Since the end of October last year, Bank of America (NYSE:BAC) The U.S. bank’s stock rallied sharply, rising 58% as the Federal Reserve announced a pause in its interest rate hike campaign. The stock gained significantly as investors priced in the pause and potential rate cuts later this year and into next, which could help ease pressure on the bank, which has a large unrealized loss portfolio.

However, it is not yet clear where interest rates will be at the end of this year or next year. At the start of the year, markets had anticipated up to six interest rate cuts. These expectations are now reduced to two cuts. Given the recent rise in the stock price, does it make sense for investors to buy now? Here are some things you’ll need to think about first.

Bank of America’s unrealized losses caught investors’ attention

Bank of America has more than $2.5 trillion in total assets, making it the second-largest bank in the United States, behind only JPMorgan ChaseIts size makes it a behemoth, and it has managed to maintain itself over time as one of the largest banks in the United States.

Banks are simply businesses that accept deposits and make loans to their customers. They make money from the difference between the interest rate charged on loans and the interest paid to customers on their deposits.

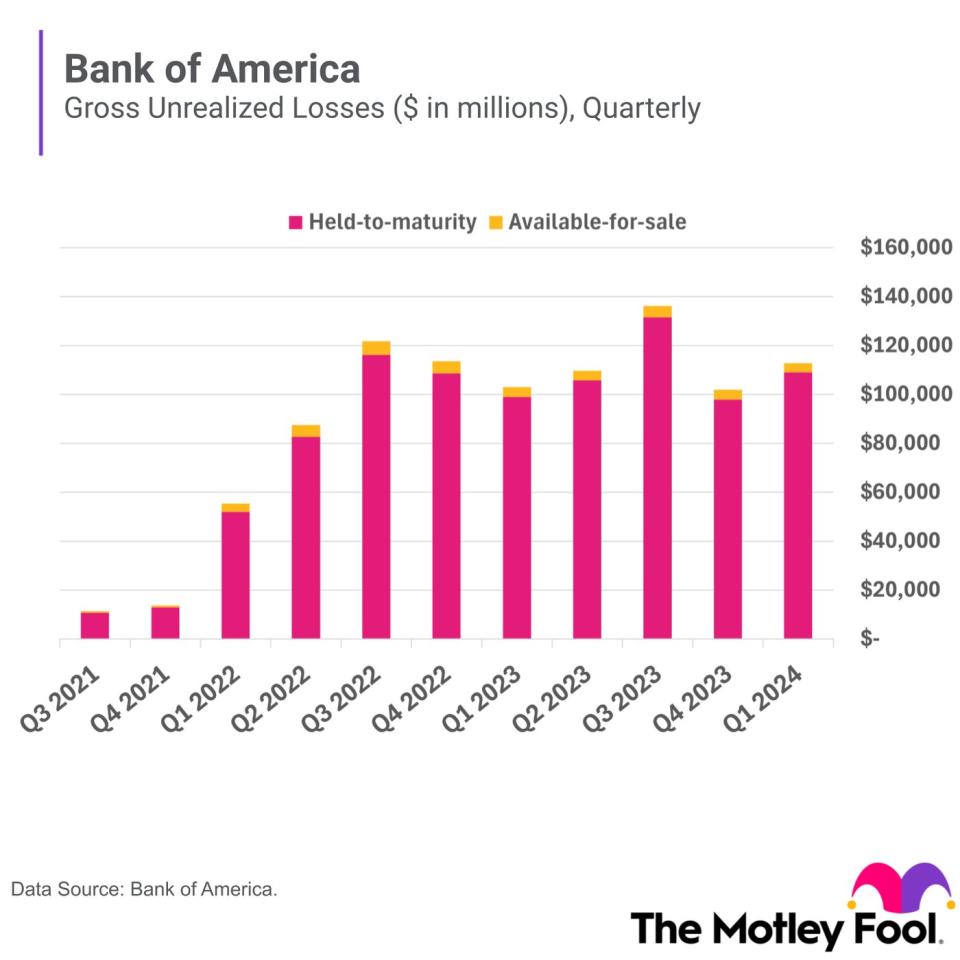

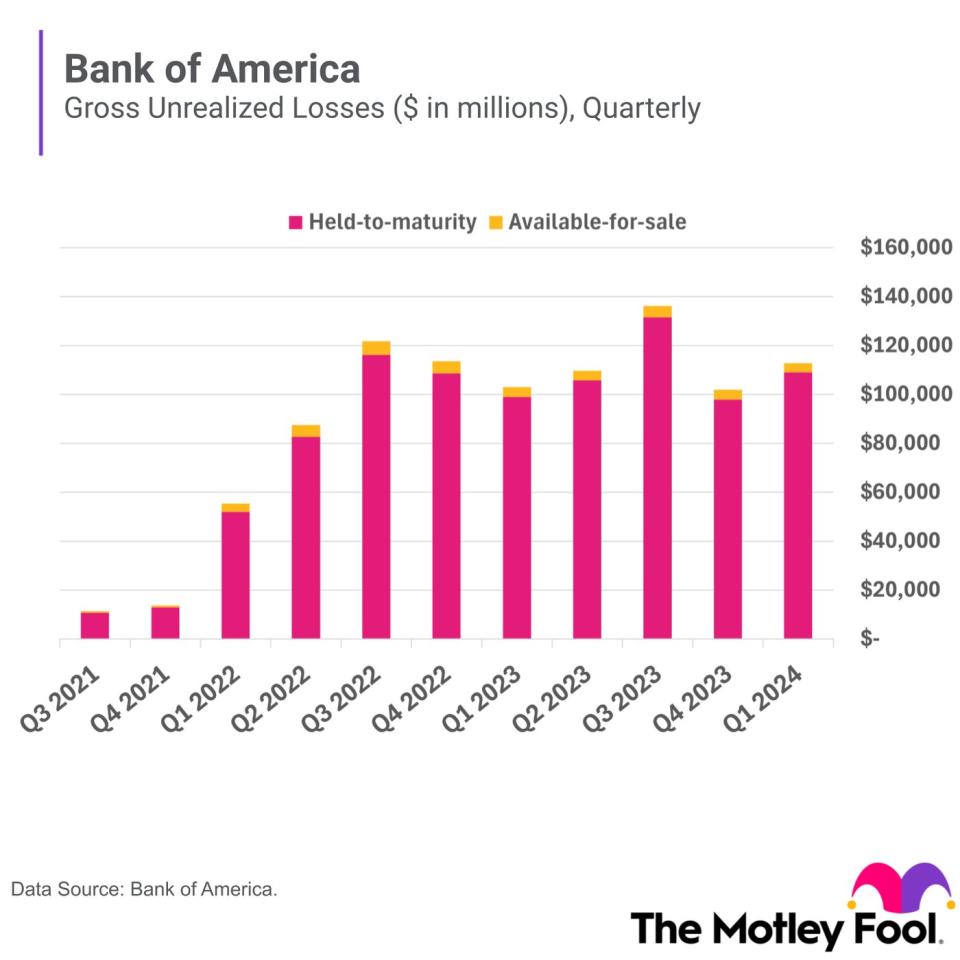

That business model makes the industry sensitive to interest rate fluctuations, and Bank of America’s sensitivity is evident when looking at its loan portfolio. Those mounting unrealized losses have been a source of concern for some investors as the Federal Reserve has raised interest rates at a pace not seen in decades. Since the Fed began raising rates in 2022, the bank’s unrealized losses have grown from $14 billion to $113 billion.

