Advanced microsystems (NASDAQ:AMD) The stock has rallied sharply over the past year, jumping 127%, even though the chipmaker’s revenue and profit have declined in recent quarters due to weakness in the personal computer market. This may lead one to question whether buying AMD is a good idea at this point, given its high valuation.

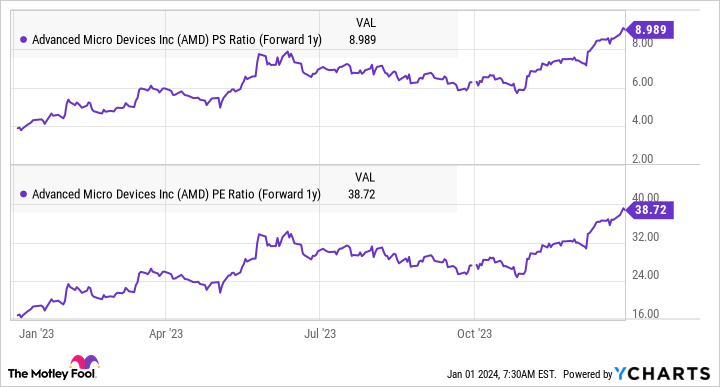

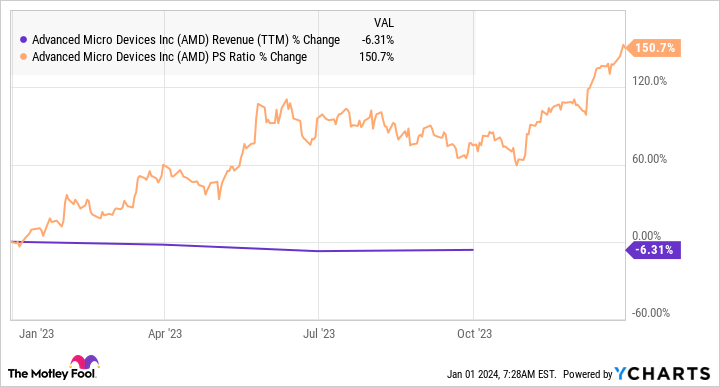

After all, AMD’s price-to-sales multiple has increased over the past year while its revenue has headed south. Meanwhile, Wall Street analyst consensus estimates that AMD’s earnings will fall 31% for 2023, to $2.40 per share.

Savvy investors should consider looking beyond these recent results, however, as there are two big catalysts that could boost AMD in 2024 and beyond.

Poised for a strong turnaround this year

Declining PC sales weighed heavily on AMD’s performance in 2023, but this problem should disappear in the new year. Canalys researchers predict an 8% increase in PC sales in 2024, following a 12.4% decline in 2023. This will be a major boost for AMD’s client CPU (central processing unit) business, which relies on PC sales and which was hit hard in 2023.

AMD’s customer revenue fell 40% year-over-year in the first nine months of 2023. This segment generated 19% of the company’s revenue, which explains why the AMD’s total revenue in the first three quarters of 2023 fell 8% year over year to $16.5. billion. Low demand for PCs has led to an oversupply of the types of computer processors sold by AMD, which is why the company decided to offer discounts in an effort to move more units. This weighed on margins and reduced AMD’s profits.

Specifically, AMD generated an operating loss of $101 million on the customer business during the first nine months of 2023, compared to an operating profit of $1.34 billion over the same period in 2022. The good news is that AMD’s client segment revenues have started to grow once again, with oversupply over, PC makers buying processors to prepare for the expected increase in demand the next year.

In the third quarter, AMD’s customer revenue increased 42% year-over-year to $1.45 billion. The segment also reported an operating profit of $140 million, compared to an operating loss of $26 million for the same period a year earlier. The clear recovery expected in the PC market this year should therefore help to get AMD out of its rut.

The growing pipeline of customers for its artificial intelligence Chips (AI) will be another key growth driver. Great actors, including Metaplatforms,OpenAI, OracleAnd Microsoft recently announced that they will be rolling out AMD’s flagship MI300X AI accelerators.

The chipmaker expects its AI chips to generate at least $2 billion in revenue in 2024. While that may not seem like much given the a huge amount of income this rival Nvidia generates AI chips, investors should note that AMD’s sales in this market could be higher than the company currently projects.

For example, AMD planned to report $400 million in revenue in the fourth quarter from its data center GPU (graphics processing unit) business. Thus, the $2 billion annual revenue forecast for the data center GPU business for 2024 would mean that AMD’s quarterly revenue run rate in this segment is expected to reach $500 million.

But at the same time, we shouldn’t forget that AMD is likely to get its hands on a large part of its foundry partner’s AI chip supply, which could lead to even stronger growth in the GPU sector for data centers. Citing industry sources, the Taiwanese daily DigiTimes points out that AMD could ship 400,000 AI GPUs in 2024. AMD has not yet revealed the price of its AI processors, but it could price it aggressively to gain market share from Nvidia, which sells its flagship H100 processors for $40,000 on average.

Assuming AMD decides to compete with Nvidia and offers its AI GPU at $30,000, it could generate $12 billion in revenue from the data center GPU segment. So it won’t be surprising to see AMD growing at a much faster rate than analysts predict in 2024 and beyond.

From a forward-looking perspective, the stock is a Buy

As the following table suggests, AMD’s results are expected to return to solid growth in 2024, followed by another robust year in 2025.

Year | Estimated revenue (in billions of dollars) | Year-over-year change (%) | Estimated earnings per share | Year-over-year change (%) |

|---|---|---|---|---|

2023 | $22.7 | -4% | $2.65 | -24% |

2024 | $26.5 | 17% | $3.83 | 45% |

2025 | $31 | 17% | $5.16 | 35% |

Source: YCharts and Yahoo! Finance

This explains why the company’s forecast earnings and sales multiples are at relatively attractive levels compared to the tracking multiples mentioned earlier in the article.

The market may further reward AMD’s accelerating growth, especially given its large opportunity in the AI chip market. As such, savvy investors looking to buy growth stocks to capitalize on the accelerated adoption of AI and the resurgence of the PC market should consider adding AMD to their portfolios before it tanks. flies more.

Should you invest $1,000 in advanced micro devices right now?

Before buying Advanced Micro Devices stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Advanced Micro Devices was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns December 18, 2023

Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Hard Chauhan has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia and Oracle. The Motley Fool has a disclosure policy.

Is AMD stock a buy now? was originally published by The Motley Fool