(Bloomberg) — OPEC+ has agreed to extend its oil supply cuts, delegates said, as the group continues its efforts to avoid a global surplus and support prices.

Most read on Bloomberg

So-called “voluntary” cuts by key members including Saudi Arabia and Russia, which total about 2 million barrels per day and were due to expire at the end of June, will continue until the end of 2024, delegates said , asking not to reduce them. be named because the discussions were private.

The restrictions came on top of a previous group-wide agreement capping crude production until the end of this year. The alliance also agreed to extend this agreement until the end of 2025, according to a statement published on the OPEC website. The United Arab Emirates, which has invested heavily in new oil projects in recent years, saw its production target increase by 300,000 barrels per day for next year.

OPEC+ ministers gathered on Sunday for a meeting to decide oil policy, with some taking part in discussions in person at the Ritz Hotel in Riyadh and others online. Traders and analysts had widely expected the group’s voluntary cuts to be extended, seeing them as necessary to offset rising output from several OPEC+ rivals – notably US shale drillers – and the country’s fragile economic outlook. main consumer, China. The deal to extend group-wide cuts for 12 months actually goes a bit further than OPEC observers expected.

While crude prices briefly climbed above $90 a barrel in April as conflict in the Middle East threatened regional exports, they have since fallen. Brent crude futures settled at $81.62 per barrel on May 31, down 7.1% for the month.

Lower oil prices have brought some relief to central banks struggling with persistent inflation, but threaten the revenues of producers like Saudi Arabia. The kingdom needs prices close to $100 a barrel to finance Crown Prince Mohammed bin Salman’s ambitious spending plans, the International Monetary Fund estimates. Alongside the OPEC+ meeting, the Saudi government completed a $12 billion sale of shares in state-owned oil giant Aramco, raising funds to help finance a massive economic transformation plan.

Oil market indicators have likely pushed the Organization of the Petroleum Exporting Countries and its allies to exercise caution. The premium on fast Brent contracts – which traders call “backwardation” – has declined, suggesting global markets are moving from shortage to surplus.

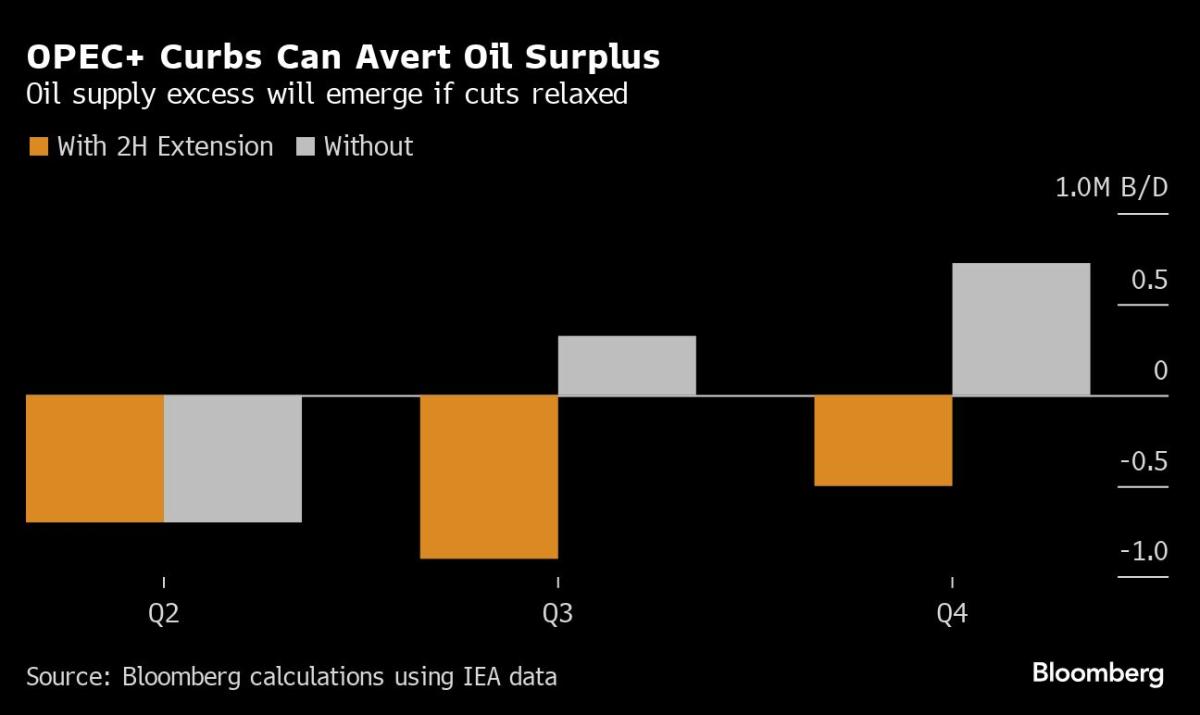

Data from the International Energy Agency in Paris indicates that OPEC+ must persevere with its restrictions in order to cause a global supply deficit in the second half. If the group were to lift restrictions and restore production, a new oversupply would emerge.

–With help from Fiona MacDonald, Ben Bartenstein, Salma El Wardany, Anthony Di Paola and Nayla Razzouk.

(Updates with details of the agreement in the fourth paragraph.)

Most read from Bloomberg Businessweek

©2024 Bloomberg LP