Today, businesses generate mountains of data. This data can be of great value, but only if it is properly leveraged, visualized and used to improve decision-making. Often, however, this data resides in a variety of different software systems, with various elements siled into platforms that cannot communicate with each other, complicating any effort to see the big picture. For example, a business may have a customer service database, business management software, marketing platform, etc. Unifying data from all these platforms into a single system and leveraging the integrated output for actionable insights is a complex task. Palantir‘s (NYSE: PLTR) specialty and why its services are in demand.

The Palantir Artificial Intelligence Platform (AIP) is its latest innovation and it’s bursting with potential.

Customers flock to Palantir AIP

Imagine a wholesale supplier facing a severe weather event impacting one of their centers. Management needs to know the most efficient alternative methods to supply their customers and how their choices will impact margins. Or maybe you manage inventory level planning for a company and need to know how a price increase or decrease will impact demand. Or maybe you want to automate your vendor payment processing by unifying documents like purchase orders, invoices, and warehouse receipts. These are all use cases for Palantir AIP.

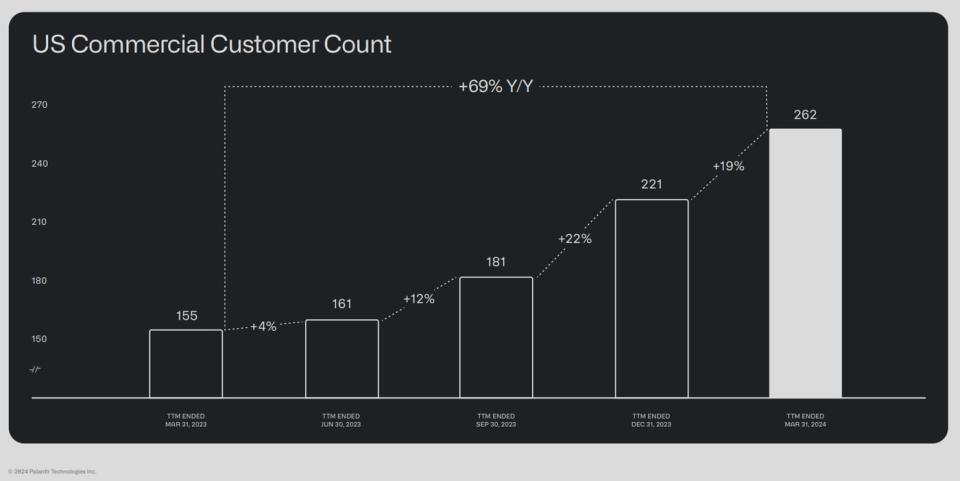

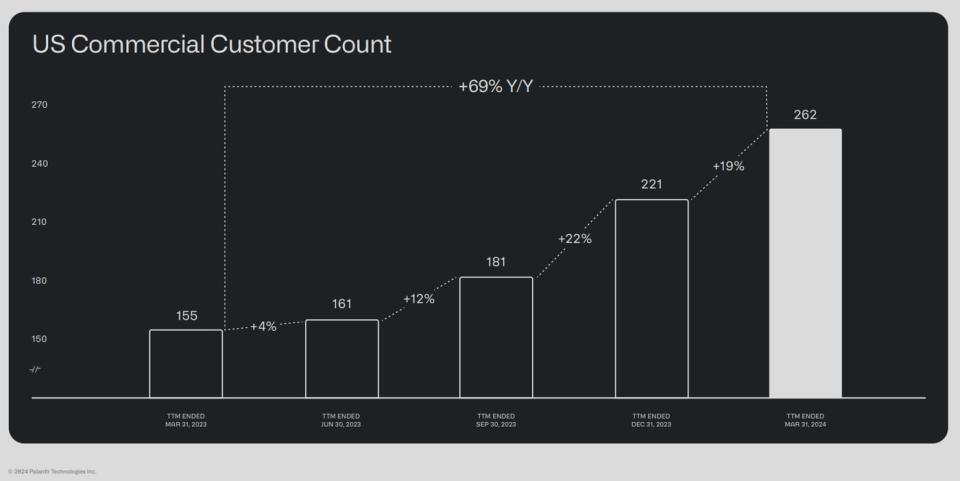

Uses of AIP large language models that allow its customers to ask questions like these in plain English and receive actionable answers. Selling such a complex platform is difficult. Looking at other companies’ use cases is helpful, but it’s still difficult to visualize how a platform like AIP will work in a specific company. For this reason, Palantir hosts “boot camps” where potential customers develop use cases specific to their business in just a few days. These camps have proven to be a great tool for growing Palantir’s customer base: the number of its commercial customers in the United States is exploding.

In the first quarter, this translated into a 40% increase in U.S. commercial sales compared to the prior year, to $150 million, and a 27% increase in global commercial sales, to $299 million. Government revenue increased 16% to $335 million. Penetration of the commercial market will be critical to Palantir’s long-term success.

Total first-quarter sales increased 21% from a year earlier to $634 million, and Palantir increased its profitability. But not everyone is convinced.

Palantir Bear Case Review

Palantir enjoys a large following among retail investors and has sparked heated debates between its bulls and bears in recent years. Society methodically puts aside many pessimistic arguments. I will present two of them to you.

