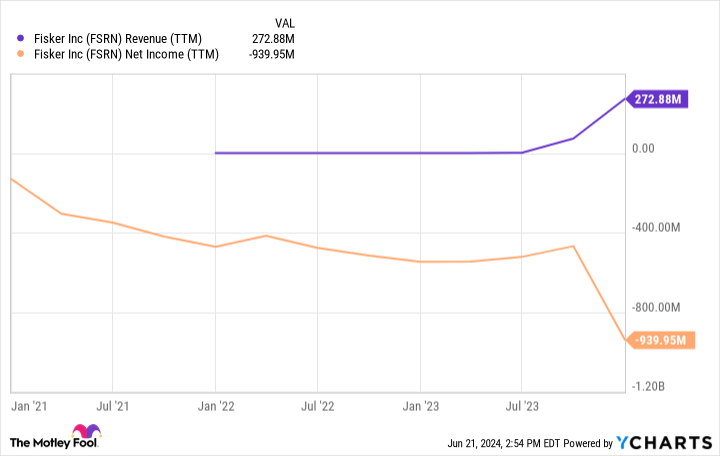

Electric vehicle (EV) stocks collapsed this week after Fisker filed for bankruptcy. The struggling automaker never got off the ground after a promising vehicle was plagued by poor software. While a failure doesn’t say much about other operators in the industry, it doesn’t bode well for the market’s willingness to finance EV losses in the long term.

According to data provided by S&P Global Market Intelligenceelectric vehicle manufacturers Faraday Future Smart Electric (NASDAQ:FFIE) fell up to 26.9% and VinFast (NASDAQ:VFS) fell 9.9%. Both manufacturers are down 23.1% and 8.5%, respectively, for the week as of 2:45 p.m. ET. Charging companies Flashing Loading (NASDAQ:BLNK) And Charging point (NYSE:CHPT) fell 14.1% and 20.1% respectively at their lowest and are now down 12.8% and 19.5% for the week.

The collapse of Fisker and its aftermath

Fisker had many problems that investors couldn’t solve. Software was problematic and manufacturing never met production targets. But the other problem was demand.

Growth in demand for electric vehicles has slowed as supply has increased in the market. For companies that have yet to build mature supply chains and generate significant sales and profits, the lack of demand has translated into mounting losses.

With more options, buyers didn’t have much sympathy for electric vehicle startups because they could find other options that were high quality and readily available. Fisker was the first domino to fall, but it won’t be the last.

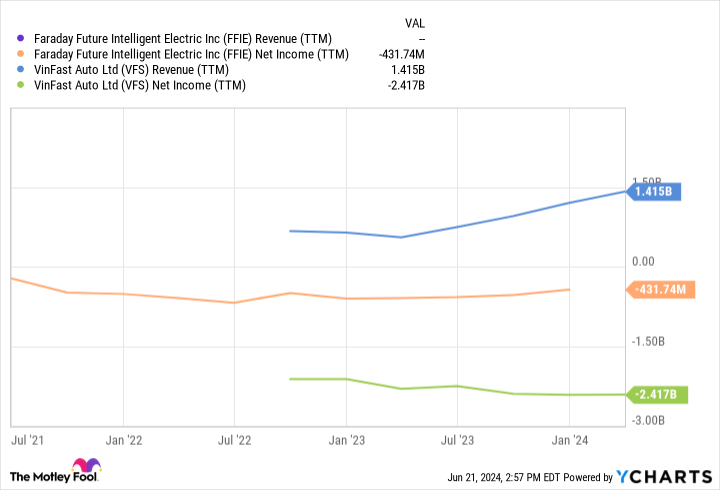

Faraday and VinFast look a lot like Fisker’s operations and may not have much of a lifeline anymore.

The new scrutiny of the electric vehicle market

Losses were not a problem when stock prices were high, because companies could simply sell their shares to finance their operations. But as stock prices fall, this becomes more difficult.

Debt markets close first, then equity markets no longer want to finance their operations, triggering a downward spiral that is almost impossible to stop.

I think most EV manufacturers will meet the same fate if not acquired first.

The impact on inventory invoicing

Recharge stocks were not spared from the liquidation and for good reason. Demand issues for electric vehicle manufacturers are translating into lower demand for chargers. And if there are fewer electric vehicle manufacturers, they can negotiate better terms for their users and commoditize charging networks.

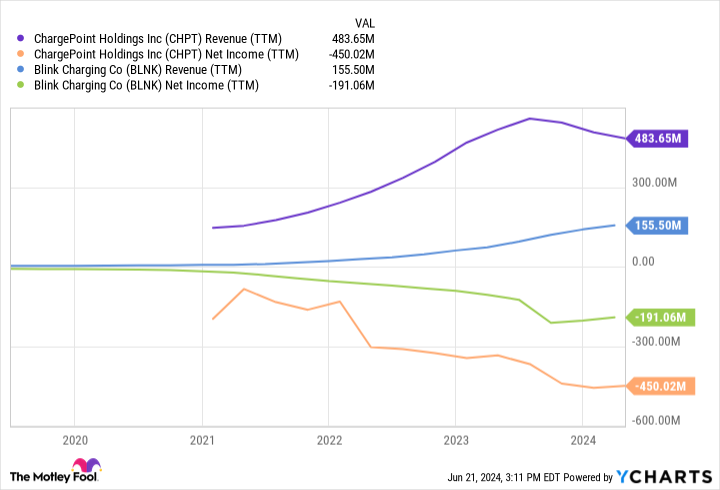

ChargePoint and Blink Charging also don’t have much better financials than the EV makers themselves, as you can see below.

The electric vehicle market is collapsing

The issue is not whether or not people use electric vehicles, but rather whether companies that make electric vehicles and chargers can make money selling their products. So far, only one U.S. electric vehicle company has become profitable and even that may not be sustainable.

Companies that lose money year after year do not seem to be able to turn around their operations and the market is not willing to finance their operations indefinitely. This doesn’t bode well for electric vehicle stocks in the long term and I think this is just one of many bad weeks ahead for the industry.

Should you invest $1,000 in ChargePoint right now?

Before buying shares in ChargePoint, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and ChargePoint wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $801,365!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the securities mentioned. The Motley Fool has a disclosure policy.

Massive Bankruptcy News Crushes Electric Vehicle Stocks was originally published by The Motley Fool