Buying and holding large companies for a very long time is a proven strategy for making money in the stock market. This allows investors to not only make the most of secular growth trends but also helps capitalize their investments over time.

For example, an investment worth $10,000 in shares of Nvidia (NASDAQ:NVDA) ten years ago, is now worth $1.9 million. This translates to a whopping annual return of almost 70% over the past 10 years. During that time, Nvidia investors benefited from the growing adoption of the company’s graphics cards in the gaming, automotive and data center markets, illustrating why owning a strong company for a long time could be a rewarding thing to do, or even to help. you become a millionaire.

However, a stock going 100x and turning $10,000 into almost $2 million is a rare occurrence. But at the same time, if you have that much money left after paying your bills, saving for tough times, and paying off your high-interest debts, it might make sense to put that money into a fund. undervalued stock with tremendous long-term potential.

This will not only help you benefit from the power of compounding and long-term growth opportunities, but will also allow you to build a diversified portfolio.

Let’s look at why buying Nvidia now as part of a diversified portfolio could help investors become millionaires in the long run.

Here’s why Nvidia stock is undervalued

You may be wondering why I’m calling Nvidia an undervalued stock after eye-popping gains of over 500% since the start of 2023. After all, shares trade at 36 times sales and 74 times trailing earnings. Both figures are significantly higher than the company’s five-year average sales multiple of 18 and current earnings multiple of 65.

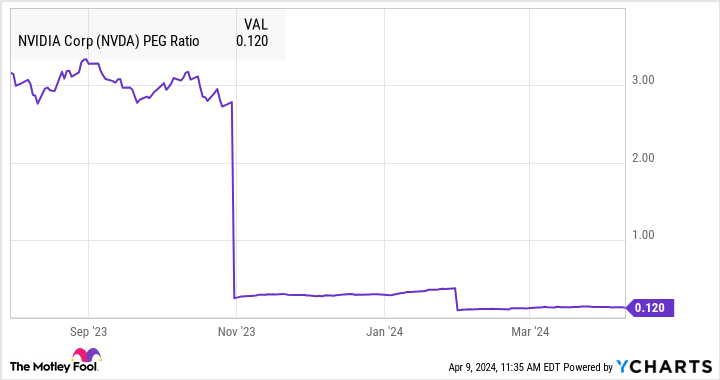

However, Nvidia stock is undervalued based on the growth potential it is expected to generate. This is evident from the stock’s forward price-to-earnings (P/E) ratio of 36, which is lower than the five-year average forward earnings multiple of 39. Meanwhile, Nvidia’s price-to-earnings-to-growth ratio (PEG ratio ) ) is another clear indication that the stock is undervalued.

The PEG ratio is determined by dividing a stock’s P/E ratio by the projected annual earnings growth it is expected to generate. In simpler terms, the PEG ratio helps investors understand a stock’s price relative to the growth it could generate. A PEG ratio below 1 means the stock is undervalued. As the following chart tells us, Nvidia is significantly undervalued based on the relevant PEG ratio.

Buying Nvidia at this multiple seems like the smart thing to do given that it benefits from lucrative secular growth opportunities in several markets. Let’s take a look at them.

These strong opportunities can help Nvidia maintain its breathtaking growth

Artificial intelligence (AI) is the reason why Nvidia shares have risen so impressively over the past year. What’s positive is that the company’s rising share price is supported by strong revenue and earnings growth.

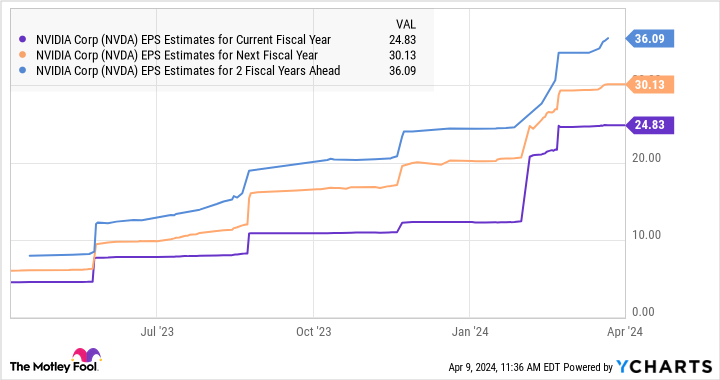

After ending fiscal 2024 with a 126% increase in revenue to $60.9 billion and a 288% jump in adjusted earnings to $12.96 per share, analysts expect that Nvidia maintains its exceptional growth over the next three years.

More importantly, Wall Street is optimistic about Nvidia’s long-term prospects. For example, analyst Vijay Rakesh of the Japanese investment bank Mizuho expects Nvidia’s data center revenue to reach $89 billion in fiscal 2025, up from $47.5 billion last year. By fiscal 2028, Rakesh estimates that Nvidia could generate $280 billion from its data center business alone, driven by the tremendous growth opportunity in the AI chip market.

This will not be surprising for several reasons. First, the global AI chip market is expected to generate $400 billion in revenue in 2027, according to Advanced microsystems. Second, Nvidia largely dominates the AI chip market, with an estimated market share of over 95%. The good news is that Nvidia has taken steps to ensure that it remains the number one player in this space.

Whether it’s launching new AI graphics cards that are much more powerful than existing ones at aggressive prices or entering the custom AI chip market, there’s a good chance the company will continue to dominate this market long-term. At the same time, Nvidia is also ready to capitalize on new niches such as digital twins and AI-enabled personal computers (PCs).

These are multi-billion dollar opportunities for the company. For example, Nvidia management projects a $150 billion addressable market for its Omniverse enterprise software, and it started to progress. Similarly, the potential revenue opportunity for Nvidia in the AI PC market suggests that its annual gaming sales could grow 5x over the next four years.

All of this shows that Nvidia could indeed remain a long-term growth stock, as the market will likely reward its healthy growth with more gains. That’s why investors looking to build a million-dollar portfolio may consider buying it while it remains undervalued.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns April 8, 2024

Hard Chauhan has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Advanced Micro Devices and Nvidia. The Mad Motley has a disclosure policy.

Could this undervalued stock make you a millionaire one day? was originally published by The Motley Fool