PayPal (NASDAQ:PYPL) has struggled in recent years. The company thrived during the pandemic and had high expectations for growth over the next few years. However, the company has faced difficulties since then, leading to revised expectations and a stock sell-off; the stock is down 80% from its 2021 all-time high price.

PayPal is under new management looking to right the ship, and the stock is trading at a cheap valuation compared to its history. Here’s what you need to know to help you decide if PayPal is right for your wallet.

PayPal has seen a dramatic rise and fall over the past few years

PayPal has seen massive growth during the pandemic, adding 122 million new accounts and increasing revenue by 43% over two years, while surpassing $1 trillion in total payments volume.

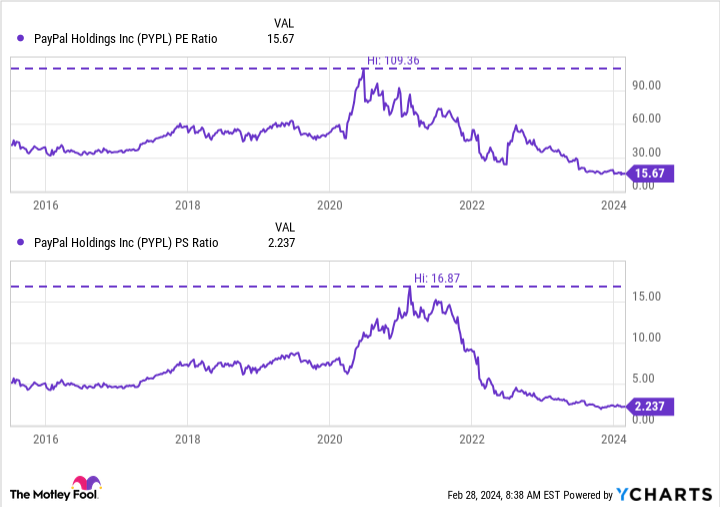

The company was flying high and dreaming of considerable growth in the years to come. At the time, the company planned to nearly double its active accounts from 377 million in 2020 to 750 million by 2025. It also expects free cash flow and revenue to double. At its peak, investors valued PayPal stock at 16.9 times sales and 109.3 times earnings.

It turned out that these expectations were too optimistic, and the company shifted its focus from rapid growth to more sustainable growth. Customer growth slowed and PayPal focused on increasing activity from its existing customers instead of adding new accounts by hand. This change in direction alarmed investors. In addition to that, eBaywho owned PayPal until its split in 2015, left the company and moved to Adyen as the preferred payment platform, which creates barriers to future growth.

PayPal Stock Has Never Been Cheaper Than Today

Investor pessimism toward PayPal has probably never been higher than it is today, which is evident when looking at the company’s valuation. Today, investors value PayPal shares at 2.2 times sales and 15.7 times earnings, representing the company’s lowest valuations since its 2015 spinoff from eBay.

Investors have expressed concerns about PayPal’s margins, which have gradually declined. It is Gross margin, or the company’s sales minus the cost of goods sold (transaction costs for PayPal), was about 65% in 2015. Today, its gross margin is about 46%. One reason for its declining margins is the growing popularity of PayPal’s unbranded payment option, Braintree, compared to its branded payment option.

Braintree is a fast-growing part of PayPal’s business, which is great for top-line growth but hasn’t been as effective at growing profits. In the fourth quarter, total payments volume (TPV) grew 15% year-over-year, and Braintree played a critical role in this growth. Growth was particularly strong internationally, with TPV up 22% (or 17% on a currency-neutral basis), driven by strength in Europe and Asia.

Here’s what’s next for PayPal

During the fourth-quarter earnings conference call, new CEO Alex Chriss said the company would focus on accelerating growth in branded checkouts, which generate higher margins. To do this, it will redesign the brand’s payment experience to make it more efficient and minimize friction, allowing shoppers to pay twice as quickly.

Another step the company is taking is improving its offerings for small and medium-sized businesses with PayPal Complete Payments. The company will look to evolve this offering by leveraging its data and artificial intelligence to improve its merchants’ conversion rates while helping them better connect with customers. If PayPal can achieve this, it could increase its profit margins and provide additional offerings to small and medium-sized businesses, which was Chriss’ specialty at Intuit before becoming CEO of PayPal.

Should you buy PayPal stock?

In an interview with CNBC last month, Chriss said, “2024 will be a transition year for us.” PayPal shares will likely experience greater volatility throughout the year as it works to improve margins and expand its offerings for small and mid-sized businesses.

Despite its struggles, PayPal continues to generate solid revenue. Last year, the company grew revenue 8% and reported its best net profit ever, with $4.25 billion surpassing 2021’s $4.2 billion. PayPal continues to grow and I believe it will continue to progress under the leadership of its new CEO. With so much pessimism built into the stock’s price, I think this is a solid value stock to buy today.

Where to invest $1,000 now

When our team of analysts has a stock tip, it can pay to listen. After all, the newsletter they’ve been running for two decades, Motley Fool Stock Advisormore than tripled the market.*

They just revealed what they think is the 10 best stocks that investors can buy right now… and PayPal is on the list – but there are 9 other stocks you may be overlooking.

*Stock Advisor returns February 26, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool ranks and recommends Adyen, Intuit and PayPal. The Motley Fool recommends eBay and recommends the following options: short April 2024 $45 calls on eBay and short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

PayPal Stock: Buy, Sell or Hold? was originally published by The Motley Fool