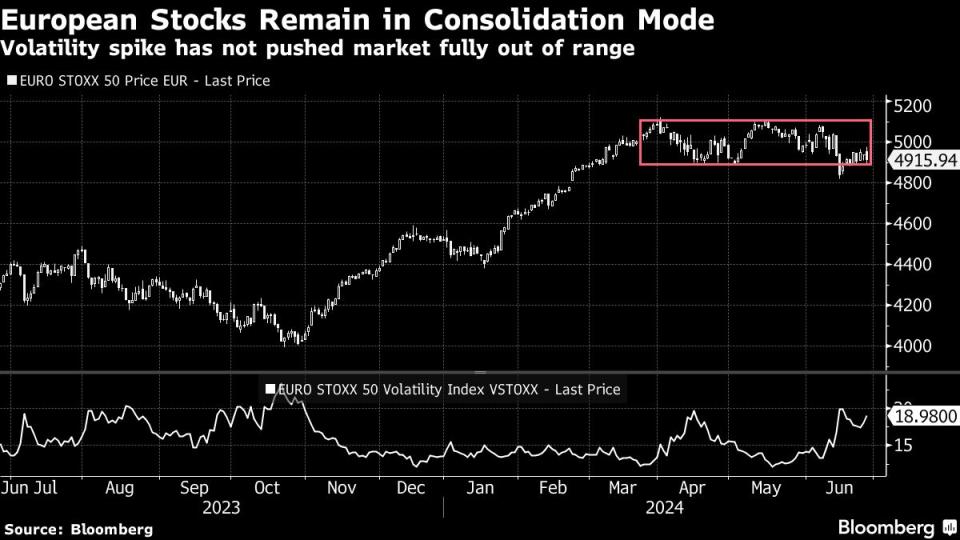

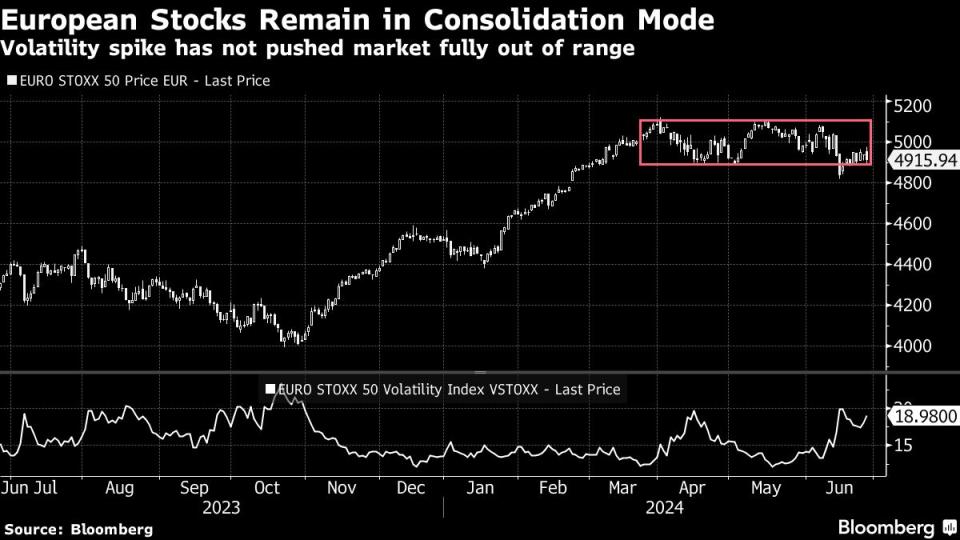

The European equity benchmark was little changed as traders were in wait-and-see mode ahead of Sunday’s French elections. Fashion retailer Hennes & Mauritz AB fell more than 14% after missing profit and sales estimates. GSK Plc fell after U.S. health authorities dealt another regulatory blow to its blockbuster RSV vaccine.

Stocks in Japan, Hong Kong, South Korea and China all fell, putting the MSCI Asia-Pacific indicator on track for its first loss in three days. The yen mitigated some of Wednesday’s decline when it fell to 160.87 per dollar, its lowest level since 1986.

MSCI Inc.’s key gauge for Chinese stocks is on track for a technical correction as traders struggle to find catalysts ahead of the July meeting of the country’s top leaders. The MSCI China index fell 2% on Thursday, falling from a May 20 peak to around 10%.

Micron technology (IN) shares fell in extended U.S. trading after the computer memory chipmaker disappointed some investors who had hoped it would benefit from the AI computing boom. The news led to a slump in a number of other chipmakers, including giant Nvidia Corp.NVDA).

Wall Street’s latest attempt to expand the mega-cap group was short-lived, with a series of measures further showing how weak the market’s breadth remains, heightening uncertainty over the sustainability of the rally. Bifurcation between the S&P 500 (^GSPC), performance and scope reached one of the worst levels in three decades, according to Bloomberg Intelligence.

In the commodities sector, gold stabilized after two days of declines, while oil traded in a tight range ahead of the next round of US economic data.

Key events this week:

Chinese industrial profits, Thursday

Eurozone Economic Confidence, Consumer Confidence, Thursday

US Durable Goods, Initial Jobless Claims, GDP, Thursday

Nike reports results on Thursday

Japan Tokyo CPI, unemployment, industrial production, Friday

U.S. PCE Inflation, Spending, and Income, University of Michigan Consumer Sentiment, Friday

Fed’s Thomas Barkin speaks Friday

Some of the main market movements:

Actions

S&P 500 futures fell 0.1% as of 3:27 a.m. New York time.

Nasdaq 100 futures fell 0.2%

Dow Jones Industrial Average futures fell 0.1%

The Stoxx Europe 600 has changed little

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.1% to $1.0694

The British pound rose 0.2% to $1.2642

The Japanese yen rose 0.2% to 160.47 per dollar

Cryptocurrencies

Bitcoin fell 0.4% to $60,730.09

Ether fell 0.7% to $3,367.6

Obligations

The yield on 10-year Treasury bills changed little at 4.34%

The German 10-year yield rose two basis points to 2.47%

The UK 10-year yield rose three basis points to 4.16%

Raw materials

West Texas Intermediate crude was little changed

Spot gold rose 0.2% to $2,302.27 an ounce

This story was produced with the help of Bloomberg Automation.

—With help from Jan-Patrick Barnert and Richard Henderson.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP