Amid the AI chip race, semiconductor specialist Qualcomm (NASDAQ:QCOM) almost seems like an afterthought. Currently, the focus is on graphics processors. In contrast, Qualcomm focuses on mobile and wireless technologies. However, Qualcomm’s strategic focus on power efficiency and its new partnership to develop more efficient AI chips allow it to make a significant impact in the AI space.

Therefore, I am bullish on QCOM stock due to its potential to solve the critical problem of power consumption in AI applications.

Qualcomm teams up to deliver revolutionary new chip

According to a Reuters Last month, Ampere Computing announced that it had integrated its chips with Qualcomm semiconductor products in an effort to reduce utility bills related to AI-related operations. According to the report, Ampere uses technology passed down from ARM Holdings (NASDAQ:ARM) to make central processing chips.

Interestingly, these chips are used by powerful companies like Oracle (NYSE:ORCL) and Google under parent company Alphabet (NASDAQ:GOOGL). Enticingly, Ampere – which is a startup – aims to make more energy-efficient chips than what industry leaders Intel (NASDAQ:INTC) and advanced microdevices (NASDAQ:AMD) produce.

“Qualcomm, which dominates the mobile phone chip market, has been working since 2019 to enter the data center AI chip market with its own energy-efficient offering,” wrote Reuters contributors Stephen Nellis and Max A. Cherney.

The initiative fits perfectly into Qualcomm’s long-term directive. According to its website, it notes: “For more than a decade, Qualcomm engineers have pioneered AI processing systems focused on efficiency. The systems, which align our state-of-the-art hardware, software, algorithms and memory hierarchy toward AI acceleration, help reduce power consumption and deliver breakthrough improvements in energy efficiency, performance and latency.

Of course, overall performance will always matter. However, so does durability. As Qualcomm rightly puts it: “More efficiency means less smartphone charging globally, which makes the technology more sustainable – a long-standing priority of this company. »

Focusing only on pure semiconductor performance and not paying attention to sustainability could have detrimental financial impacts. First, many companies have jumped on the sustainability bandwagon. It would therefore be extremely hypocritical to promote products that put society in a worse environmental situation than before.

Additionally, there is ample evidence that consumers care about sustainability. If news comes out that some companies aren’t keeping their word, that could be bad news. Thus, QCOM stock stands on viable ground as the underlying business moves beyond the low-hanging fruit of seeking pure semiconductor performance metrics.

Efficiency May Be Key for QCOM Stock

Earlier this year, The Washington Post published an alarming headline. Essentially, because of the nation’s 2,700 data centers consuming more than 4% of the nation’s electricity generation in 2022, America is running out of electricity. This isn’t a clickbait concept either.

Other publications have noted that AI treats use as much energy as a small nation. Moreover, this situation will probably only get worse. The International Energy Agency estimates that, based on its projections, global energy demand – driven by data centers, cryptocurrenciesand AI – could account for as much electricity consumption as Japan currently uses.

And we’re not talking about a specific industry in Japan. Rather, we are talking about the entire nation.

Paul Hoffman wrote an excellent article on TipRanks about Broad Implications of AI Power Consumption. Hoffman particularly identifies the nuclear power industry as a key beneficiary. In the context of AI-related consumption, “nuclear power, with its renewed appeal due to its low carbon emissions and 24-hour reliability, appears ideally placed to meet the growing demand for AI-driven energy,” Hoffman wrote.

When it comes to QCOM stocks, the tech industry will need to come up with viable solutions to solve the problem of energy consumption. This is the vulnerability that could impact the usual suspects in the AI business. It is wonderful that digital intelligence is developing and can generate various efficiencies. However, if the cost of innovation becomes too high, this dynamic can become counterproductive.

Fortunately, as Qualcomm works on its efficiency-focused directive, the company could come up with a solution that offers the best of both worlds: incredible computing capacity while being environmentally friendly. I don’t think it’s a coincidence QCOM stock gained nearly 43% since the beginning of the year.

Compelling valuation strengthens bullish arguments

Finally, we need to talk about valuation. Currently, QCOM stock is trading at a trailing year earnings multiple of 27.43x and a forward multiple of 20.62x. Whether compared to the semiconductor equipment and materials category or the broad semiconductor sector, Qualcomm is undervalued. The first category has an average multiple of 31.4x, while the second is 34.8x.

Where the situation is a bit heated is at the level of the Ministry of Finance. Currently, QCOM stock is trading at 6.32 times last year’s sales. This is high compared to the two categories of semiconductors, which run at around 4.3x each. However, with Qualcomm’s efficiency directive, the premium may actually be reduced relative to the long-term upside potential.

Is QCOM Stock a Buy, According to Analysts?

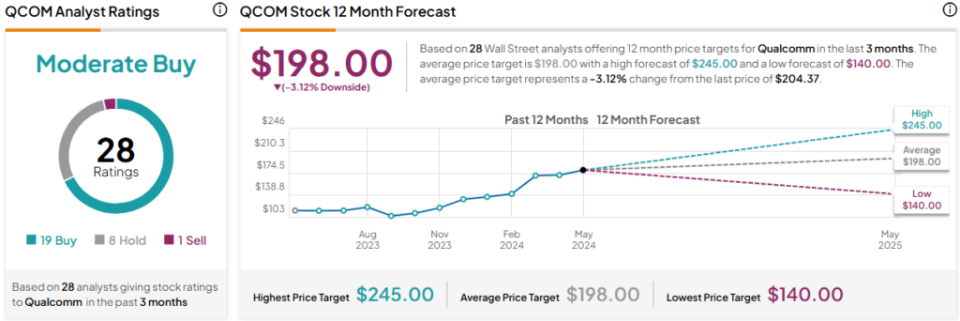

As for Wall Street, QCOM stock has a Moderate Buy consensus rating based on 19 Buys, eight Holds, and a Sell rating. THE average price target for QCOM stock is $198, implying a downside risk of 3.1%.

The takeaway: QCOM stock could make a big AI debut

While other technology companies have embraced AI innovation, Qualcomm is going about it in a different way, focusing on sustainable digital intelligence. Even if this approach is not as interesting, it is undoubtedly the most relevant. As many resources have pointed out, AI is consuming too much energy and something needs to be done. Qualcomm may offer a viable solution, which makes QCOM stock worth considering.