It cannot be denied that Nvidia (NASDAQ: NVDA) has been on fire since the start of last year. The stock has soared more than 750% at the time of writing, driven higher by the potential implications of generative artificial intelligence (AI)The ability to streamline time-consuming tasks and automate routine processes promises to increase productivity and could unleash a wave of greater profits for companies that adopt this cutting-edge technology.

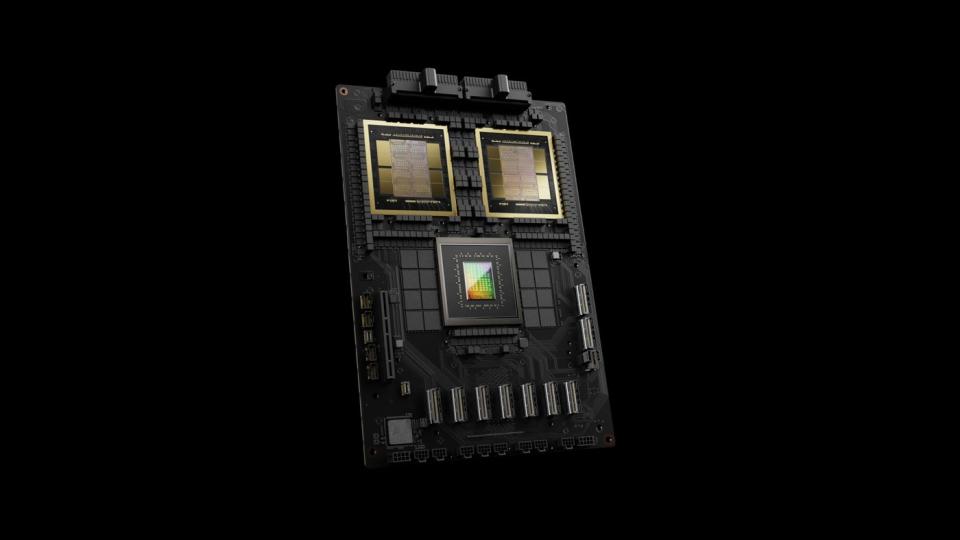

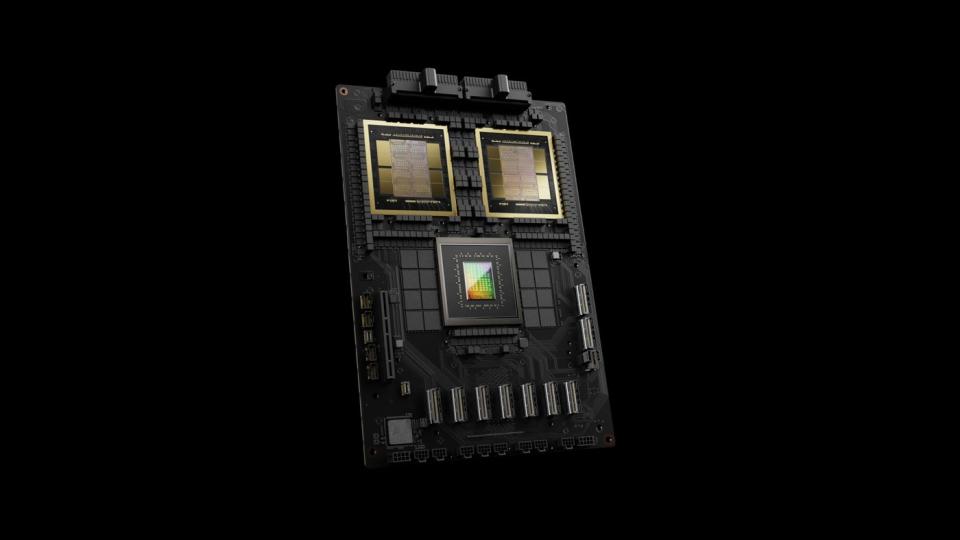

Nvidia’s graphics processing units (GPUs) are the gold standard and provide the computing power needed to process AI. This has triggered a wave of demand for the company’s high-end processors, sending its business and financial results soaring, leading to its recent 10-for-1 stock split.

While some investors worry that the easy money is already made, others believe the best is yet to come. One analyst believes Nvidia has a key advantage that will allow it to stay ahead of the competition and free up a stream of cash that will benefit shareholders.

Let’s see if the analyst’s argument holds water and what it means for investors.

A long history of success

To understand the source of this “liquidity well,” it helps to take a step back and see how Nvidia got to where it is today.

Nvidia’s cutting-edge processors have long been the industry standard for serious gamers. The company controlled 88% of the discrete desktop GPU market in the first quarter, according to data compiled by Jon Peddie Research.

However, Nvidia has adapted this same technology to send data into the ether, becoming the go-to processor for data centers. The company is estimated to control up to 92% of the data center GPU market, according to IoT Analytics. Nvidia is also the undisputed leader in machine learning processing—an established branch of AI—with an estimated 95% share. that market, according to data provided by New Street Research.

With much of the processing of generative AI happening in the cloud and data centers, Nvidia has solidified its leadership position. The company is set to launch its Blackwell processor line later this year, with CEO Jensen Huang saying, “The Blackwell Architecture platform will likely be the most successful product in our history.” If that’s the case, and I think it is, the best may be yet to come.

Moreover, while popular discourse claims that competition is bearing down on Nvidia, so far – despite years of opportunity – no serious competitor has emerged.

A “liquidity well”

Melius Research analyst Ben Reitzes believes Nvidia has a key advantage that some investors might overlook, one that will help the company stay at the forefront of technology. Nvidia not only provides the custom-built AI chips, but also the embedded software that helps extract the most performance from these AI-centric processors. This “full stack” approach, or the marriage of hardware and software, gives Nvidia a key advantage that competitors will struggle to match, especially given the company’s long history of leadership in the space.

“What they’ve done is they’ve built a computer language and an ecosystem that allows you to monetize AI, and obviously they’re killing it,” Reitzes said.

The analyst goes on to point out that Nvidia’s research and development (R&D) cadence makes it difficult for competitors to keep up. The company has recently accelerated its already relentless pace of innovation, with CEO Jensen Huang saying the company is now on an “annual cadence,” releasing new processors every year instead of every two years. “They’re running at 150 miles per hour while everyone else is running at 100 miles per hour. It’s going to be hard to catch up with those guys,” Reitzes said.

Due to the accelerated adoption of AI and Nvidia’s dominant position, the company is estimated to generate $270 billion in cash over the next three years, which could trigger a wave of shareholder returns in the form of share buybacks and higher dividend payments.

The analyst notes that even with higher R&D spending, the cash inflow will far outweigh any potential use, suggesting that the majority will be returned to shareholders.

Investors are already seeing signs of this shift. Late last year, Nvidia announced a new $25 billion stock repurchase plan. Additionally, in conjunction with its stock split announcement in May, the company increased its dividend payout by 150%. That said, Nvidia currently uses less than 1% of profits to fund its dividend, and even at its higher rate, the yield is a meager 0.03%.

This shows that Nvidia still has plenty of room to return money to shareholders, and with the current tsunami of AI adoption, the company will have increasing resources to do so. Plus, given its competitive advantage, it’s unlikely that any competitor will take the crown, at least not anytime soon.

Should You Invest $1,000 in Nvidia Right Now?

Before you buy Nvidia stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors need to buy now…and Nvidia isn’t one of them. These 10 stocks could deliver monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Nvidia’s 1 Killer Advantage will produce a “gush of cash” for shareholders following its 10-for-1 stock split, according to 1 Wall Street analyst. was originally published by The Motley Fool