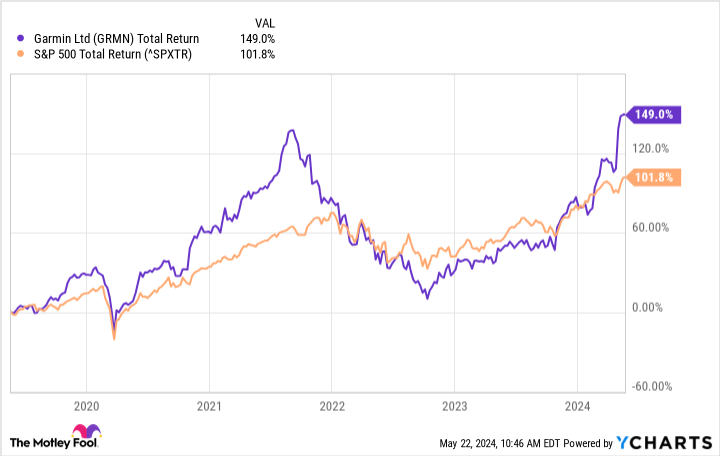

THE S&P500 The index may have just hit a new all-time high, but there’s an even better place to invest your money. Over the past five years, the total comeback of the leader in GPS navigation and wearable technology Garmin (NYSE:GRMN) exceeded that of the popular stock market index. And there is good reason to believe that this record will continue.

The S&P 500 just crossed the 5,300 level for the first time and closed at a new record this week. The index holding a broad range of company stocks has doubled over the past five years, including dividend payments. But Garmin shares returned about 150% during that period. And a rise after its latest quarterly earnings report could be the start of more to come.

Win the race

Garmin offers a diverse line of outdoor lifestyle products. The company stopped focusing on automotive GPS years ago and the business has been in growth mode for a decade. Sales in its fitness segment soared 40% to a new record in the first quarter.

Each segment reported higher revenue year-over-year, with total sales increasing 20%. The company’s most recent forecast calls for sales growth of 10% in 2024 compared to 2023. These growing sales are why the company profits have increased steadily for years, as shown in the graph below.

Even Garmin’s automotive segment has been rejuvenated. Sales to automotive original equipment manufacturers (OEMs) jumped 58%, driven primarily by increased shipments of domain controllers to BMW. This is an example of how Garmin is constantly innovating and developing new technologies for home and commercial customers.

