There is no way to hide the obvious facts: Rivien (NASDAQ:RIVN) management sees 2024 as a key turning point for the company. But if it doesn’t achieve the operational goals it has set for itself, the future could be more difficult than expected. On the other hand, if Rivian achieves its bold goals, this electric vehicle maker’s stock could quickly become very popular – and could help make you a millionaire.

Rivian takes on some major automakers

When you think of electric vehicles (EV), the first name that probably comes to mind is You’re here (NASDAQ:TSLA). This makes perfect sense since Elon Musk’s company has pulled off what can only be described as a coup in the automotive sector. Not only did he build a profitable car company from the ground up, but he did so with technology that major automakers didn’t think was viable. This success attracted many imitators, including Rivian.

But Rivian is built on slightly different foundations. Tesla started with a very expensive sports car. Rivian started with a very expensive pickup truck. This truck was well received by consumers and won numerous design and quality awards. There’s just one problem. Rivian loses money on every truck sold. The numbers aren’t pretty, with a loss of more than $38,000 per vehicle delivered in the first quarter of 2024.

Company management knows this is a problem. But until 2024, the focus was on volume truck manufacturing. It achieved this in 2023, when it produced more than 57,000 vehicles, proving it could operate at scale. In 2024, the goal is to prove that it can operate on a large scale and thus make money. The future of the company largely depends on its success.

Rivian has just reorganized its production tool

The first step in the process was actually to stop increasing its production rate and instead focus on improving its production processes. In fact, its loss per vehicle in the first quarter included more than $9,000 “primarily related to various suppliers and other costs incurred prior to new technology changes and the integration of parts into the R1 platform as part of its development initiatives.” ‘cost efficiency’. It’s corporate jargon, but it means that Rivian has turned to cheaper suppliers, improved its products to make them more desirable and, at the same time, increased its vehicle production capacity by a whopping 30%.

The next few quarters will reveal important information for investors. Rivian aims to achieve a positive result gross profit in the fourth quarter. However, it will still lose money in 2024, and even if it manages to make a gross profit for the whole of 2025, other expenses (such as R&D and selling, general and administrative expenses ) could prevent it from achieving absolute profitability. But achieving gross profitability would be an important step.

The next big thing will be for the company to finally offer trucks to less fortunate buyers. Right now, Rivian’s trucks are expensive, which is a good thing, but it severely limits the company’s potential market. It really needs to follow Tesla’s example and start offering mainstream models. On this front, it plans to launch its lower-cost R2 truck in the first half of 2026. Other models are also in the works. But the real story is that once it proves it can make an electric vehicle profitably, its next big goal will be to profitably make electric vehicles for the general public.

Could Rivian be a millionaire stock?

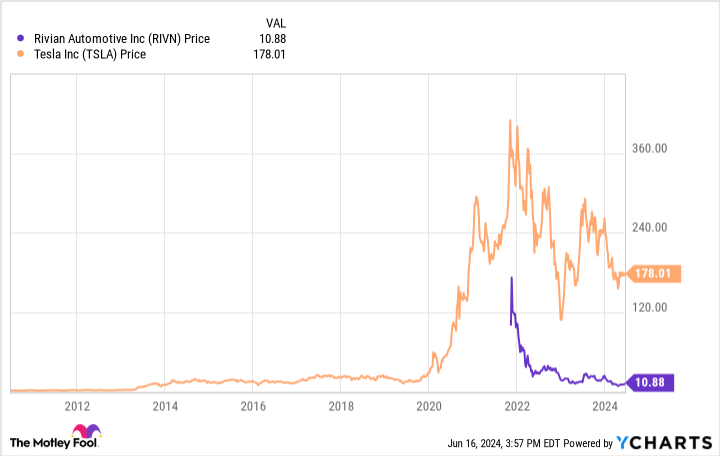

So far, Rivian has not been a good stock to own. Shares have fallen more than 90% from their peak. This is a clear sign that investing in this stock carries significant risks and only the most aggressive and risk-tolerant investors should consider buying it.

However, the company has achieved its internal operational objectives well. And if the massive stock price gains Tesla has witnessed as it moves toward profitability are anything to go by, there could be huge upside potential for Rivian stock as it follows the same path. path. The risk, of course, is that Rivian could stop short of achieving Tesla-like success.

Investing in Rivian could help more aggressive investors build seven-figure portfolios, but the risk/reward balance still seems to lean toward the risk side of the equation. If you do get in, don’t back the truck up until management has checked a few more items off their to-do list.

Should you invest $1,000 in Rivian Automotive right now?

Before buying Rivian Automotive stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Rivian Automotive was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $830,777!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Ruben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool Ranks and Recommends Tesla. The Motley Fool has a disclosure policy.

Is Rivian a millionaire stock? was originally published by The Motley Fool