Unrealized losses represent the losses Bank of America would incur if it were forced to sell its securities in the market today. This does not necessarily mean the bank is in trouble as long as it can hold those securities to maturity. However, a run on deposits at Silicon Valley Bank (a subsidiary of SVB Financial) last year forced the bank to raise capital and take huge losses on its treasury, which could have been even worse had the federal government not intervened.

Bank of America, one of the largest and best-known banks in the United States, has a well-diversified deposit base, with 37 million consumer checking accounts and nearly $2 trillion in deposits. individuals and businesses. That gives it a solid foundation for its business, making it less vulnerable to bank runs like those that occurred last year at Silicon Valley Bank and other regional banks.

Bank of America’s Net Interest Income Could Continue to Climb

The high interest rate environment is a double-edged sword for banks. While Bank of America’s unrealized losses exploded, it also benefited from rising net interest income. Net interest income is the difference between the interest a bank earns on its loans and the interest it pays to depositors.

When interest rates are low, as they were throughout 2021, a bank’s net interest income is low. However, during periods of rising interest rates, banks benefit from a tailwind because interest charged on loans adjusts faster than interest paid on deposits. Bank of America, one of the most interest-rate-sensitive banks in the industry, increased its net interest income from $43 billion in 2021 to $57 billion last year.

Today, banks are in a delicate situation. In the first quarter, Bank of America’s net interest income fell compared to the same quarter last year. The bank faced rising interest charges on deposits and slowing loan growth as banks tightened their lending standards amid rising losses, putting the pressure on its net interest spread.

