Dividend stocks can be great investments for generating passive income. The best dividend-paying companies have consistent earnings growth and, in return, increase their payouts to shareholders. The elite among them can eventually fall into the category of The Dividend Kings — companies that have increased their annual payments for at least 50 consecutive years.

In addition to being a dividend king, PepsiCo (NASDAQ:PEP) has a yield of 3.3% at its current price, which is high compared to the average yield of 1.3% for the S&P 500. Its business is also fairly recession-resistant, making it exactly the kind of consistent company that many income-seeking, risk-averse investors are looking for.

Pepsi is a top dividend stock and a household name for most consumers, but the least known Illinois Tool Factory (NYSE: ITW) it might be even better than a Dividend King to buy now.

Discover ITW

Illinois Tool Works, also known as ITW, is a global industrial conglomerate with a diversified product portfolio spanning multiple industries. The company primarily sells products to businesses, so it would be understandable if you are unfamiliar with many of its brands.

The company does not manufacture massive earthmoving equipment or extremely complex machines. Instead, many of its products play a role in larger systems. Here is a breakdown of its segments and some product examples.

Segment | Product examples | 2023 turnover | Operating margin 2023 |

|---|---|---|---|

Automobile | Fasteners, interior and exterior components, powertrain components | $3.2 billion | 17% |

Test & Measurement and Electronics | Laboratory test and assembly equipment, accessories, consumables, spare parts and services | $2.8 billion | 24% |

Food equipment | Advanced warewashing, services, equipment for cooking, refrigeration and food processing | $2.6 billion | 27% |

Construction products | Fastening solutions, complementary fasteners and accessories, construction design and engineering software | 2 billion dollars | 28% |

Welding | Welding equipment, specialized consumables, safety solutions | $1.9 billion | 32% |

Polymers and fluids | Adhesives, sealants, coatings, lubricants, additives, automotive wiper blades, engineered cleaners | $1.8 billion | 27% |

Specialized products | Zippers and rings for six-packs for packaged goods, medical products, aircraft ground support equipment, coating and metallization activities for the product branding and national security markets | $1.7 billion | 27% |

Data source: Illinois Tool Works.

ITW stands out from other industrial conglomerates in that no one of its seven segments dominates its revenue mix. And with the exception of automotive—which is struggling in North America but growing rapidly in China—all of its segments have excellent operating margins. The entire business posted an operating margin of more than 25% in 2023.

Management expects an even better operating margin of 26-27% in 2024 and an operating margin of 30% by 2030.

Growth concerns

ITW’s main challenge has been weak organic growth. Its organic revenue actually declined 0.6% in the most recent quarter. ITW expects organic growth of just 1% to 3% for the year and revenue growth of 2% to 4%. Earnings per share (EPS) growth is expected to be a bit better, at 6% to 10%, for a total of $10.30 to $10.70 in full-year EPS, thanks in part to a one-time accounting change.

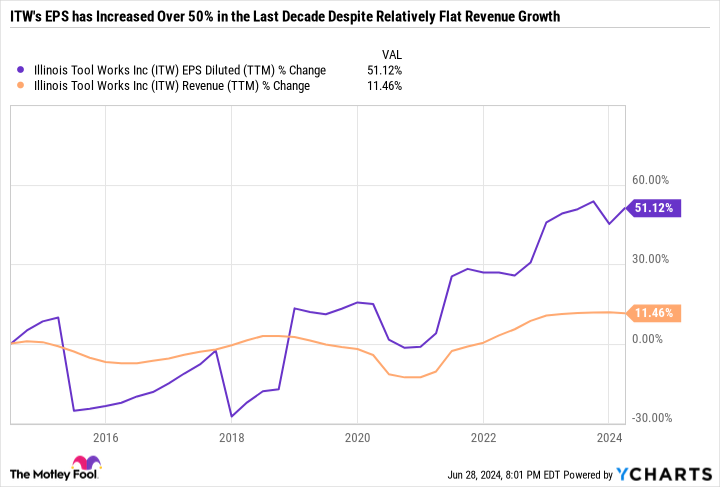

Taking a step back, you’ll see that ITW’s EPS has only grown 20.6% over the past three years. That’s not a terrible growth rate for a mediocre dividend payer, but it’s not exactly great either. Revenue has grown even more slowly, at 14.7%. However, if you look over an even longer period, you’ll notice that its earnings have grown much faster than its revenue, which is a testament to ITW becoming a more efficient, higher-margin company.

A leaner business with higher margins is preferable to an overextended model that relies heavily on sales growth at the expense of margins. But eventually, ITW will need to chart a path to higher margins and higher revenues, especially because there is a limit to the number of efficiency improvements a company can make.

If you listen to a typical ITW earnings call, you’ll find that most of the conversation revolves around margins. It may seem trivial to discuss a single percentage point of margin. But ITW generated $16.1 billion in revenue over the last 12 months and $4.2 billion in operating income. So every percentage point change in margin is equivalent to a $160 million difference in operating income.

