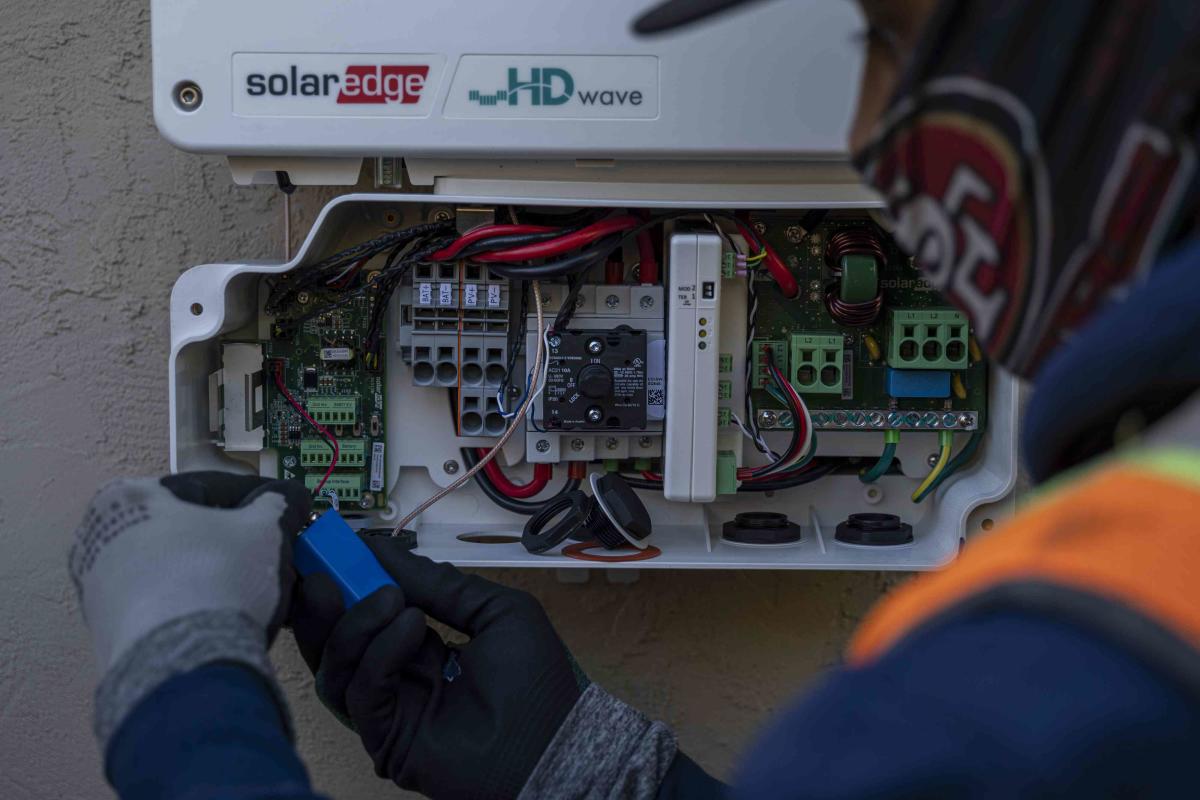

David Paul Morris/Bloomberg via Getty Images

Key takeaways

SolarEdge Technologies said one of its customers has filed for bankruptcy and likely won’t be able to pay the $11.4 million it owes.

Additionally, the company warned that it expects to burn through $150 million of available cash in the current quarter.

SolarEdge also announced the sale of $300 million in convertible notes.

SolarEdge Technologies (SEDG) shares collapsed Tuesday, a day after the solar power equipment maker announced that one of its customers had filed for Chapter 7 bankruptcy and likely would not be able to pay its multi-year debt. millions of dollars. He also warned about spending in the current quarter and announced another bond sell-off.

SolarEdge wrote in a Securities and Exchange Commission (SEC) filing Monday that PM&M Electric, an Arizona solar panel installer, owes the company $11.4 million, and noted that while it is monitoring the bankruptcy, “it cannot guarantee the outcome of the procedure and may not recover amounts owed to the company. or recover these amounts only after a significant delay.

SolarEdge expects to have used $150 million of available cash in the second quarter

In the same report, SolarEdge explained that it planned to have used $150 million to free currency in the second quarter, primarily due to “certain discretionary minority investments, credit extensions granted to certain customers, higher-than-expected working capital related to the ramp-up of U.S. manufacturing and a slower pace of payments on customer accounts.

Additionally, the company announced that it will sell $300 million worth of senior convertible bonds due in 2029. It plans to use the money to cover the cost of capped call transactions, repay previous debts and meet general business needs.

Shares of SolarEdge Technologies plunged nearly 15% as of 10:30 a.m. ET Tuesday to $28.41, their lowest level in nearly seven years.

Read the original article on Investopedia.