Stock splits are often misunderstood. They don’t change the fundamental value of a company; instead, they increase the number of shares available, making them more accessible to a wider range of investors.

It’s like peeling and segmenting an orange. The orange remains the same, but the smaller pieces are more convenient to consume.

This technical adjustment – pure accounting gymnastics, in fact – can generate excitement in the market, because it often signals a company’s strong performance and growth potential. For those looking to take advantage of the buzz around Stock distributionhere are two exceptional investments about to be split right now.

Key Details About Chipotle’s Upcoming Stock Split

Let’s start with the most obvious stock allocator. Chipotle Mexican Grill (NYSE:CMG) has proposed a 50-for-1 stock split on March 19, and shareholders will vote on the proposal at Thursday’s annual meeting. The measure is expected to pass by an overwhelming majority.

First, I don’t recall a single example of a common stock split being rejected in the area of shareholder approval. Second, this would be the first stock split in Chipotle’s history, and the stock price is getting quite rich. Currently trading at $3,090 per share, there are only four higher stock prices in the U.S. market today.

Again, the split won’t add any value to Chipotle’s market cap, but it will make the stock more manageable, especially for retail investors with modest stock budgets. Some of us would have to save for several months before purchasing a single Chipotle stock today, and some of the most popular brokerages have yet to adopt split trading. But after the suggested 50-to-1 split, the stock price is expected to fall to around $62 on the morning of June 26.

Chipotle stands out in the restaurant industry for many reasons. In the era of widespread franchising, Chipotle insists on owning its stores to control product quality and employee relations. His career-oriented management style reminds me CostcoIt is (NASDAQ: COST)with generous benefits and solid pay scales.

The upcoming stock split suggests that Chipotle executives expect stock prices to continue rising for the foreseeable future. The company’s focus on product quality and human relations with employees sets new standards for the restaurant industry.

Personally, I can’t eat at Chipotle — the cilantro tastes like soap — but it’s undeniably a great company, and the stock split makes it more accessible.

Why Costco should consider a stock split soon

Speaking of Costco, the wholesaler should consider a stock split these days.

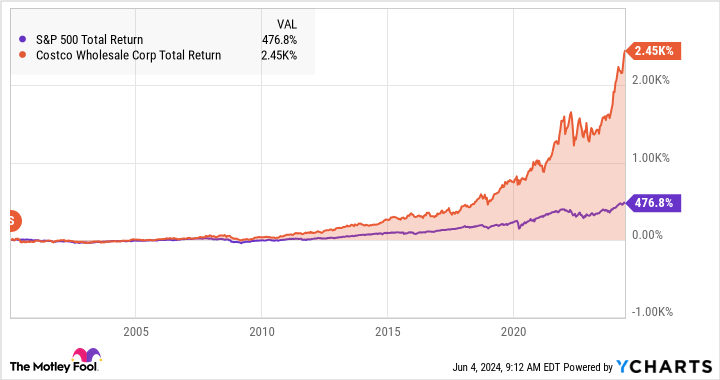

Costco isn’t a complete stranger to stock splits – it’s only been a while. Its last stock split occurred on January 13, 2000, 2-for-1. Since then, Costco’s stock has seen a total return of 2,450%, leaving the S&P500 (INDEXSNP: ^GSPC) index far behind with a gain of only 477%:

Like Chipotle, Costco is known for its employee-friendly environment. Its selection of brand name products in Kirkland is often indistinguishable from big brand options. Actually, they are often made in the same factoriesby the same market-leading producers, but packaged with a Kirkland label and sold at a lower price.

And Costco runs its retail operations near break-even. The company is quite profitable anyway, thanks to its membership purchasing system. Annual fees accounted for 1.9% of Costco’s total revenue in last month’s third-quarter report, but they also generated more than half of the company’s operating profits.

Now, Costco has yet to announce a stock split or hold a shareholder vote on the idea. But as the stock price crossed the $800 mark last week, those heels are getting a little heavy. It would be up to Costco’s board to make the stock more easily accessible to individual investors, including their own workers.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before buying Chipotle Mexican Grill stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Chipotle Mexican Grill wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $704,612!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool posts and recommends Chipotle Mexican Grill and Costco Wholesale. The Mad Motley has a disclosure policy.

Stock Split Watch: 2 Family Name Stocks That Look Ready for a Split was originally published by The Motley Fool