Before owning the NFL’s Carolina Panthers and MLS’s Charlotte FC, David Tepper made a name for himself (and money) through Appaloosa Management, a global hedge fund he founded. Tepper, whose net worth is around $20 billion, is among the world’s 100 richest people. Needless to say, he found success in the world of investing.

Given Tepper’s success, it makes sense that investors would look to his and his hedge fund’s investments for guidance. Even though the average investor and billionaire hedge fund managers don’t have the same risk tolerance or investment goals, there’s nothing wrong with taking inspiration from them.

Tepper’s portfolio is quite concentrated, with almost a third held in three “Magnificent Seven” stocks. If investors want strong, sustainable companies for the long term, they need look no further.

1. Amazon

Amazon (NASDAQ:AMZN) became a household name due to its e-commerce businessbut it has since diversified and become a major player in a handful of industries.

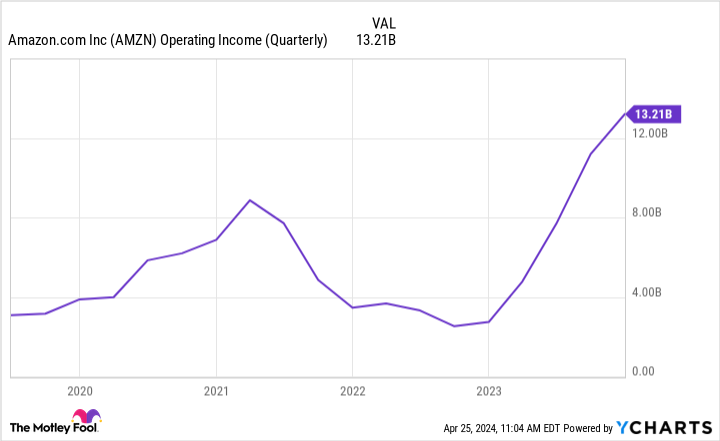

For a while, Amazon’s e-commerce business was unprofitable and was used primarily as a revenue generator. It’s still Amazon’s largest source of revenue, but it has recently become profitable. In the fourth quarter, Amazon’s North American segment earned about $6.5 billion in operating profits, an impressive turnaround from the $240 million it lost in the fourth quarter of 2022. Its international segment lost $419 million. of dollars, which isn’t ideal, but it leaves Amazon profitable in the fourth quarter. its non-Amazon Web Services (AWS) activities.

There’s still room for growth in e-commerce, but much of Amazon’s growth will rely on its cloud service, AWS. Although AWS’s growth has slowed recently, 13% year-over-year growth isn’t too bad for Amazon’s biggest profit producer. AWS has a significant market share in global cloud services, but has lost some ground over the past year. However, its market share is 31%, which places it in the lead MicrosoftIt is (NASDAQ:MSFT) Azure (a 24% share) and Alphabet’s Google Cloud (11%).

In the long term, Amazon is expected to benefit from organic growth in cloud services and e-commerce. However, the company has also shown that it is willing to invest in new industries. Take for example its $13.7 billion purchase of Whole Foods and its healthcare ambitions. Investors can count on the company not to be complacent.

2.Microsoft

There are various tech companies, and then there is Microsoft, the poster child for a broad network of companies.

Microsoft did not become the most valuable public company in the world by chance; it took years of impressive business growth and a boost from the AI craze. The latter could also support the company in its next phases of growth.

Microsoft’s strategic partnership with OpenAI – which gives it exclusive licenses to OpenAI’s Large Language Models (LLMs) – could be just what it needs to further strengthen its grip on office software. From Office (Excel, Word, PowerPoint, etc.) to Azure and Teams, Microsoft is almost essential in the business world.

Microsoft’s abundance of enterprise customers gives it an advantage in ensuring longevity and protecting against economic and market downturns. When times are tough, consumers can easily forgo the latest smartphones or online shopping, and companies can cut back on advertising. It’s much harder for businesses to stop using Office software, migrate their data out of the cloud, or leave established communications platforms like Teams.

With Microsoft, investors can be confident that they are investing in a company built for sustained growth over the long term.

3. Metaplatforms

Facebook Creator Metaplatforms (NASDAQ:META) continues to be one of the top cash cow companies, with revenue of approximately $36.5 billion in the first quarter, up 27% year-over-year.

With an average of 3.24 billion daily active people in March 2024 (up 7% year-over-year), Facebook shows why it continues to be a benchmark for many of the world’s biggest advertisers. Meta took advantage, increasing the average family income per person from $9.47 in the first quarter of 2023 to $11.20 in the first quarter of 2024.

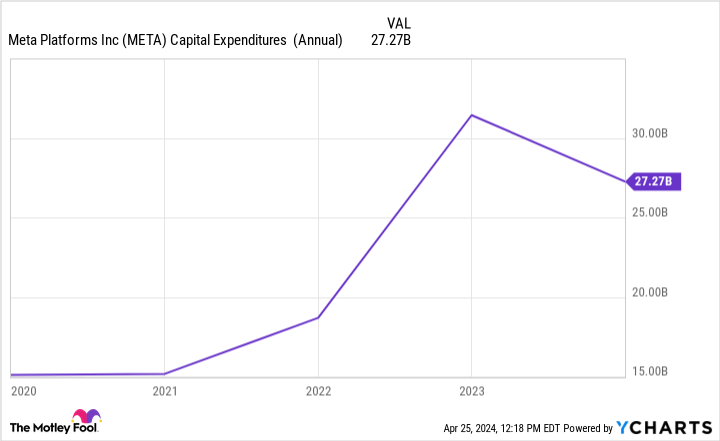

Despite the growth in key metrics, Meta’s stock fell after its latest earnings release, falling as much as 15% on the same day. This is largely due to the company’s spending plan, which primarily concerns its AI infrastructure. Meta said it plans to spend between $35 billion and $40 billion this year, up from $30 billion to $37 billion previously estimated.

Investors may not agree with the spending plan, but their reaction appears to be overreacting. The good news, however, is that its lower valuation makes it a more attractive entry point.

Investors should also like Meta’s new dividend of $0.50 per share. The dividend yield isn’t enough to please most income-seeking investors, but it’s an incentive that can encourage investor patience while Meta works on its AI plans.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Amazon was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $537,557!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Steve Walters holds positions at Microsoft. The Motley Fool holds positions and recommends Alphabet, Amazon, Meta Platforms and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Mad Motley has a disclosure policy.

A third of billionaire David Tepper’s portfolio is made up of these 3 seven magnificent stocks was originally published by The Motley Fool