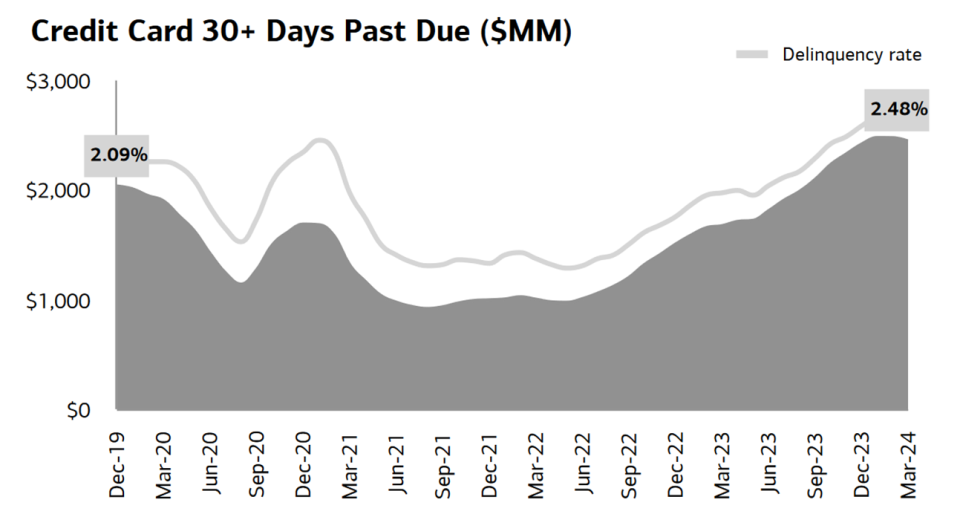

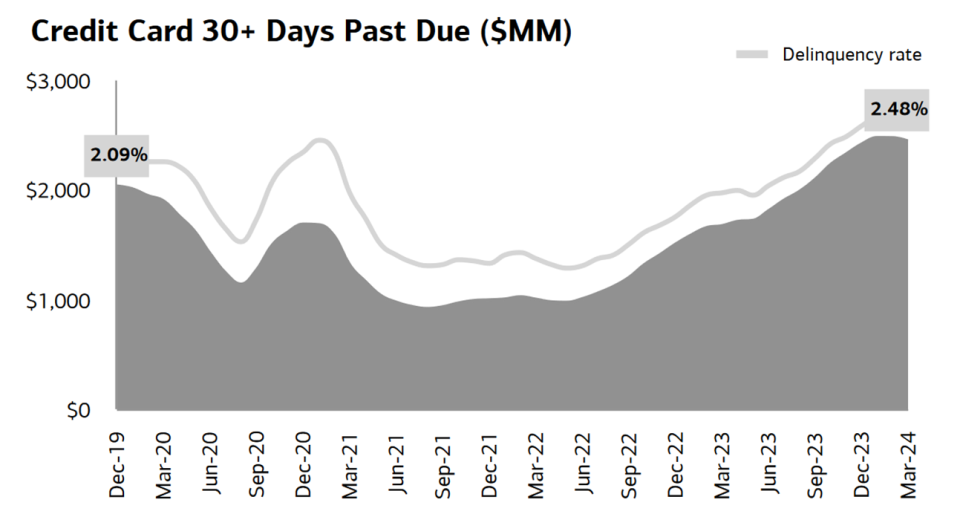

Consumer loan delinquencies and net charge-offs could be a near-term headwind for the bank, but Bank of America management sees a light at the end of the tunnel. On its first-quarter earnings call, CFO Alastair Borthwick said delinquency trends are starting to improve and that will likely lead to a stabilization of charge-offs over the next quarter or two.

During this period, Bank of America has capitalized on the “higher for longer” interest rate environment by replacing lower-yielding assets with higher-yielding assets, which should help it grow its income net interest from the end of this year to the beginning of next year.

A KBW analyst recently expressed optimism for Bank of America, predicting that its fourth-quarter net interest income will be 5% higher than his previous estimate. Analyst David Konrad said net interest income and growth in other key areas of Bank of America’s business will help close the gap to its target of generating a 15% return on tangible common equity (ROTCE).

Is this a purchase?

Bank of America’s stock has risen significantly since the Federal Reserve suspended interest rate hikes. Despite this rise, the stock is still reasonably valued at 1.6 times its body value book value and 13.6 times earnings.

Although its business fluctuates with the U.S. economy and market conditions, Bank of America has done an excellent job navigating market cycles. As one of the largest banks in the United States, with a strong brand and strong balance sheet, the bank is well positioned for success as it makes the most of the current interest rate environment and is a great stock to buy today.

Don’t miss this second chance and a potentially lucrative opportunity

Have you ever felt like you missed the boat buying the best performing stocks? Then you’ll want to hear this.

On rare occasions, our team of expert analysts issues a Double Down Action Investors recommend companies that they believe are on the verge of breaking out. If you’re worried that you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Amazon: If you invested $1,000 when we doubled our efforts in 2010, you would have $21,765!*

Apple: If you invested $1,000 when we doubled our efforts in 2008, you would have $39,798!*

Netflix: If you invested $1,000 when we doubled down in 2004, you would have $363,957!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns June 24, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. SVB Financial provides credit and banking services to The Motley Fool. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in Bank of America and JPMorgan Chase and recommends these companies. The Motley Fool has a disclosure policy.

Is Bank of America Stock a Buy? was originally published by The Motley Fool