The euphoria around artificial intelligence (AI) is in full swing. Both S&P500 And Nasdaq Composite Indexes are trading at near record highs, and many on Wall Street expect further gains.

Among the hottest names in the field of AI are “Magnificent Seven” stocks — a catchy nickname used to collectively describe mega-cap giants Microsoft, Alphabet, Nvidia, Apple, Metaplatforms, You’re hereAnd Amazon (NASDAQ:AMZN).

Microsoft and Nvidia have been identified as the first two darlings of the AI revolution. But Amazon, the leader in e-commerce and cloud computing, has quietly made notable progress.

Brian Nowak Morgan Stanley recently raised its price target for Amazon stock to $215, implying an upside of about 15% by the market close on April 10.

Let’s take a look at why this could be a great opportunity to buy Amazon stock.

Cash flow is king

The last few years have been difficult for Amazon. The macroeconomy has been hit by unusually high inflation, prompting the Federal Reserve to impose a number of aggressive interest rate hikes.

The combination of persistent inflation and rising borrowing costs has had a significant impact on consumers and businesses. As a result, Amazon’s e-commerce and cloud software businesses saw stagnant growth as businesses and consumers curbed spending.

Nonetheless, Amazon’s management adapted and proved that the company could thrive even during tougher economic times. In 2023, inflation began to slow as artificial intelligence (AI) became all the rage in the technology sector.

Amazon’s growth has started to accelerate again, but it’s the company’s profitability profile that has really shined.