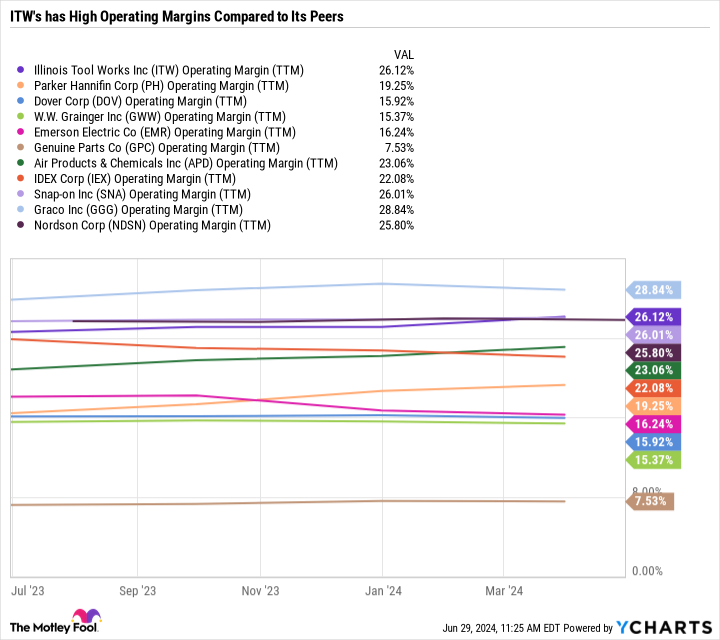

Because ITW operates in many different industries (and generates a significant portion of its sales outside of North America), no company is an exact competitor. However, there are companies that compete in one or more segments. And ITW has significantly higher margins than many of its competitors.

Despite lower incomes than those Authentic pieces, Parker Hannifin, WW GraingerAnd Emerson ElectricITW has the highest operating income of any company on this list. What makes it so special is that it combines size with strong margins across many different product categories. Conglomerates can often be large and inefficient, but ITW is a good example of an efficient conglomerate that benefits from diversification.

Expect a dividend increase soon

Last August, ITW announced a 7% dividend increase to $1.40 per share per quarter. ITW typically announces its annual dividend increases in the summer, with the first payment in October. Given the consistency of its dividend program, investors should expect an announcement in the coming months.

Not all Dividend Kings use share buybacks as their primary means of returning capital to shareholders, but ITW plans to repurchase $1.5 billion of its stock this year. By comparison, it paid out $418 million in dividends last quarter, or about $1.7 billion over the past year. So, at first glance, ITW’s 2.4% yield may not seem very attractive, but its capital return program is much stronger when you factor in the buyback program.

High margins allow ITW to squeeze more profit out of every dollar of revenue. But share repurchases reduce the share count, which leads to higher earnings per share. Over the past five years, the company has reduced its share count by 7.8%, which has boosted EPS by 36.1%, even as net income has increased by 24.2%.

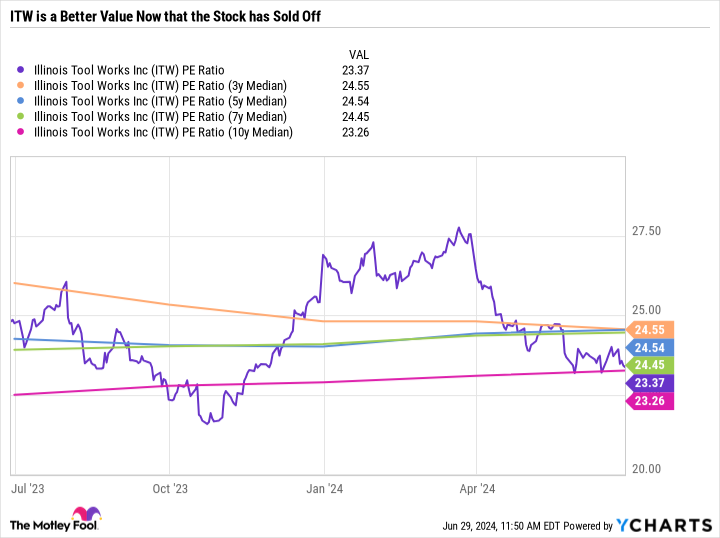

Share buybacks have also helped keep ITW’s valuation reasonable. The stock’s recent selloff, coupled with steady earnings growth, has pushed its price-to-earnings (PE) ratio down to just 23.4, which is below its three-, five-, and seven-year median P/E ratios. And ITW was trading above those key levels just a few months ago.

ITW is a complete purchase

ITW is a phenomenal company, but its valuation is high and its revenue growth is weak. Now that the stock has been sold, the only weak point of the conglomerate is its weak sales growth.

There are near-perfect companies, but there is no such thing as a perfect stock. The best companies are usually expensive relative to their historical or projected earnings, while bad companies are trading at cheap prices for good reasons.

ITW is, however, close to a blue chip value in terms of dividends. It is an extremely efficient business with high margins, a 50+ year history of dividend increases, a significant share buyback program, and a reasonable valuation. The conglomerate model works well for ITW and helps the company offset much of the cyclicality of its various end markets.

Adding it all up, there’s a lot to like about ITW as a blue chip dividend king to buy and hold for years to come.

Should you invest $1,000 in Illinois Tool Works right now?

Before you buy Illinois Tool Works stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors should buy now…and Illinois Tool Works wasn’t one of them. The 10 stocks we picked could deliver monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has a position in Emerson Electric and recommends the company. The Motley Fool has a disclosure policy.

Pepsi is a rock-solid dividend king, but so is this blue-chip stock, which has fallen 12% in the past 3 months. was originally published by The Motley Fool