(Bloomberg) — Nvidia Corp. is the most expensive stock in the S&P 500 Index, with its shares trading at approximately 23 times the company’s projected sales over the next 12 months.

Most read on Bloomberg

But there is a problem with this assessment. In the era of the artificial intelligence boom, no one can determine what the chipmaker’s revenue will actually be — not the Wall Street analysts who cover Nvidia or Nvidia executives themselves. So how are investors supposed to calculate whether stocks are expensive or not?

For more than a year, the surge in demand for Nvidia chips, caused by the frenzy around AI, has made a mockery of Wall Street’s quarterly financial estimates. Analysts don’t make up numbers, they take their cues from management like they do in every other company. However, even Nvidia executives are having trouble anticipating how much money the chipmaker will generate in three months.

Since Nvidia’s sales began exploding in its fiscal quarter ended April 2023, revenue has exceeded the midpoint of the company’s forecast by 13% on average, more than twice the average last year. decade. When Nvidia reported results in August, sales exceeded its forecasts by 23%, the biggest increase since at least 2013, according to data compiled by Bloomberg.

An Nvidia representative declined to comment.

Parking sales

Part of what makes modeling for Nvidia so difficult is that supply is the most uncertain variable when demand is booming, which makes the chipmaker unique, according to Brian Colello, an analyst at Morningstar, who has last month raised its price target for the shares to $105 from $105. $91. They are currently trading at around $127.

Assuming continued improvement in Nvidia’s ability to increase its supply, Colello said he adds up to $4 billion to Nvidia’s quarterly revenue to gauge sales for the coming quarter.

“I’m not the first analyst to raise my price target or fair value or be surprised that earnings are much higher than we thought a year ago,” Colello said. “It’s been interesting and rewarding, but definitely challenging.”

Colello is not the only one to increase his price estimate. On Friday, Melius analyst Ben Reitzes raised his price target on Nvidia for the fifth time this year, from $125 to $160, implying a 26% gain from Friday’s closing price.

Of course, many traders are buying Nvidia based on momentum alone. Nvidia has gained 156% this year and surpassed Microsoft Corp. Tuesday to briefly become the world’s most valuable company at $3.34 trillion. That rally helped generate a record $8.7 billion in tech funds last week through June 19, according to a Bank of America Corp. analysis. data from EPFR Global. Nvidia shares have since fallen 6.7%, wiping out more than $200 billion in market value.

For investors inclined to look at discounted cash flow models that exhibit more variability than in the past, the gap between estimates and actual results has created a conundrum.

