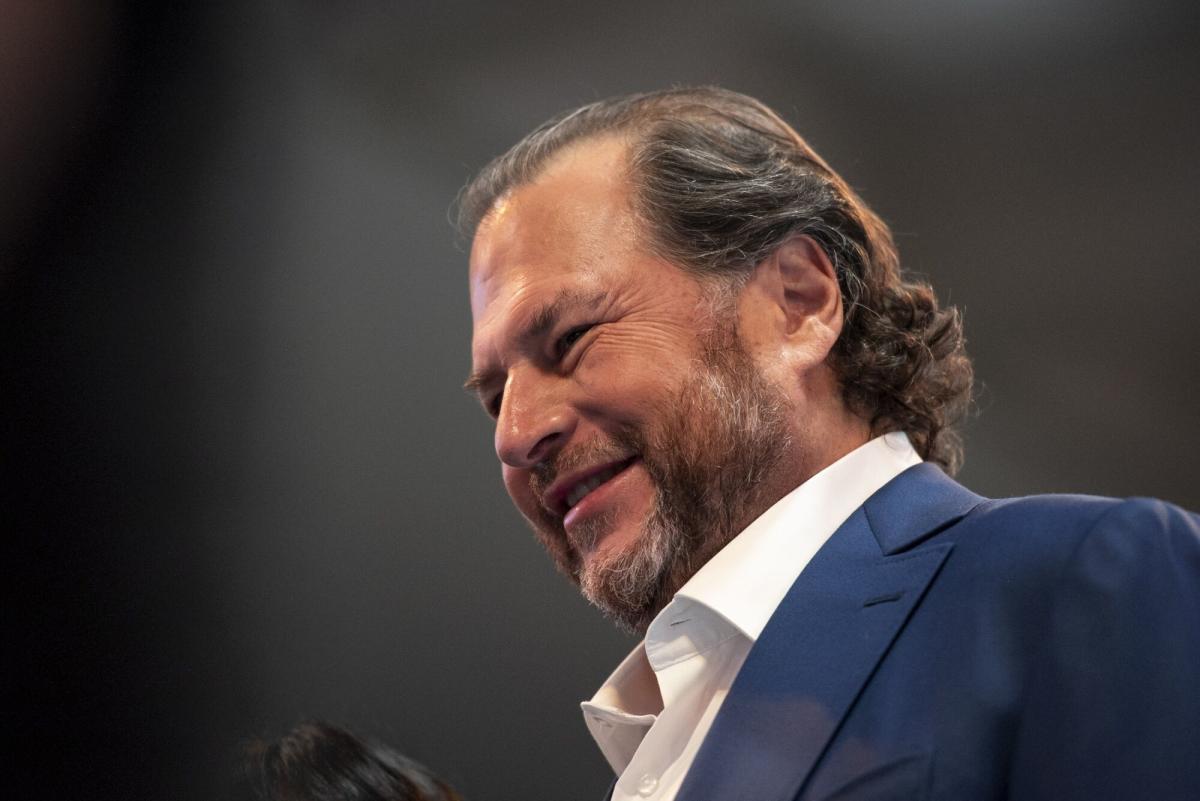

(Bloomberg) — Marc Benioff’s cash flow is growing a little every day, thanks to a unique sales strategy unlike any other billionaire tracked by the Bloomberg Billionaires Index.

Most read on Bloomberg

Since July, the Salesforce Inc. co-founder has sold 15,000 shares of the software company’s stock almost daily, worth about $3 million. Including a more modest sequence of sales earlier in the year, Benioff sold more than $475 million worth of stock in about 170 transactions.

His strategy of taking a little off the table each day dates back to shortly after Salesforce’s IPO in 2004, with Benioff making more than 200 sales the following year, records show. He has since continued this strategy, which Benioff said helps fund charitable donations to pediatric hospitals, public schools and medical research, among others.

“Business is the best platform for change,” Benioff, 59, said in a text message when asked about stock sales. “That’s why I love business, because it can be used to improve the state of the world.” This is also why I love philanthropy.

He also noted that he owns Time magazine, a publication he purchased for $190 million in 2018.

Read more: Salesforce signals that the golden age of cushy tech jobs is over

A CEO selling hundreds of millions of shares can sometimes be a signal to investors or pose a legal risk, but Benioff’s approach is one of the “safest” ways to do it, Alan Jagolinzer said, Professor at the Judge Business School, University of Cambridge. .

It is important for CEOs and other executives to diversify and dispose of some of their stocks, but they run the risk of violating insider trading rules or influencing stock prices if they do so in an uncontrolled manner. single shot, he said.

“This risk is significantly mitigated by daily trading because it subjects sales to normal price movements,” Jagolinzer said. “Sometimes they negotiate advantageously, and sometimes they don’t. »

Zuckerberg, Bezos

Other billionaires vary their approaches to stock liquidation, from selling off large blocks to suspending sales for years. Meta Platforms Inc.’s Mark Zuckerberg sold $185 million worth of shares in a series of deals in November, his first sales in two years, while Amazon.com Inc. co-founder Jeff Bezos sold only no action since he gave up more. worth over $20 billion in 2020 and 2021.

After leaving Airbnb Inc. in 2022, co-founder Joe Gebbia has steadily divested shares, including more than $1 billion worth as of mid-July. The closest billionaire super-seller to Benioff is Morningstar Inc.’s Joe Mansueto, who has sold stocks nearly 100 times this year and about 1,500 times since 2006. Yet Benioff’s more than 2,800 trades over the course of the same period eclipse those of Mansueto.

Many executives and insiders file 10b5-1 trading plans to signal in advance that they will sell shares within a prescribed time period and to certify that the sales are not based on material nonpublic information. The plans allow managers to sell in a predictable pattern, which can minimize the scare of other investors.

“The downside is you can’t time things,” said Daniel Taylor, a professor at the University of Pennsylvania’s Wharton School who studies CEOs’ business plans. “So if the stock price collapses, you could sell at a discount.”

This is not to say that plans cannot be used strategically, as in the case of the Salesforce leader.

Benioff was selling 5,000 shares per day in 2020, but he increased that to 15,000 per day during the final quarter of this year as Salesforce’s stock price climbed, according to data from InsiderSentiment.com, which tracks insider sales. As the market crashed in 2022, he cut back on sales and dumped only a few thousand shares per day. But in July 2023, as Salesforce’s stock price rose above $200, Benioff increased his sales again to 15,000 shares per day.

“This is a very cleverly designed trading system, which helps Benioff sell his shares at above-average prices and avoids any danger of legal problems,” said Ross finance professor Nejat Seyhun. School of Business at the University of Michigan, which analyzed Benioff’s trades on InsiderSentiment.

Benioff’s fortune grew more than 55% in 2023 to $9.3 billion, according to the Bloomberg Wealth Index. He owns about 2.5% of the San Francisco-based company he founded in 1999, representing about two-thirds of his fortune, with the rest made up of cash and other assets.

(Adds Joe Gebbia exchanges in 10th paragraph. An earlier version of this story corrected the spelling of Nejat Seyhun.)

Most read from Bloomberg Businessweek

©2023 Bloomberg LP