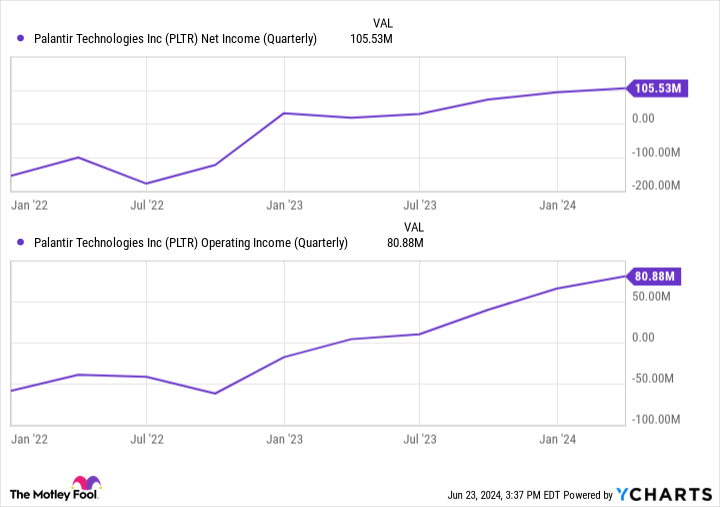

First, many have lamented the company’s continued unprofitability. This was a legitimate criticism since the company had been racking up annual losses until 2023, when it reached profitability. Palantir published net profits over the past six quarters and has significantly increased its operating profits.

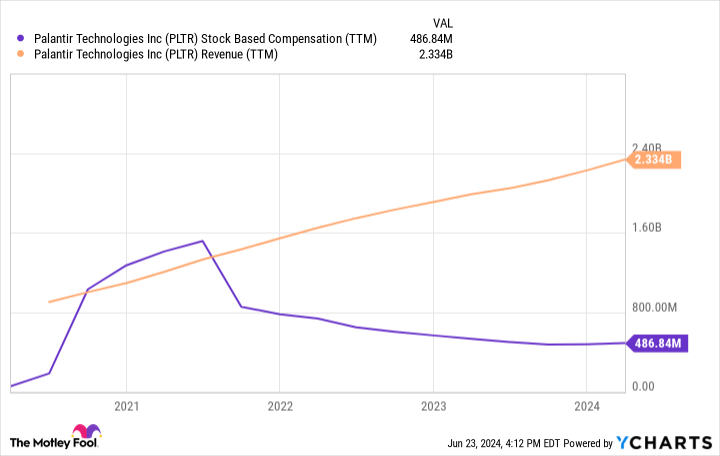

Second, Palantir highlighted the company’s heavy reliance on stock-based compensation to reward its employees. The largest portion of these distributions typically goes to senior executives. However, issuing a large number of new shares to compensate your team results in an increase in the number of shares outstanding and a decrease in shareholders’ share of the pie. However, Palantir has been reducing its stock-based compensation as its revenues have grown.

Using stock compensation also helps companies preserve cash. Palantir ended the first quarter with $3.9 billion in cash and investments on its books and no long-term debt.

Is Palantir stock a buy?

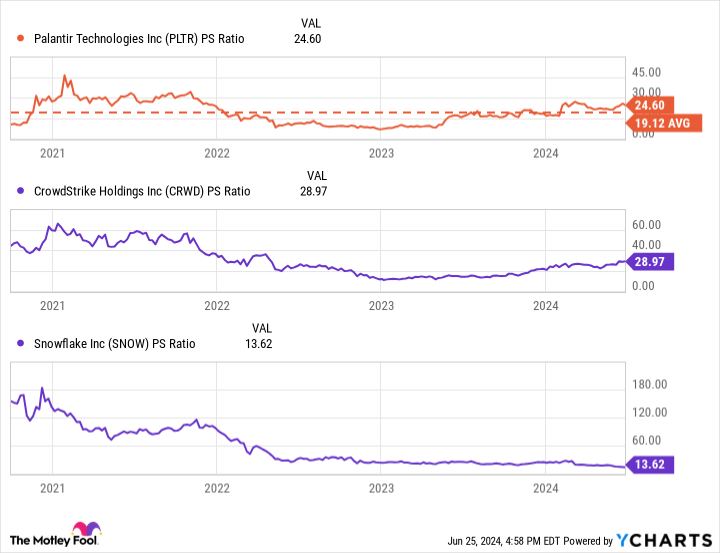

Another reason some investors remain in Palantir’s bear camp is its high valuation. The stock trades at nearly 25 times current sales. This is a lower price/sales ratio than Crowd strike and a higher than Snowflake – which, like Palantir, are both high-growth software companies with market caps under $100 billion.

The stock is also trading at a higher valuation than its historical average. However, Palantir is the most profitable of these three tech companies. Over its last four quarters, Palantir generated nearly $200 million in operating profits, compared to CrowdStrike’s $24 million and Snowflake’s loss of $1.2 billion.

Investors can afford to be patient if they choose to buy Palantir stock. The best strategy is to gradually and steadily increase your stake over time so you can take advantage of any price drops that may occur. A dollar-cost averaging strategy can reduce short-term risk when investing in high-priced stocks.

Palantir has established itself as a leader in data management and artificial intelligence. While its valuation is high, its earnings are growing and it is in a strong financial position to excel over the long term.

Should you invest $1,000 in Palantir Technologies right now?

Before buying Palantir Technologies stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what it believes to be the 10 best stocks Investors need to buy now…and Palantir Technologies isn’t one of them. These 10 stocks could deliver monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005…if you invested $1,000 at the time of our recommendation, you would have $759,759!*

Securities Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Bradley Guichard holds positions in CrowdStrike. The Motley Fool holds positions in and recommends CrowdStrike, Palantir Technologies, and Snowflake. The Motley Fool has a disclosure policy.

The Untapped Potential of Palantir: Decoding the Long-Term Value of Artificial Intelligence (AI) Stocks for Strategic Investors was originally published by The Motley Fool