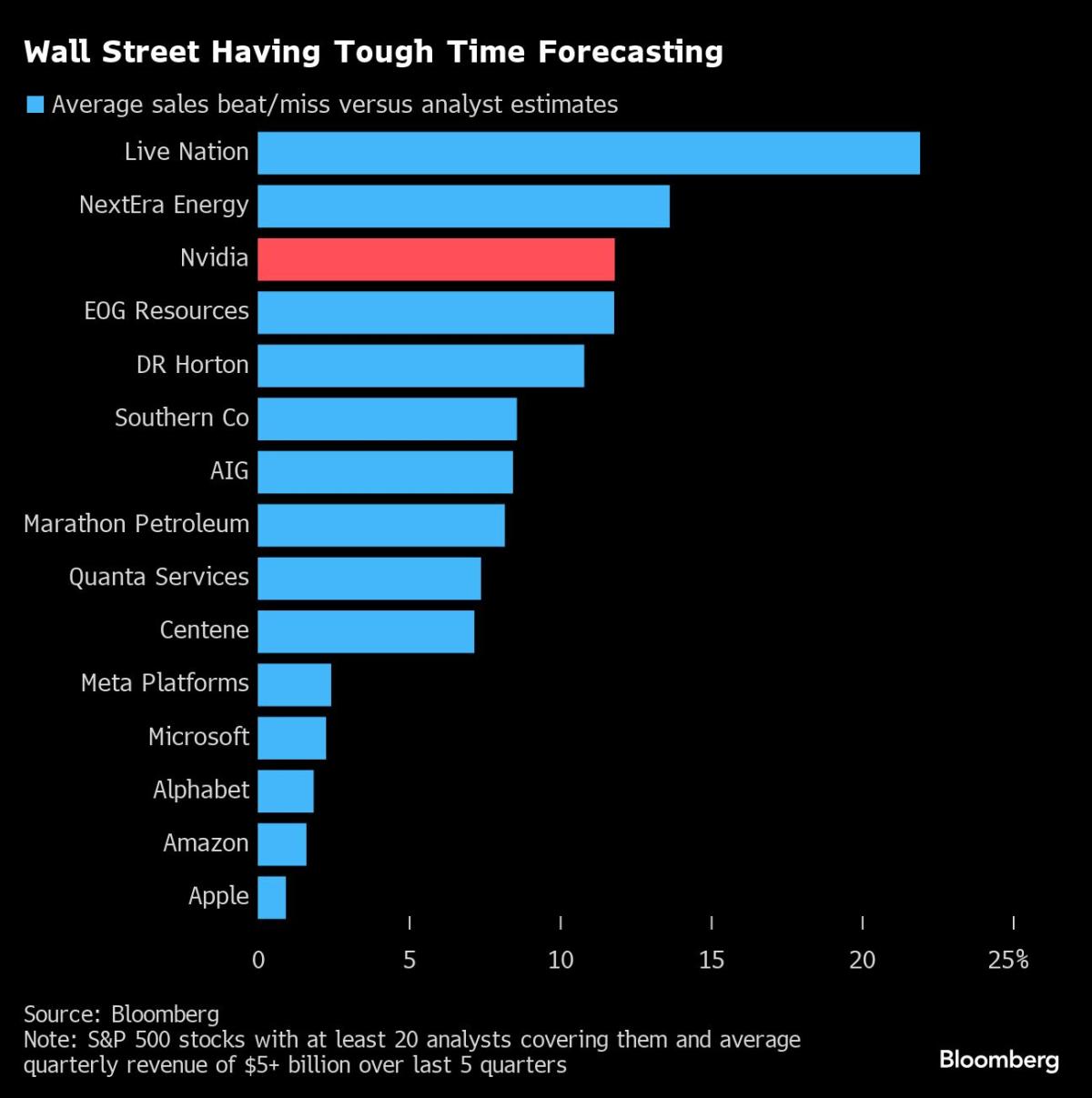

Over the past five quarters, analyst estimates for Nvidia’s sales have deviated from actual results by an average of 12%, according to data compiled by Bloomberg. It is the third company in the S&P 500 that has averaged quarterly revenue of at least $5 billion over the past five quarters and is covered by at least 20 analysts.

What price?

With Nvidia’s business booming and its biggest customers like Microsoft pledging to spend even more on hardware in the coming quarters, the biggest question for investors is what is a reasonable price to pay for a stock whose earnings and sales growth is much higher than that of its mega-cap peers.

Based on current estimates, Nvidia is expected to post a profit of $14.7 billion on revenue of $28.4 billion in the current quarter, up 137% and 111% respectively from at the same time last year. At the same time, Microsoft’s sales are expected to increase by 15%, with Apple’s forecast being around 3%.

While Nvidia’s valuation multiples are rich, they seem more reasonable given Nvidia’s growth, especially as estimates remain low. For Michael O’Rourke, chief market strategist at Jonestrading, the biggest concern is that the extent to which Nvidia exceeds Wall Street’s growth expectations will soon start to decline, simply because of the company’s size. This could make it harder to justify stock prices.

“That’s where the risk comes in,” O’Rourke said. “You’re paying a premium price for a large market cap company whose beats are trending down and that’s likely to continue.”

–With help from Matt Turner.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP