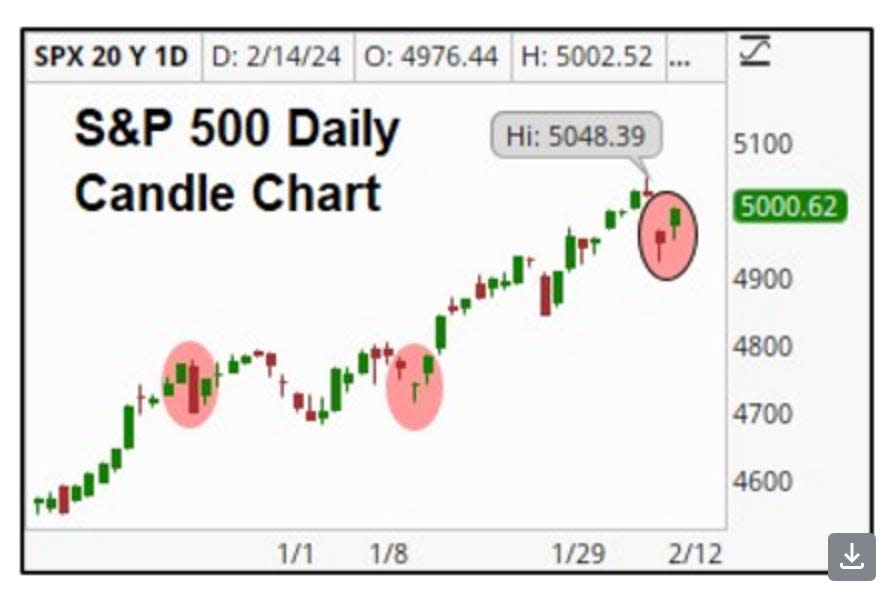

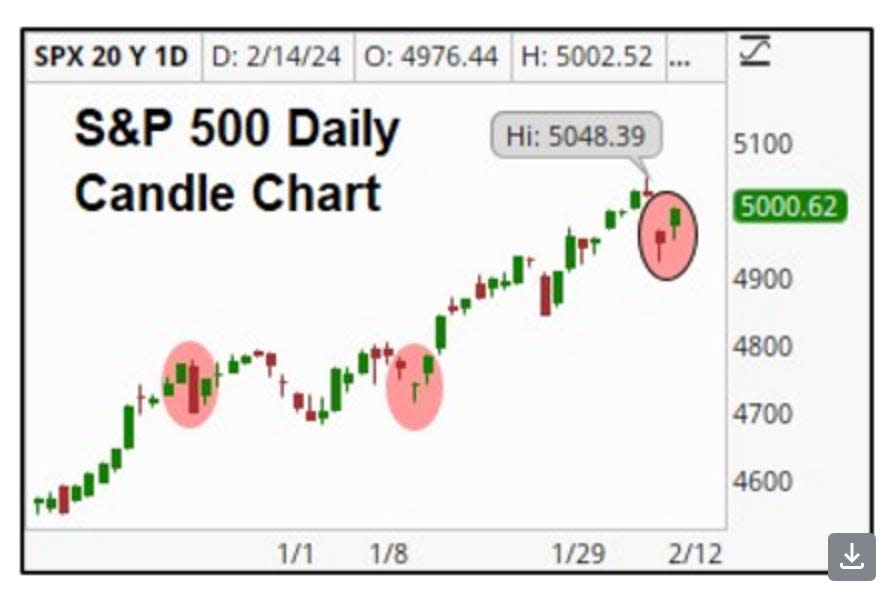

Stocks are vulnerable to a 5% “air pocket drop” as traders sell volatility, Sevens Report Research said.

VIX futures expirations have recently started to have a greater impact on the S&P 500, reminiscent of 2018’s “Volmageddon.”

“These expirations will remain dates to keep in mind as the threat of volatility will increase as we move toward 2024,” a note said.

Tuesday’s stock market pullback after a searing inflation report actually showed us something else about the market, according to one research firm — and it could lead to a selloff later this year.

“On Tuesday, stocks appeared to have additional influence on the broader market,” Tom Essaye, founder and president of Sevens Report Research, wrote Thursday. “Turns out it is…a crowded short side of the options market not unlike the ‘Volmageddon’ event of 2018.”

The “Volmageddon” episode occurred six years ago after traders piled into a group of ETFs designed to return the inverse of market volatility (essentially betting on a calm market). And when volatility increased in February 2018, these strategies took a hit, sending the S&P 500 down more than 10% in two weeks.

Investors appear to be taking risky bets again, particularly on VIX futures, which are assets that allow investors to bet on future volatility. As VIX futures contracts expire, the S&P 500 experiences stronger price reactions.

“Based on the magnitude of the move in VIX futures on Tuesday, there is a growing threat that the increasing level of greed in “short volatility” trading, similar to what we saw in 2018, could result in a shrinkage of air pockets of 5% or more in the S&P 500,” Essaye said.

Volatility short trading became very popular after 2010, when volatility was low and traders could make money by betting against market turbulence.

The Cboe Volatility Index, also known as the VIX or the market’s “fear gauge,” is at 13.97, near its all-time low.

“The renewed interest in short-term volatility strategies once again poses a risk to the broader markets, as a negative catalyst can clearly trigger a derivatives-driven sell-off in the stock market at broad sense, like the one we saw in 2018,” Essaye said.

This is not a major immediate concern, as increases in volatility have been small and the S&P 500 has remained resilient. The market pretty quickly shrugged off Tuesday’s decline. But it’s worth keeping an eye on as the year progresses.

“Going forward, these expirations will remain dates to keep in mind as the threat of volatility will increase as we move toward 2024,” Essaye said.

Read the original article on Business Insider