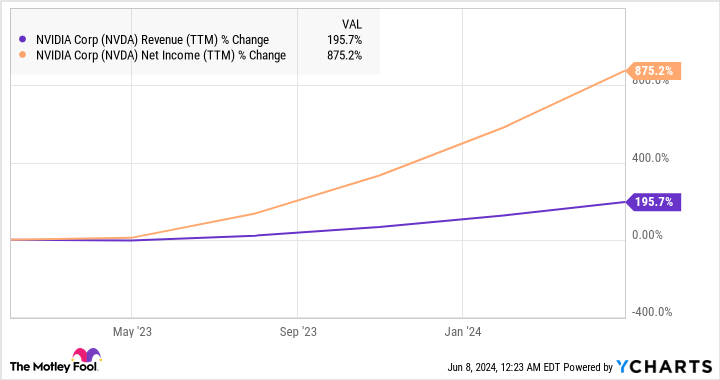

The stock market has largely rewarded Nvidia‘s dominant position in the field of artificial intelligence (AI) chips with astonishing gains of over 222% over the past year. And the company justified this red-hot rally with tremendous growth quarter after quarter.

Such phenomenal growth in Nvidia’s revenue and profits is due to the fact that it controls a whopping 98% share of the AI chip market. Market research firm Gartner estimates that the AI semiconductor market could generate $71 billion in revenue in 2024. If Nvidia can maintain its hold on this market, its data center revenues could increase significantly from 47,000 levels. $5 billion from the previous fiscal year.

So there is a good chance that Nvidia can continue to progress and remain among the best. AI Growth Stock go forward. However, if you missed Nvidia’s tremendous rise over the past year and are worried about the stock’s valuation, there is a solid alternative to buy: ASML Holding (NASDAQ: ASML).

Let’s take a look at why ASML is one of the best AI stocks to buy right now.

ASML Holding’s machines made Nvidia’s dominance in AI possible

ASML’s extreme ultraviolet (EUV) lithography machines could be the main reason why Nvidia has dominated the AI chip market. These machines allow Nvidia’s foundry partner, Taiwan semiconductor manufacturing companyalso known as TSMC, to manufacture chips using advanced and smaller process nodes.

According to ASML, “Chipmakers use our NXE systems to print the highly complex base layers of their 7nm, 5nm and 3nm nodes.” Nvidia’s popular H100 AI GPU (graphics processing unit) is manufactured on a 5 nanometer (nm) process node, while the next generation of Blackwell chips are said to be manufactured on a 4nm process from TSMC.

Additionally, Nvidia’s recently announced Rubin chips, expected to launch in late 2025, are expected to be manufactured using a 3nm process. It’s no surprise that chipmakers and foundries are lining up to purchase ASML’s advanced chipmaking equipment to meet strong AI-driven demand. The Dutch semiconductor equipment manufacturer will ship its latest EUV machine to Intel and TSMC later this year.

Priced at $380 million, this machine will allow ASML customers to make chips 1.7 times smaller than the previous generation of machines. These chips are expected to be deployed for AI-related workloads. Transistors are packed more tightly on chips made using smaller process nodes, allowing electrons to move faster and leading to increased computing power. Additionally, because electrons have to travel a smaller distance, the heat generated in these advanced chips is lower and they are more energy efficient.

At the same time, investments by chipmakers to increase their production capacities will be an asset for ASML. For example, a TSMC-backed chipmaker recently announced that it would invest $7.8 billion in a new chip factory in Singapore. Additionally, the growing demand for AI chips will likely encourage chipmakers to purchase more EUV lithography equipment.

Data Bridge Market Research estimates that the global EUV lithography market could generate $40.5 billion in revenue in 2031, up from $9.4 billion last year. Given that ASML has a monopolistic position in the EUV lithography market, the company appears poised to continue growing at a healthy pace over the long term.

Company growth expected to accelerate

ASML ended 2023 with a turnover of 27.6 billion euros, an increase of 30% compared to the previous year. The company expects a similar level of revenue this year, as semiconductor industry revenues fell in 2023, prompting ASML customers to delay purchases of new equipment this year as they work their way down.

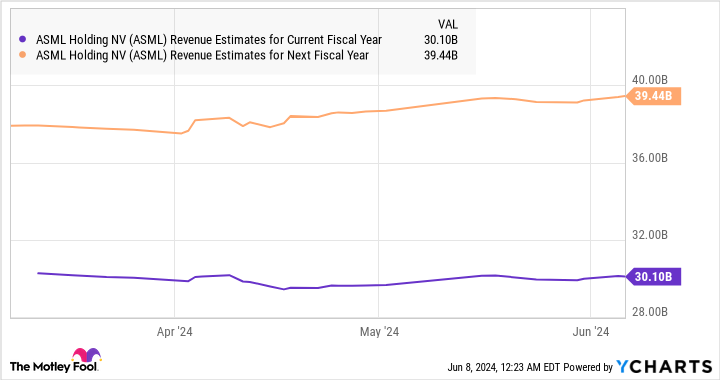

ASML expects to return to growth from 2025, and its enormous order book of 38 billion euros will play a key role in this recovery. The following chart indicates that ASML’s revenue could increase by 30% next year.

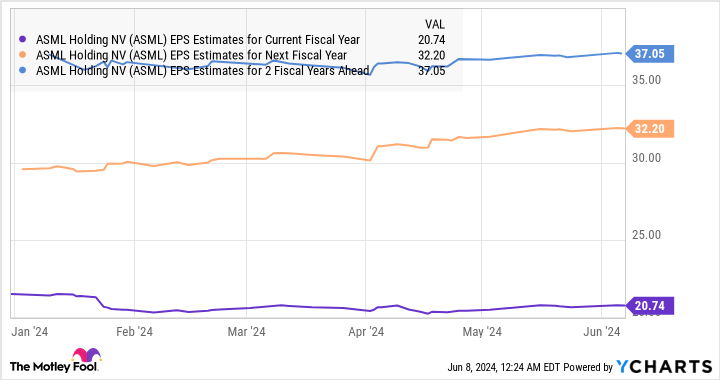

Analysts expect the company to also post healthy growth in its financial results, thanks to the impressive momentum its business is expected to gain.

ASML shares have gained 44% over the past year, which is lower than the 52% gains recorded by the PHLX Semiconductor Sector hint. However, the situation could change in the future thanks to enablers such as AI, which could drive demand for the company’s offerings.

With ASML currently trading at 14x sales, representing a significant discount to Nvidia multiple sales Over 38 years, investors can get their hands on this AI stock at a relatively attractive valuation. Consider taking advantage of this opportunity before ASML stock begins to soar, due to the critical role it plays in the AI chip market.

Should you invest $1,000 in ASML right now?

Before buying stocks in ASML, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and ASML was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $740,690!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Hard Chauhan has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends ASML, Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Gartner and Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Mad Motley has a disclosure policy.

Did you miss the Nvidia run-up? My Top Artificial Intelligence (AI) Stocks to Buy and Hold was originally published by The Motley Fool