The excitement around artificial intelligence (AI) cannot be underestimated. Tech stocks, in particular, have soared in 2023, helping to propel the market. Nasdaq Composite by 43%.

Last year, a small cohort of mega-cap technology companies, collectively called the “Magnificent Seven,” played a major role in pushing the markets higher. However, a number of other opportunities are emerging outside of big tech as the AI revolution advances.

Actions of Palantir Technologies (NYSE:PLTR) soared 167% last year. Additionally, Palantir stock was up 36% this year before its first-quarter earnings release on May 6.

But since the company’s earnings release in early May, Palantir shares have fallen 18%.

Now is the time to buy the dip, or could Palantir be a falling knife? Let’s take a look at the stock price volatility and evaluate the company’s earnings report.

A Close Look at Stock Movement

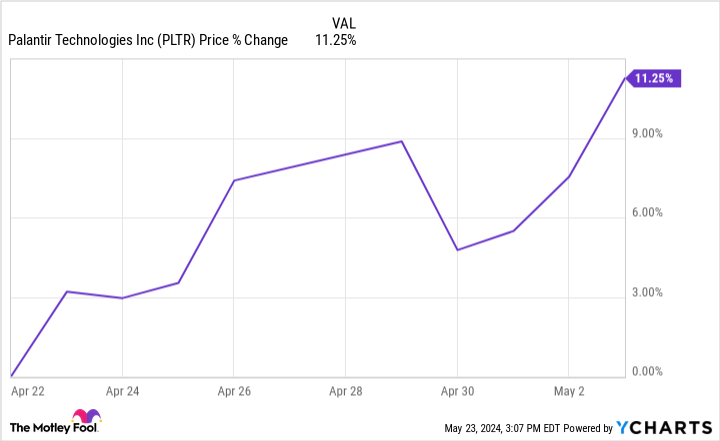

The chart below illustrates Palantir’s stock price movements in the two weeks leading up to its first-quarter earnings report.

While 11% may not seem like much, it’s a pretty dramatic move over a short period of time. To put things in perspective, the entire Nasdaq index moved only 4.6% during this same period. Additionally, from January 1 to May 3, the Nasdaq rose 7.6%.

The fact that Palantir stock outperformed the Nasdaq’s annual performance in just two weeks hints at something deeper.

Namely, sometimes before an earnings report is released, a stock starts to see some momentum. While there are many reasons for this, I would argue that this excessive commercial activity is not justified most of the time.

Additionally, momentum stocks often carry risk, as day traders can enter and exit a position in a flash.

Expectations are very high

Last year, the stock market was heavily influenced by technology companies’ dramatic investments in AI. In other words, much of the AI discourse was incorporated into software courses in particular, even though many of these companies had not yet shown much of their investments in AI.

In April 2023, Palantir launched its fourth major software product: the Palantir Artificial Intelligence Platform (AIP). Since its release, Palantir has sparked a new wave of customer acquisition, which has resulted in impressive levels of revenue growth.

There is a lot of hype around AIP, and Palantir has proven that it can compete with big tech at a high level. Additionally, given that less than 50% of Palantir’s stock is owned by large institutions, I think it’s clear that the company has become a favorite among the retail investing community.

Palantir continues to move things forward across its business. For the quarter ended March 31, Palantir increased its revenue 21% year over year to $634 million.

Additionally, the company increased its operating margin from 24% in the first quarter of 2023 to 36% at the end of the first quarter of this year. The combination of accelerating revenue and rapid margin growth has resulted in consistently positive net income and free cash flow for Palantir.

Despite these positive indicators, Palantir stock has fallen sharply and remains at depressed prices. Excitement over the company’s AI advancements led to a short-lived period of increased purchasing activity. However, investor expectations are now at levels inconsistent with reality.

To be frank, Palantir’s current price action is currently showing signs closer to those of a meme stock.

Is now a good time to invest in Palantir stock?

Despite some of the stock’s quirky features, I see many reasons to invest in Palantir.

AIP has proven to be a new source of growth for Palantir, particularly in the private sector. During the first quarter, the company’s number of commercial customers in the United States climbed 69% year-over-year. Additionally, the company is making inroads with big tech in terms of strategic alliances.

Palantir recently partnered with Oracle to transfer its data loads to Oracle’s cloud infrastructure. I see this as a lucrative source of lead generation, and one that has yet to be recognized in Palantir’s current results.

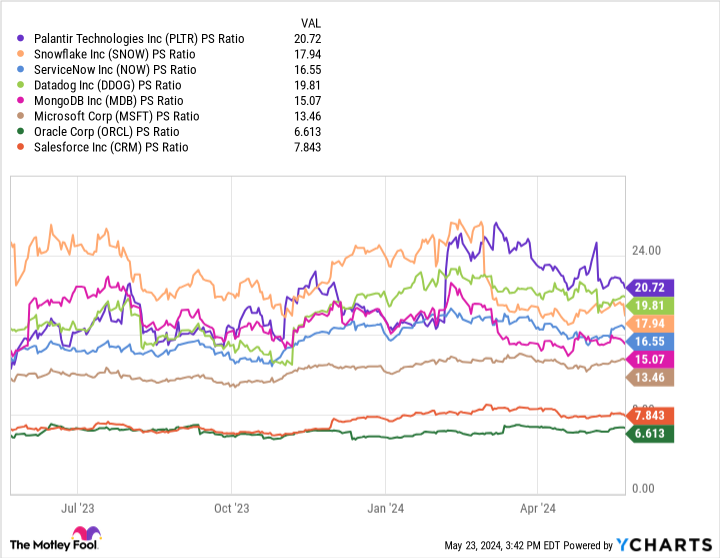

With a price-to-sales (P/S) ratio of 20.7, Palantir stock trades at a premium to many of its enterprise software peers and even several large technology companies in AI. While this shows that Palantir shares are not very cheap, the trends seen in the chart above illustrate that Palantir’s valuation multiples have normalized through the sell-off.

Even though Palantir stock is a bit expensive, I would still consider buying it. The company has made measurable progress over the past year, and with sales and profits increasing, Palantir represents a unique opportunity among high-growth AI software companies.

Should you invest $1,000 in Palantir Technologies right now?

Before buying Palantir Technologies stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Palantir Technologies was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $697,878!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 28, 2024

Adam Spatacco holds positions at Microsoft and Palantir Technologies. The Motley Fool ranks and recommends Datadog, Microsoft, MongoDB, Oracle, Palantir Technologies, Salesforce, ServiceNow, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Mad Motley has a disclosure policy.

Palantir Stock Is Crashing, But the Reason May Surprise You (Hint: It’s Not Because of Artificial Intelligence Competition) was originally published by The Motley Fool