It’s official: a new bull market is here. And this is partly explained by the rise in power artificial intelligence (AI).

This roundtable of Motley Fool contributors agrees that AI stocks will lead this new bull market. But will the AI actions that led the market out of the doldrums and toward recent highs be the same ones that drive the bull market forward? Or will new AI stocks become market leaders? See why Amazon (NASDAQ:AMZN), Metaplatforms (NASDAQ:META)And Nvidia (NASDAQ:NVDA) are the best choices now.

Amazon set to benefit from AI growth

Jake Lerch (Amazon): I think 2024 will see a massive transformation for AI, and that’s why I’m choosing Amazon as the title of the AI that will lead this new bull market.

In short, the commercialization of AI is only just beginning. Relatively few AI products are currently available, but this is changing rapidly. Microsoft now offers AI-based Copilot features in its Office software, Crowd strikeSecurity modules use machine learning to prevent hacking, and Adobe has several multimedia tools that use generative AI. Countless other AI-powered products will soon be available to individuals and businesses.

Amazon, the world’s largest cloud service provider and the world’s largest e-commerce company, stands to benefit in several ways:

Cloud spending could accelerate as companies increase spending on generative AI, which runs on the cloud. Best of all, cloud spending is one of Amazon’s fastest-growing revenue streams.

E-commerce spending could be boosted by the rise of AI-powered digital marketing, known as programmatic advertising, which helps advertisers deliver better, more targeted ads. Increased e-commerce spending is expected to lead to increased revenue for Amazon.

Robotic innovations could lead to massive savings. Amazon is already America’s second-largest employer, with more than 1.5 million employees. However, it already uses more than 750,000 robots in its extensive warehouse network. Expect more robots – managed by AI – in the future; this could lead to higher profits for Amazon.

Amazon’s enormous size – and the diverse nature of its business model (mostly split between e-commerce and cloud) – means the company will generate additional revenue as AI technology matures. Additionally, the company’s innovations in AI and advances in outdoor robotics could help the company become more efficient, resulting in greater profits for the company and greater returns for Amazon shareholders.

This stock is up over 300% and could continue to soar

Justin Pope (meta-platforms): The social media giant and AI innovator is an obvious choice to lead the new bull market, because it’s already doing so. The stock bottomed around $90, as did the broader market, in late 2022. Since then, it has risen more than 300%.

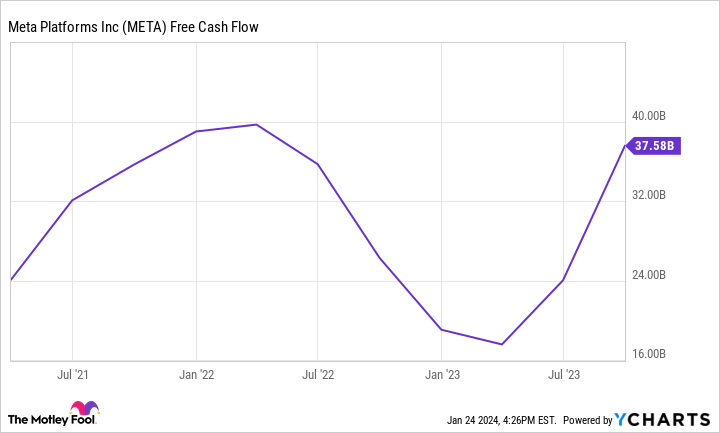

It’s remarkable that meta-platforms are still undervalued today. The company found itself in Wall Street’s doghouse when advertising woes related to iPhone software changes and frivolous spending significantly reduced Meta’s free cash flow between mid-2022 and early 2023.

The cure? CEO Mark Zuckerberg has aggressively cut expenses and relied on AI to counter Meta’s iPhone privacy headwinds and get the company’s finances back on track. Today, analysts are once again optimistic about Meta’s future, estimating a long-term average annual earnings growth rate of 20%.

That’s an attractive PEG ratio of 1.1, based on the stock’s forward P/E of just 22. In other words, Meta’s stock has been beaten so badly at its low that stocks remain a bargain despite their meteoric rebound.

As long as Meta continues to perform and can meet analyst estimates, the stock is poised to help lead this new bull market.

Investors must not forget the leader in AI chips

Will Healy (Nvidia): When it comes to AI stocks, you’d think they missed Nvidia. The semiconductor stock is up nearly 240% in 2023, and with an additional 25% rise so far in 2024, one would assume its price will plateau in the near future.

Don’t be so sure.

AI-enabled chips are essential to supporting the technology, and late last year, a Raymond James The analyst estimates that Nvidia controls more than 85% of the generative AI accelerator chip market. Certainly, this success has attracted competitors. Companies such as Advanced microsystems And Intel have taken note and are looking to eliminate some of this activity with their own lines of AI chips.

However, with Nvidia’s leading position in the market, these companies will likely find it difficult to challenge its dominance in the near term. Additionally, Allied Market Research estimates a compound annual growth rate of 38% in the AI chip market through 2030.

Such a growth rate makes it easier for Nvidia to ignore any potential competition and appears to bolster optimism. Through the first nine months of fiscal 2024 (ended Oct. 29), the company reported revenue of $39 billion, an 86% increase over last year’s levels.

During the same period, net profit exceeded $17 billion, a considerable increase from the $3 billion earned during the same period of fiscal 2023.

Additionally, analysts expect revenue to grow 119% in the current fiscal year. Although this slowdown is likely, they project revenues to increase by another 57% in fiscal 2025, indicating that rapid increases will continue.

Additionally, thanks to the increase in net income, Nvidia’s valuation has fallen significantly. Its P/E ratio had exceeded 240 as recently as July. Today, the earnings multiple stands at 81 and its forward P/E ratio has fallen to 50.

As long as net income continues to soar, these multiples will likely decline further, making Nvidia stock’s burgeoning AI-driven opportunity a much safer choice.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Amazon was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns effective January 22, 2024

Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch holds positions at Adobe, Amazon, CrowdStrike and Nvidia. Justin Pope has no position in any of the stocks mentioned. Will Healy holds positions at Advanced Micro Devices, CrowdStrike and Intel. The Motley Fool holds positions and recommends Adobe, Advanced Micro Devices, Amazon, CrowdStrike, Meta Platforms, Microsoft and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Prediction: 3 Artificial Intelligence (AI) Stocks That Will Lead the New Bull Market was originally published by The Motley Fool