Driven by the growing demand for servers to support artificial intelligence (AI) applications, Super microcomputer (NASDAQ:SMCI) has become one of the hottest values on the market. The high-performance server specialist’s stock price has soared nearly 300% in the 2024 trading period alone, and it is up 1,000% over the past year. More recently, AI stock surged following news of its addition to the market. S&P500 hint.

As the company’s business performance has accelerated significantly, the stock’s incredible gains naturally raise valuation questions. Is it too late to buy this explosive AI stock, or is it poised for even bigger gains?

What’s Fueling Supermicro’s Massive Stock Gains?

It’s no secret that AI stocks are hot, and Supermicro (as it’s commonly known) has benefited from strong business results from Nvidia. Supermicro uses graphics processing units from Nvidia (GPU) in its high-performance rack servers, and the enthusiasm generated by the GPU leader has helped to raise the valuation of the server specialist. But it would be a mistake to view valuation gains as purely driven by hype.

Supermicro has positioned itself as a one-stop shop for AI server solutions. This is a great niche to fill right now. The company’s technologies are used to process and distribute information for software applications, and demand for its high-performance rack servers has increased alongside the rapid adoption of AI applications.

The company reported revenue of $3.66 billion during the second quarter of its 2024 fiscal year, which ended Dec. 31. Revenue for the period increased 103% year over year. In the meantime, non-GAAP (Adjusted) earnings per share increased 71.5% year over year to $5.59 per share.

AI has pushed Supermicro into a new phase of growth. The key question is how long this cycle will last and whether or not company valuations have become excessively high.

Strong growth expected to continue in the short term

For its current quarter, Supermicro forecasts revenue between $3.7 billion and $4.1 billion, which would equate to year-over-year growth of between 188% and 219%. On adjusted earnings per share, it shows a range of $5.20 to $6.01. For comparison, the company posted adjusted earnings per share of $1.63 in the third quarter of fiscal 2023. Hitting the midpoint of its guidance range would mean earnings per share growth of 244% over a year.

Given recent demand indicators, it wouldn’t be surprising to see the company’s third-quarter sales and profits exceed the upper ends of these forecast ranges.

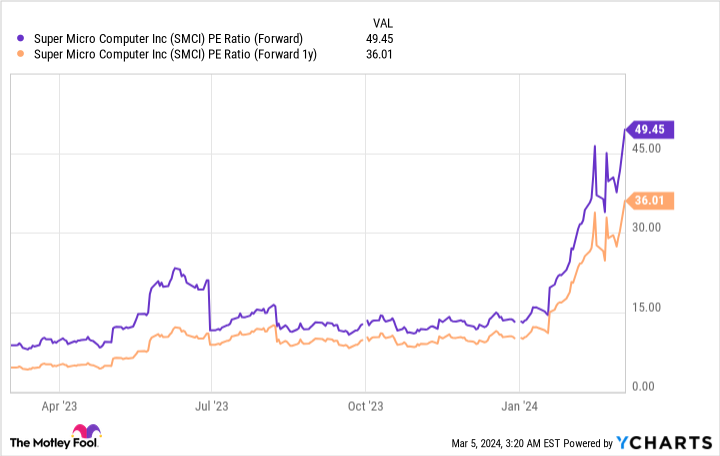

Trading at around 50 times expected earnings this year and 36 times expected earnings next year, Supermicro is a growth-dependent stock. On the other hand, its current valuation actually seems cheap given the company’s recent momentum.

Notably, Supermicro currently has a forward price-to-earnings-to-growth (PEG) ratio of around 0.55. Using next year’s expected earnings growth rate, the company has a one-year forward PEG ratio of around 0.68. For reference, a PEG ratio below 1 is generally considered a sign that a stock is undervalued because earnings are growing at a rate that can support a higher valuation multiple.

Of course, there is still some uncertainty about how long-term demand will evolve for Supermicro’s offerings. Investors need to understand that its incredible rise has made the stock a much riskier investment, and it’s possible that the company’s future performance may not live up to current high expectations.

Despite everything, the stars still seem to align for Supermicro. Although it is reasonable to expect that demand for its server technologies will experience a cyclical moderation at some point, market conditions suggest that the company is poised for years of strong revenue growth. sales and profits.

The overall AI server market appears poised to continue growing rapidly, and Supermicro appears on track to continue gaining market share. Although its stock can experience volatile swings, it still makes for an attractive portfolio addition for AI-focused investors with above-average risk tolerance.

Should you invest $1,000 in Super Micro Computer right now?

Before buying Super Micro Computer stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Super Micro Computer was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns March 8, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool Ranks and Recommends Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

Is it too late to buy Super Micro Computer stock? was originally published by The Motley Fool