Plug in the power (NASDAQ: CAP) the stock has been a roller coaster. In January, stocks nearly doubled in value only to give up those gains by the end of the month. February was much of the same, with the stock price recently jumping 17% in a matter of days.

Despite the volatility, stocks remain well below their all-time highs. But if the company’s management team realizes its vision, it’s possible that Plug Power’s stock value could increase by 1,000% or more.

Is this beaten-down growth stock finally a buy?

Plug Power has an exciting history

Despite its innovative business model, Plug Power is not a new company. The company went public in 1999, at the height of the dot-com bubble. Its leaders had a noble vision: to replace fossil fuels with hydrogen fuel cells.

This vision proved to be ahead of its time. When the dotcom bubble collapsed, Plug Power stock lost more than 99% of its value. Over the next decade, the stock price remained depressed.

In 2020, everything changed. The stock price soared nearly 2,000%, reaching a market capitalization of more than $35 billion.

Then, just as suddenly, the stock price collapsed. Today, the stock price remains down, trading around pre-surge levels, with a market cap of around $3.5 billion.

It’s important to point out that from a fundamental perspective, many elements of Plug Power’s income statement have continued to improve throughout the volatility. Revenue for 2023 was about three times 2020 levels. And if management is to be believed, this rapid growth is only just beginning.

Today, Plug Power’s core mission is to create a vertically integrated clean energy hub focused on hydrogen fuel cells. It seeks not only to produce hydrogen, but also to transport, store and deliver the fuel to customers.

As the company’s revenue indicates, Plug Power has already achieved part of its long-term vision. For example, it has a manufacturing capacity of almost one million square feet. It also has five hydrogen production facilities under construction or already in operation, and five more in development. Meanwhile, several pilot projects in South Korea provide concrete evidence that its technology can work on a small scale.

Management believes that hydrogen fuel cells can quickly contribute to a rapid transition of the global economy fossil fuels. Its revenue targets – $6 billion by 2027 and $20 billion by 2030 – reflect that optimism.

Plug Power has an exciting history, but the hydrogen economy has long been overrated and underexploited.

Lack of cost competitiveness is largely to blame, but there are also concerns about the cleanliness of the energy source, as hydrogen can be produced either from renewable energy or from conventional fossil fuels.

However, with an unprecedented amount of funding dedicated to climate-friendly technologies, this could finally be Plug Power’s opportunity to shine. It operates in an increasingly crowded market and many competitors believe they can move faster with more efficient technologies.

Yet one of the main reasons Plug Power struggled in previous decades is that the global hydrogen economy failed to take off in any significant way. In the coming years, this could change.

Should you buy this growth stock right now?

Before you jump into Plug Power stock, there are a few important things to know.

First, the company is betting on a change in the status quo. Currently, the use of hydrogen as a fuel source remains incredibly limited. Switching to hydrogen as a fuel source generally requires costly investments. For most industries, the cost of switching still isn’t worth it, which means Plug Power must continue to expand to reduce those costs.

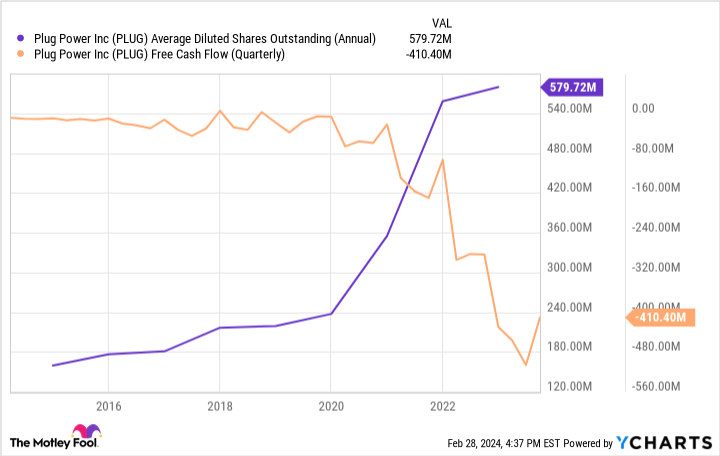

To realize its growth vision, Plug Power will likely need to invest billions of additional dollars in new infrastructure. This will require additional debt or stock sales, with free cash flow levels remaining negative likely for several more years at a minimum.

Notably, the company issued a “going concern” notice in November, an accounting warning that is triggered whenever a company’s balance sheet deteriorates to the point that its short-term financial survival is threatened. The company sold its shares en masse to raise cash and recently finalized a term sheet with the U.S. Department of Energy for a $1.6 billion loan. But make no mistake: Plug Power’s current balance sheet will struggle to deliver on the company’s lofty promises.

Can Plug Power grow its revenue to $30 billion by 2030, as its management team predicts? Of course, but there is a high probability of failure. If funding dries up or demand for hydrogen fails to increase, Plug Power could end up building an empire for nothing.

The second thing to know before buying Plug Power stock is that the company could fail even if hydrogen wins. For example, the company currently transports most of its hydrogen to customers via a fleet of trucks. However, in the long run, it is likely cheaper to deliver the fuel by pipeline, in the same way that fossil fuels are transported long distances.

Of course, Plug Power could end up transporting its production by pipeline, but that type of infrastructure is incredibly expensive to produce, meaning the company would have to build its own infrastructure from scratch or pay an existing pipeline operator to use your network.

Currently, there are only about 1,000 miles of hydrogen pipelines in operation in the United States, compared to 2.6 million miles of fossil fuel pipelines in the country. Many fossil fuel companies are looking to evolve their conventional pipelines to be able to process hydrogen, but this transition will take years, if not decades.

All of this is to say that the future of the hydrogen economy is still uncertain, even assuming overall global demand for this fuel source is skyrocketing. Plug Power is poised to get the hydrogen economy off the ground, but it’s possible the industry is shaping up in a way that won’t benefit the company as much as management believes.

Should you take a chance on Plug Power stock? The growth potential is clearly enormous, but it will likely be many years before the company’s final fate can be determined. The company’s repeated failure to deliver on its big promises, combined with a short-term funding crisis, will continue to keep me on the sidelines.

Should you invest $1,000 in Plug Power right now?

Before buying Plug Power stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Plug Power wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns February 26, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the securities mentioned. The Motley Fool has a disclosure policy.

Taking Power stock just rose 17%. Is This Beaten Growth Stock Finally A Buy? was originally published by The Motley Fool