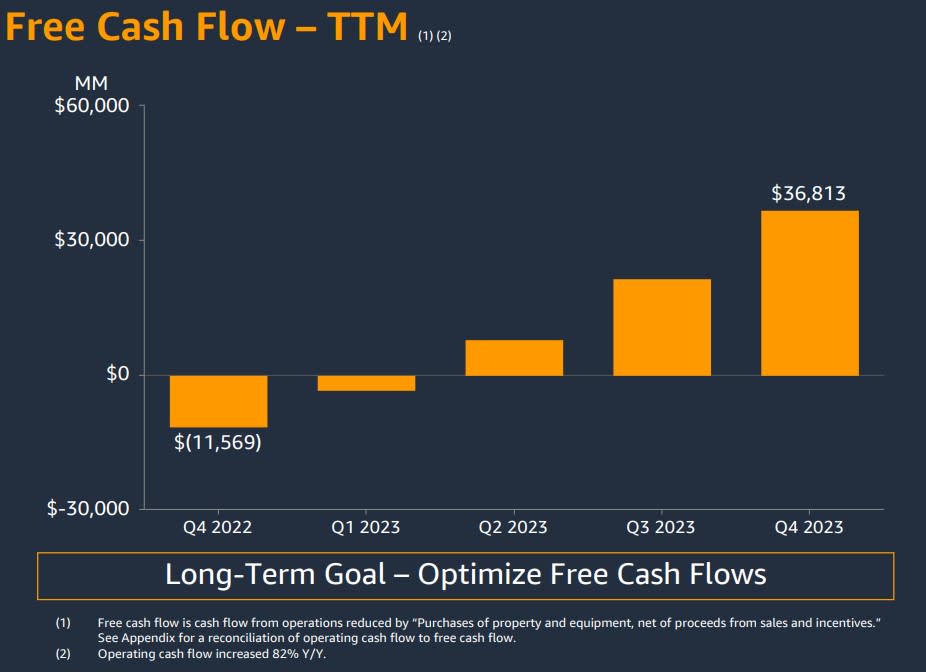

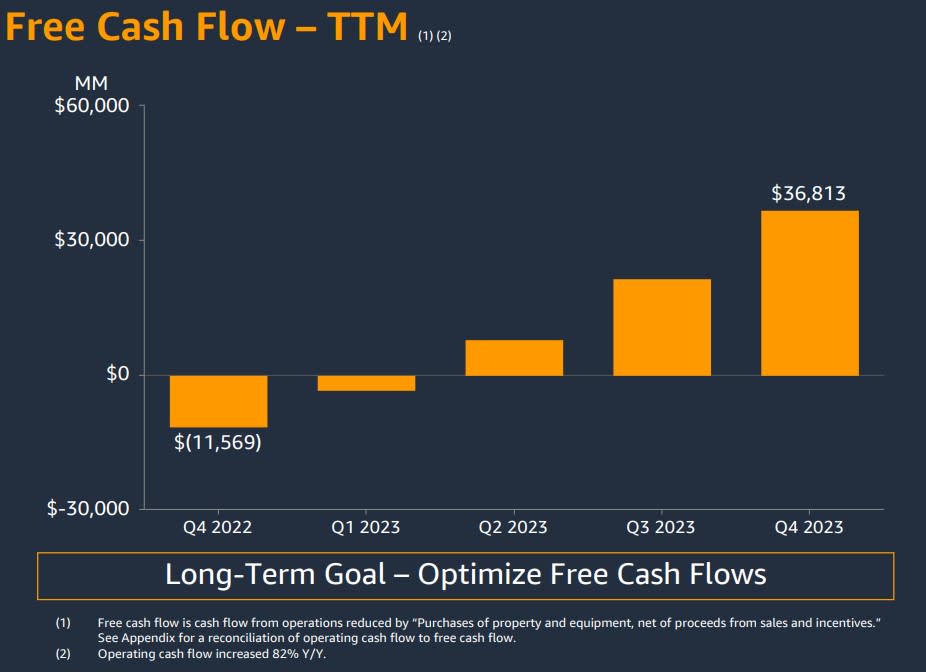

In 2023, Amazon generated a staggering $36.8 billion in free cash flow, which is what’s left of the cash flow after operating expenses and capital expenditures. This is a considerable turnaround considering that the year before, Amazon burned through $11.6 billion in cash.

The most encouraging aspect of Amazon’s consistent, cumulative cash flow is that it comes from different aspects of the company’s business.

Amazon groups its online and physical stores and advertising activities into geographic categories called North America and International. In 2023, the combined operating profit of these segments was $12.2 billion, a major reversal from a combined operating loss of $10.6 billion in 2022.

But it was Amazon’s cloud business that really helped jumpstart the company’s return to profitability. Amazon Web Services (AWS) sales grew 13% year-over-year in 2023 to $90.6 billion, while posting an impressive 27% operating margin.

Amazon’s strong performance in high-growth markets, combined with its strong cash flow profile, sets the company apart from its peers. It’s no wonder the company has earned a place in the portfolios of Cathie Wood and Warren Buffett.

While there was plenty to celebrate in 2023, Amazon isn’t resting on its laurels. Wise investments in artificial intelligence (AI) could be the key to unlocking the company’s next phase of supercharged growth.

Artificial intelligence (AI) is a huge opportunity

Microsoft truly launched the AI revolution after its investment in OpenAI, the developer of ChatGPT. The move provided the impetus for more aggressive spending on AI, particularly from big tech.

Amazon followed Microsoft with its own investment in a competing platform called Anthropic. Under the agreement, Anthropic will use AWS as its primary cloud service provider. This is a huge deal and should not be underestimated. The partnership with Anthropic could spark a new wave of lead generation for AWS and serve as a catalyst for even more accelerated growth, both in terms of revenue and bottom line.

Additionally, Anthropic will also use Amazon’s in-house Trainium and Inferentia chips to develop and improve its generative AI models. This is a subtle opportunity that investors should watch out for. For now, the semiconductor market is dominated by Nvidia and Advanced microsystems.

However, Amazon’s foray into the chip market could represent a lucrative long-term opportunity as the company seeks to disrupt several facets of the AI field.

A magnificent valuation

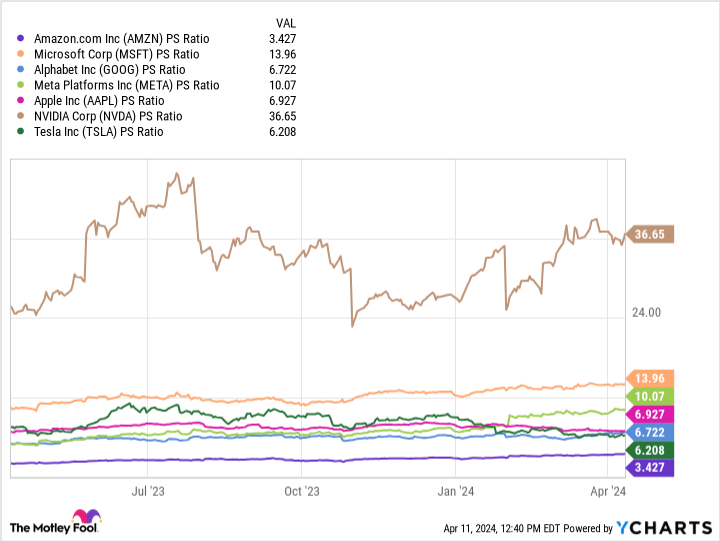

The chart below compares Magnificent Seven stock on a price-to-sales (P/S) basis. Amazon’s P/S of 3.4 is by far the lowest in this cohort.

My view is that Amazon’s position in the AI landscape is poorly understood. Unlike Amazon, very few companies can benefit from artificial intelligence (AI) in more than one way.

Since Amazon’s businesses span e-commerce, cloud computing, advertising, and streaming, the company has many ways to apply AI to its ecosystem. This could lead to a new period of exponential revenue and profit growth.

Given Amazon’s reduced valuation relative to its peers, I think this is a tremendous opportunity to own shares as the age-old themes of artificial intelligence (AI) continue to play out.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Amazon was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $540,321!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco holds positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla. The Motley Fool holds positions and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Mad Motley has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: Warren Buffett and Cathie Wood’s Artificial Intelligence (AI) Stock Will Buy Fist Before It Rises 16%, Says 1 Wall Street Analyst was originally published by The Motley Fool