Cash Flow Offers Options

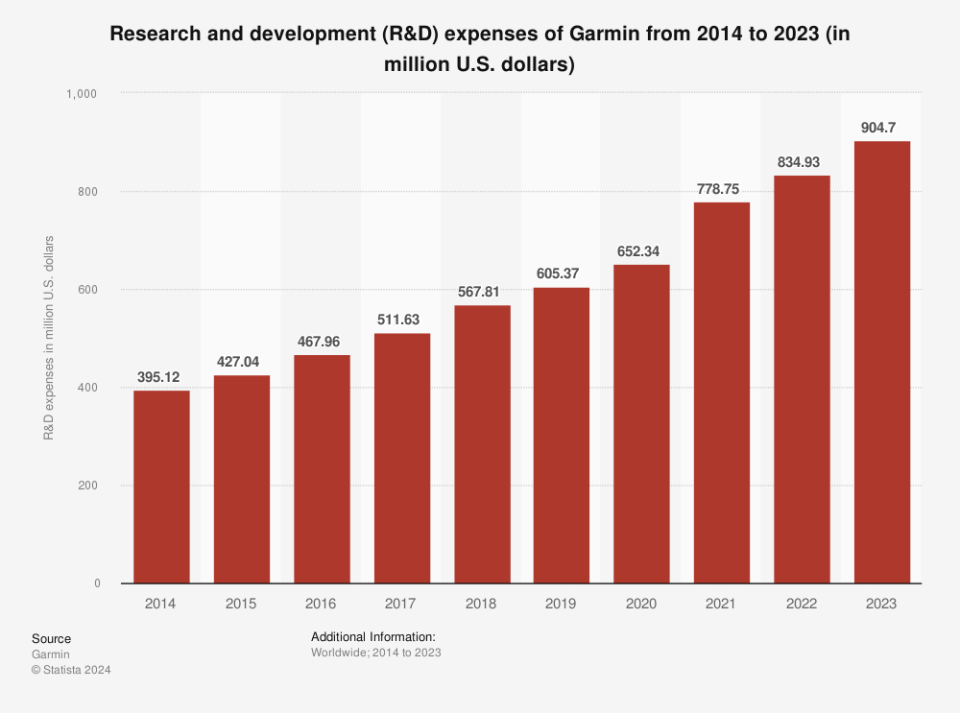

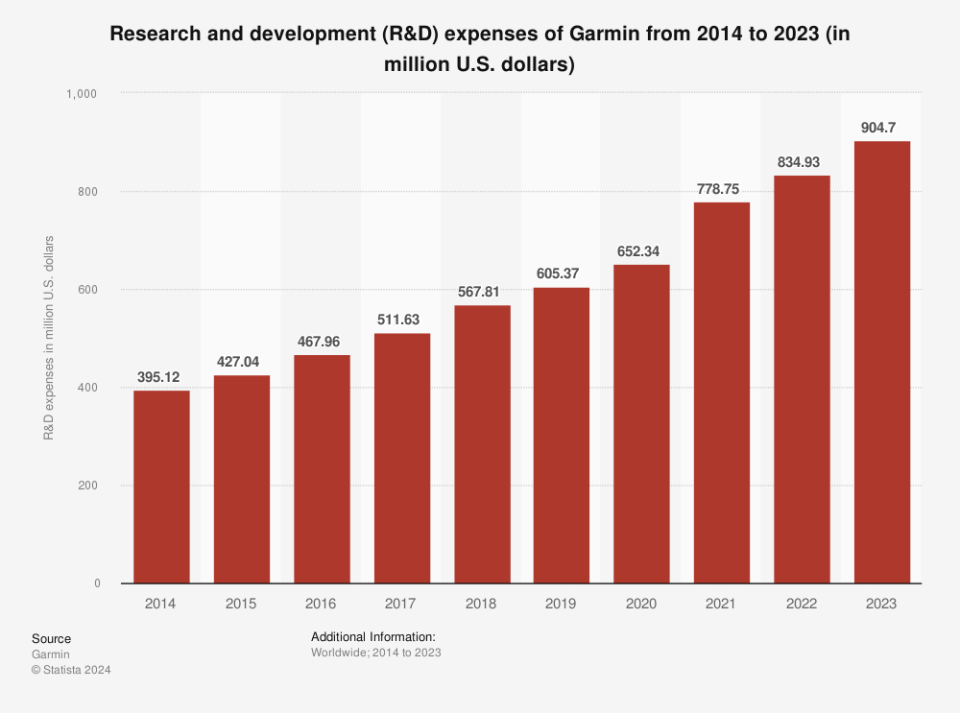

There’s one key area of Garmin’s business that explains why the company can continue to outperform the S&P 500 in the years to come. The business generates huge amounts of money. Operating profit of about $1.1 billion last year was 6% higher than the year before. And the cash generated from operating activities is put to good use to ensure continued growth.

A look at the history of its research and development (R&D) spending speaks volumes.

This R&D has led to the creation of new Garmin products as well as upgrades to existing offerings. Garmin smartwatches are known for their long battery life, measured in days and weeks rather than hours. But it now has solar charging capabilities for some models, effectively keeping batteries charged for months.

Advances in health sciences include a growing number of sleep tracking metrics and an electrocardiogram (ECG) app that can record heart rhythms and look for signs of atrial fibrillation (AFib) or normal rhythm. New safety options include its inReach satellite communications device that can notify emergency services and an underwater communications network for diver-to-diver messaging.

These are all features that help Garmin attract new customers and entice existing buyers to buy more. And yet, even after reinvesting in the company, there’s still plenty of cash left for shareholder returns.

Garmin pays a dividend that has continued to grow over the years and has a new share buyback program. With approximately $3.3 billion in cash and marketable securities on its balance sheet, the company also has the ability to grow through acquisitions. These ingredients add up to a recipe that can lead to five more years of market-beating returns for Garmin investors.

Should you invest $1,000 in Garmin right now?

Before buying Garmin stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Garmin wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $652,342!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Howard Smith holds positions at Garmin. The Motley Fool posts and recommends Garmin. The Motley Fool recommends Bayerische Motoren Werke Aktiengesellschaft. The Mad Motley has a disclosure policy.

Prediction: This stock will continue to outperform the S&P 500…and here’s why was originally published by The Motley Fool