Since peaking in 2021, You’re here (NASDAQ: TSLA) The title has struggled to gain momentum, or even gain momentum. Once trading at over $400 per share, it has taken a beating over the past three years and is currently around $185.

While those who invested before 2021 are likely enjoying healthy gains, those who invested more recently may not be so lucky. Perhaps Tesla’s best days are already over, which begs the question: Is it too late to invest in Tesla?

Explaining the fall of Tesla

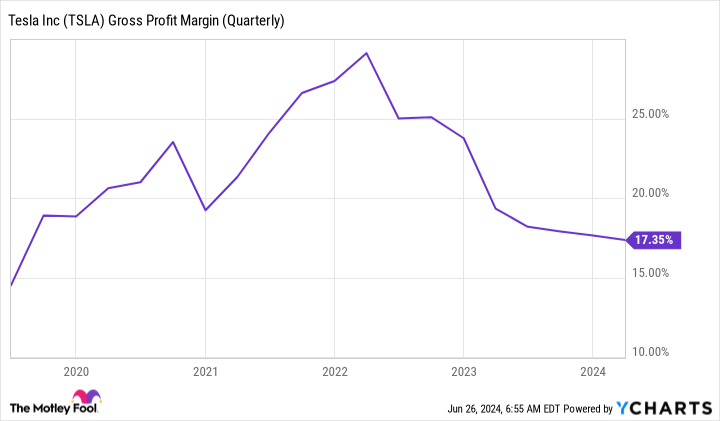

The decline in Tesla shares can be largely attributed to the decrease gross profit marginsAt its peak, Tesla’s margins were over 30%, by far the best in the entire auto industry. Today, those margins have fallen to 17%, which, while still near the top, faces a number of pressures.

The reasons for this decline are varied, but can be boiled down to a reduction in consumer demand for electric vehicles (EVs). Upper interest rate Higher financing costs have deterred potential buyers. To try to stimulate demand, Tesla decided to cut prices in 2023. This decision, combined with higher costs in supply chains and in the labor market, led to falling margins.

However, interest rates will eventually come down and demand for electric vehicles will likely rebound, as these factors are typically cyclical. Current trends suggest that rates could finally start to decline by the end of the year. Naturally, as borrowing becomes cheaper, consumer demand for electric vehicles should rebound.

Tesla is also expected to benefit from the overall trend toward electric vehicle adoption around the world. Governments are implementing stricter emissions regulations and offering incentives to encourage electric vehicle purchases, creating a favorable environment for Tesla’s long-term growth.

Furthermore, the company is expanding internationally with the ongoing construction of a factory in Mexico and plans to enter the Indian and Thai markets in the coming years.

A new Tesla is taking shape

Tesla is working to become more than just an electric vehicle company. One of its main efforts currently involves building autonomous vehicles and, eventually, launching a robot taxi company. Tesla’s self-driving technology has made significant progress and the company is preparing for a global demonstration of its robotaxi on August 8.

In addition to autonomous vehicles, Tesla is also preparing its humanoid robot, Optimus, for a market launch expected to take place in 2025. Although these projects are not yet ready for large-scale commercialization, Tesla has achieved notable progress. Optimus is already in use in Tesla factories, demonstrating its potential to improve efficiency and reduce labor costs across all types of industries.

Take the optimistic route

Critics will point out that Tesla and deadlines don’t always mix. But it’s hard to argue with its ability to follow through. If Tesla can replicate similar levels of success with its robotaxis and Optimus as it has with its electric vehicles, it could transform the company and perhaps even society for the better.

While it is difficult to measure the real monetary impact of these two innovations, simply because there is no market for such products, some estimates put the total revenue of robotaxis at $700 billion per year and that of Optimus at around $1 trillion. If these estimates are accurate, they could more than triple Tesla’s current revenue.

At the risk of being optimistic, I think Tesla’s best days are still ahead of us and it’s not too late to invest in one of the most transformative companies of the future. Tesla’s ability to innovate and push the boundaries of technology has been a key driver of its success thus far. If it can continue to dominate the electric vehicle market while successfully expanding into new areas like autonomous vehicles and robotics, the company could reach even greater heights.

Should you invest $1,000 in Tesla right now?

Before buying Tesla stock, consider this:

THE Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the 10 best stocks for investors to buy now…and Tesla wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

RJ Fulton has positions in Tesla. The Motley Fool holds positions in Tesla and recommends it. The Motley Fool has a disclosure policy.

Is it too late to buy Tesla stock? was originally published by The Motley Fool