NextEra Energy (NYSE: NO) today has a dividend yield of around 2.7%. Income investors and those with a value bias probably won’t want to buy its shares, but if you like dividend-growing stocks, the 10% annualized distribution growth NextEra Energy has achieved over the past decade will appeal to you. will probably get the juices flowing.

And if management is right, the future looks as bright as the past when it comes to dividend growth.

Why some people won’t like NextEra Energy

NextEra Energy has one major problem: Wall Street knows it’s a very well-run utility. This is why the yield is 2.7%, which is lower than the average of 3% for the public services sectorusing the Vanguard Utilities Index ETF (NYSEMKT:VPU) as agent.

Sure, NextEra yields more than the 1.3% you’d get from an S&P 500 index fund, but it’s just not a high-yielding stock. Dividend investors and those with a value bias – noting that the yield has been mid-range at best over the past decade – will likely want to look at utilities offering higher yields.

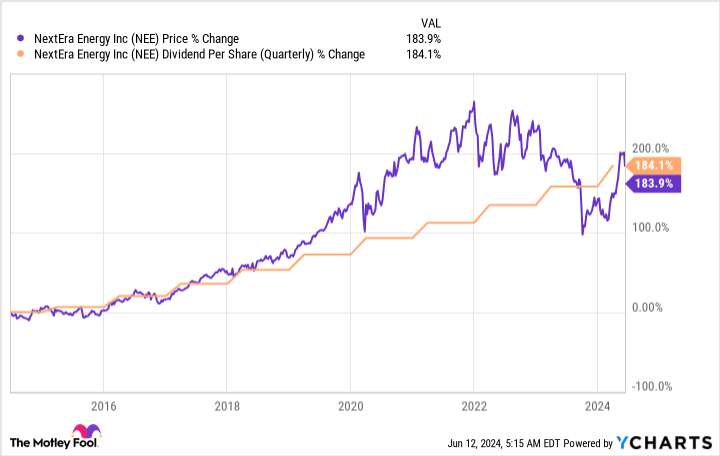

That said, the current dividend yield is not a reason to buy NextEra Energy. The real story is dividend growth, increasing more than 180% over the last 10 years.

The stock also rose almost exactly the same amount over that time, leading to a pretty impressive total return of over 260%, with dividends reinvested. It’s better than THE S&P500 hint, which recorded a total return of around 225% over the same period. Take a step back: NextEra, a utility company, beat the S&P 500!

But there is another figure that might interest you: the yield on the purchase price. If you had purchased NextEra Energy in 2013 at its most expensive point, you would have paid $22.4375 per share, adjusted for a 4-for-1 stock split in 2020. The annualized dividend in Q4 2013 was 0. $66 per share, for a purchase yield of around 2.9%.

At the end of the second quarter of 2024, the annualized dividend was $2.06 per share, which would mean your return based on the purchase price reached a whopping 9.2% in just over a decade. If you like dividend growth, you’ll love NextEra Energy.

The future looks bright for NextEra Energy

NextEra Energy achieved this dividend growth by building a large renewable energy business on top of its regulated utility operations in Florida. It is clear that the business model has worked well, based on dividend growth.

And NextEra thinks the next few years will be as good as the last decade. Currently, the company expects earnings growth of between 6% and 8% per year at least until 2027. This will lead to dividend growth of 10% per year at least until 2026.

What supports this perspective? Management expects U.S. electricity demand, driven by demand for renewable energy, to increase significantly in the coming years.

Some numbers may be helpful: between 2000 and 2020, electricity demand increased by only 9%, but between 2020 and 2040, NextEra estimates that demand will increase by 38%. This is a sea change in what has historically been considered a fairly sleepy sector.

But the more important part of the story here is that NextEra Energy’s clean energy expertise, built over decades, positions it well to benefit from the renewable energy push it expects. And if you buy NextEra today, you can benefit alongside the company.

NextEra Energy is still expensive

If you had bought the stock in 2013 when it had a dividend yield of 2.9%, you would probably be a pretty happy dividend growth investor today. But that yield is pretty close to the current yield of 2.7%, suggesting that NextEra Energy has been an expensive stock to own for a very long time. However, if you’re looking for dividend growth, this utility has proven that paying for quality can work very well in the long run.

Should you invest $1,000 in NextEra Energy right now?

Before buying NextEra Energy stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and NextEra Energy was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $808,105!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Ruben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool ranks and recommends NextEra Energy. The Motley Fool has a disclosure policy.

Is NextEra Energy Stock a Buy? was originally published by The Motley Fool