Artificial intelligence (AI) trading deteriorated on Monday as Nvidia (NASDAQ:NVDA) shares fell as much as 6.5%, taking the entire AI market with them.

Super microcomputer (NASDAQ:SMCI) fell by up to 8.5%, and Semiconductor manufacturing in Taiwan (NYSE:TSM) was down 3.8% at its lowest today. All three AI stocks were down 4.9%, 7% and 3.2%, respectively, as of 11:30 a.m. ET. There’s no specific AI news, but investors have a lot on their minds about future demand for the chips that drive AI today.

Nvidia insiders are selling in droves

On Friday, Nvidia insiders, including CEO Jensen Huang, announced massive stock sales beyond just tax sales related to stock options and warrants. Huang said he sold 240,000 shares on the open market on Thursday and Friday, for a total of $31.6 million in those two days alone.

In June alone, Huang has already sold nearly $95 million worth of stock, touting AI’s long-term growth potential. Many other executives also reported significant stock sales on the open market.

Insider selling can indicate that they are less bullish on a stock, which is why this is noteworthy.

Is the bubble bursting?

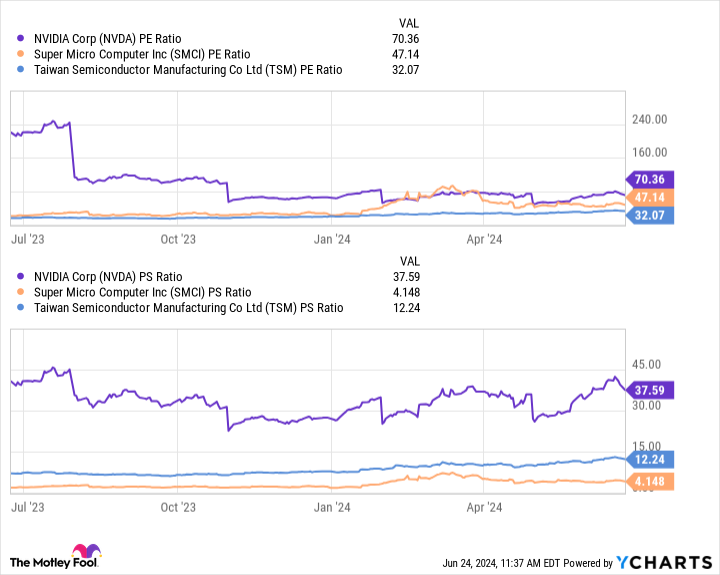

As impressive as the demand for AI is, the valuations of Nvidia and Super Micro Computer in particular have reached crazy levels. You can see below that Nvidia’s price-to-earnings (P/E) multiple is still above 70 and its price-to-sales (P/S) multiple is 37.6. The Super Micro Computer isn’t as expensive, but it’s still priced just right.

Investors should consider how much growth is currently baked into AI stocks and how likely they are to live up to that potential. Very few AI companies make money, so the money flowing into chips could slow down if those developing AI models and tools don’t create business plans that make them sustainable in the long run. term.

Earnings are the focus

Investors are suddenly thinking about demand, as we are only a few weeks away from the start of earnings season for the second quarter of 2024. That’s when we’ll hear about final demand and margins. tech companies that build AI products, including those that buy most of Nvidia’s chips.

If demand is strong, shares could rise, but investors are pulling money out of trading, fearing disappointing signs. And with stocks priced to perfection, even the smallest crack in the AI growth story could send them tumbling.

It all depends on Nvidia

Nvidia is the biggest name in AI, and its fortunes will drive Super Micro Computer and TSMC, which are suppliers to the company and beneficiaries of the overall growth in AI demand. If the Nvidia chip market continues to grow, demand from other companies will be strong.

I think the focus over the next month will be on the demand for AI products that companies have introduced and whether or not that will lead to more capital spending. Otherwise, there could be a decline in orders in the future, which could call into question revenue and margin projections.

These high valuations and lack of AI business models are why I’m avoiding AI stocks today. The risk is simply too high for the observable reward at this time.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $775,568!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool ranks and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Nvidia shares fall 6.5%, leading artificial intelligence stocks lower was originally published by The Motley Fool