For most retired Americans, their monthly income Social Security check is an essential source of income. According to surveys conducted every year for more than two decades, as many as 80 percent of today’s retirees rely on their monthly benefit to help cover their expenses.

Given the importance of America’s Best Retirement Program to the financial health of our nation’s retired workers, disabled workers, and surviving beneficiaries, one would think that ensuring the sustainability of the current payment schedule would be paramount. However, the foundations of Social Security have been showing signs of cracks for decades.

America’s main retirement program has more than $22 trillion in unfunded long-term obligations

For more than eight decades, the Social Security Board of Trustees has issued an annual report that examines the finances of the program, as well as its short-term (10 years) and long-term (75 years) aspects. -year) outlook. This outlook takes into account ongoing demographic changes, as well as changes in fiscal and monetary policy, to determine the extent to which the existing disbursement schedule is sustainable for current and future beneficiaries.

Every year since 1985, the trustees’ report warned that Social Security would face some degree of long-term unfunded obligation. In simpler terms, projected revenues over the 75 years following the publication of the trustees’ report are not expected to cover projected expenditures. In 2023, trustees estimate that Social Security will face a $22.4 trillion funding gap through 2097.

For greater clarity, this does not mean that Social Security faces bankruptcy or insolvency. Rather, it means that the current payment schedule, including annual cost of living adjustments (COLAs), cannot be sustained, based on current projections. If the Old-Age and Survivors Insurance (AVS) Trust Fund’s asset reserves are depleted by 2033, as the 2023 Trustees’ Report suggests, retired workers and survivors’ beneficiaries could see their benefits reduced by up to 23%.

The blame for this predicament has nothing to do with Congress’s theft of Social Security asset reserves, undocumented workers, or any other myth that may prevail on social media chat rooms. Rather, most of the difficulties in social security are attributable to demographic changes.

The best example is the gradual withdrawal of baby boomers from the labor market. While a post-World War II birth boom swelled Social Security’s asset reserves in the 1990s and early 2000s, the retirement of these workers now weighs heavily on the worker-to-worker ratio. beneficiaries.

A lesser-known reason for Social Security’s financial woes, which I recently wrote about, is the decline in legal migration to the United States over the past 25 years. The best American retirement program counts on a certain number of young people who emigrate to the United States each year. Young people will remain in the workforce for decades, providing much-needed wage tax revenue for social security.

But the problem that can no longer be ignored is income inequality.

Income inequality is no longer a problem that can be ignored

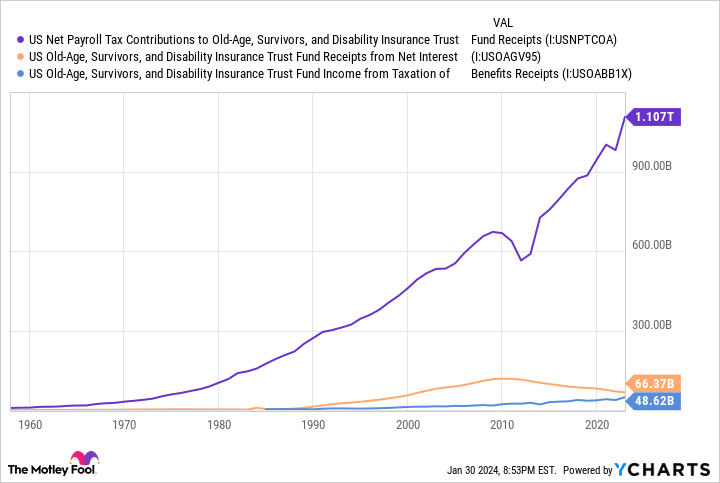

In 2022, Social Security generated approximately $1.222 trillion in revenue from three funding sources (payroll taxes, net interest on asset reserves, and benefit taxation). Payroll taxes represented approximately 90% ($1.107 trillion) of these revenues.

Social Security’s 12.4% payroll tax applies to earned income – wages and salaries, but not investment income – between $0.01 and $168,600 starting in 2024. So While self-employed people are responsible for the entirety of this 12.4% tax, employees split this tax in the middle with their employer, each covering 6.2%.

Nearly 94% of American workers earn less than the maximum taxable income limit (the $168,600 figure shown above) in any given year. This means they pay into Social Security with every dollar they earn.

On the other hand, 6.2% of American workers reached what was then the maximum taxable income limit in 2021. For these people, social charges are exempt beyond this threshold. It’s also worth noting that this threshold tends to increase in line with the National Average Wage Index (NAWI) in most years.

In 1985, 88.9% of all earned income was subject to the payroll tax, and approximately 6.5% of workers reached the maximum taxable income. But in 2021, only 81.4% of taxable income was applicable to payroll tax, of which 6.2% reached the maximum taxable income limit.

Given that $8.4 trillion in total income on Form 1040 was wages and salaries in FY 2020 – I know this isn’t an apples to apples comparison, but it often takes a few years for the IRS to compile and publish aggregate tax statistics. — that means about $1.56 trillion in earned income escapes payroll taxes each year. That’s nearly $194 billion in lost payroll tax revenue due to growing income inequality in 2021 alone.

If growth in wages and salaries of high earners continues to far outpace near-annual increases in the maximum taxable income cap, the Social Security income inequality problem will only get worse.

Taxing the rich may seem like a good idea on paper, but it’s not a ready-made solution

One lawmaker who has recognized this Social Security dilemma and wants to tackle it head on is President Joe Biden.

Before being elected president in November 2020, Biden proposed a four-point plan to strengthen the program. The signature change proposed by then-candidate Biden was to reinstate payroll taxes on earned income above $400,000, while creating a gap between the maximum taxable income cap and $400,000, where earned income would remain exempt. Since NAWI increases most years, this donut hole is expected to close after a few decades, exposing all wages and salaries to payroll taxes.

While taxing the rich may seem like a good idea on paper, it’s not as simple a solution as it seems.

To begin with, taxing high incomes does not completely resolve the Social Security funding gap. Simply taxing all earned income and making no other changes to the program would extend the life of Social Security’s asset reserves by approximately 35 years. Meanwhile, if the other principles of Biden’s proposal were implemented, the ultimate benefit would be an extension of Social Security’s asset reserves by approximately five years. Although taxing the rich extends the life of the program’s asset reserves, it is not a panacea in itself.

Another problem with raising taxes on high earners is that they are likely to adjust how they generate their income to reduce their tax burden. This could mean fewer hours worked or possibly early retirement. Either way, it would result in lower output for the U.S. economy, which would be a net negative for gross domestic product in the long run.

It can also be argued that the rich already pay their fair share to Social Security. Just as there is a cap on the amount of income that can be taxed, there is also a cap on monthly benefits at full retirement age ($3,822 per month in 2024). Raising taxes on high earners without providing a cent in additional benefits doesn’t make much sense.

Although I think it is highly likely that an eventual solution to Social Security’s long-term funding gap will involve some level of payroll tax increases, either on high earners or on all workers, it It would be naive to overlook the reality that further changes will need to be made. be done to cover a growing long-term cash deficit of $22.4 trillion.

The $21,756 Social Security bonus that most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help you boost your retirement income. For example: a simple tip could earn you up to $21,756 more… every year! Once you learn how to maximize your Social Security benefits, we believe you can retire confidently with the peace of mind we all seek. Just click here to find out how to learn more about these strategies.

The Mad Motley has a disclosure policy.

Social Security has an income inequality problem, and it can no longer be glossed over was originally published by The Motley Fool