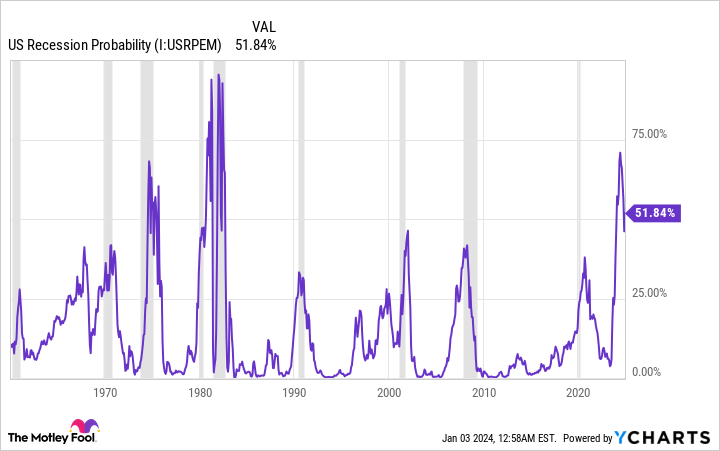

A Federal Reserve forecasting tool currently puts the probability of a recession at 51.84% over the next 12 months. This may seem insignificant, but the forecast tool in question has only given a value above 50% a few times since 1960 – the last time was four decades ago – and each event has preceded or occurred during a recession.

The chart below shows the probability of recession implied by the Fed’s forecast tool dating back to 1960. The gray areas have been classified as recessions by the National Bureau of Economic Research. Note that peaks in the recession probability curve are closely correlated with actual recessions.

No forecasting tool is perfect, but it would be unprecedented in history if the U.S. economy were not in recession a year from now, according to the Federal Reserve Bank of St. Louis.

The stock market usually declines sharply during recessions

Nine recessions have hit the U.S. economy since 1960, and each of them led to a sharp decline in the stock market. For context, reference S&P500 (INDEXSNP: ^GSPC) fell an average of 32% during these events, with peak losses ranging from 14% to 57%.

In short, history shows that the stock market will fall in the next recession, so investors may be tempted to avoid stocks in 2024. But Pierre Lynch and Warren Buffett would probably not agree with this decision.

Market timing strategies lead to losses and missed opportunities

Peter Lynch managed the Fidelity Magellan Fund between 1977 and 1990. This period was characterized by two recessions and two bear markets, but Lynch still achieved an annual return of 29.2%, doubling the performance of the S&P 500.

One of the reasons for this success is its ability to ignore fleeting headwinds and instead focus on long-term capital appreciation. Lynch once said, “Investors who were preparing for corrections or trying to anticipate corrections lost far more money than the corrections themselves lost.” »

On this basis, investors might think it is prudent to exit the market and repurchase once the risk of recession has passed. But trying to time the market often leads to missing opportunities, because many of the market’s best days occur near the worst days. In fact, 42% of the S&P 500’s best days over the past two decades occurred during a bear market, and another 36% occurred during the first two months of a bull market (before it was over). clear that the bear market was over).

Missing even a few of these days can have catastrophic consequences. For example, according to JPMorgan Chase.

Buying opportunities exist in all market environments

Warren Buffett is one of the most accomplished investors in American history. Under his leadership, Berkshire Hathaway has become a $790 billion company and its stock price has increased 43,000 times since he took control in 1965. Much of that comes from its value. $371 billion portfolioand Buffett manages the vast majority of these assets.

The most important thing investors need to know is that Berkshire has consistently invested money in the stock market. The company has purchased stocks every quarter for the past 25 years, buying through bear and bull markets, economic booms and recessions. Buffett has yet to find a market environment in which there are no buying opportunities.

That said, Berkshire invested more aggressively in some quarters, likely because valuations were more attractive. Investors should note that the S&P 500 is currently trading at 19.5 times forward earnings, a premium to its 30-year average of 16.6 times forward earnings. This warrants some caution, meaning investors should pay close attention to valuations when buying stocks.

Buy stocks that benefit from economic moats, especially when they are trading at discounted valuations.

Warren Buffett likes companies with a durable economic stronghold, and he likes to invest in these companies when their shares are trading at a price lower than their intrinsic value. Investors need to understand both concepts.

Economic moats come in different shapes and sizes, but they generally result in pricing power and cost advantages. For example, Alphabet And Amazon have pricing power arising from immense scale. Nvidia has pricing power stemming from the patented technology behind its artificial intelligence chips. And Visa enjoys cost advantages arising from its status as the largest card payment network.

In 1992, Buffett defined intrinsic value by quoting economist John Burr Williams: “Today, the value of any stock, bond, or company is determined by cash inflows and outflows – discounted at an appropriate interest rate – which may occur. during the remaining life of the asset.

This quote refers to the discounted cash flow (DCF) model, a somewhat complex mathematical formula that estimates the value of a company by discounting its future earnings to their current value. Fortunately, there are many DCF calculators online. Investors should get in the habit of using one of these calculators to estimate a stock’s fair value before purchasing shares.

Here’s the bottom line: The Federal Reserve’s forecast tool currently signals a high likelihood of a recession over the next year. Despite this risk, I think Lynch and Buffett would still recommend buying stocks in 2024, provided investors take the time to identify good stocks trading at reasonable prices.

Additionally, if the economy enters a recession, investors should view any subsequent declines in the stock market as a buying opportunity. To quote Buffett, “the best chance to deploy capital is when things are bad.”

Should you invest $1,000 in the S&P 500 right now?

Before buying S&P 500 stocks, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and the S&P 500 index was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Suzanne Frey, an executive at Alphabet, is a member of the board of directors of The Motley Fool. Trevor Jennevine holds positions at Amazon, Nvidia and Visa. The Motley Fool holds positions and recommends Alphabet, Amazon, Berkshire Hathaway, JPMorgan Chase, Nvidia and Visa. The Mad Motley has a disclosure policy.

Should you buy stocks in 2024 despite the biggest recession risk in decades? Follow the advice of Warren Buffett and Peter Lynch was originally published by The Motley Fool